T1 Energy (±$800M) - The Hidden AI Power Play

Market's slowly connecting the dots on America’s only vertically integrated solar bet

!Disclaimer. Nothing is financial advice. Go look for an entry point instead. No Chasing and No FOMOing!!

While everyone obsesses over NVIDIA’s chips, they’re missing the electricity. AI data centers need 3-5x more power than traditional computing, and guess who’s building the only end-to-end American solar supply chain just as hyperscale demand explodes?

T1 Energy is the picks and shovels play hiding in plain sight.

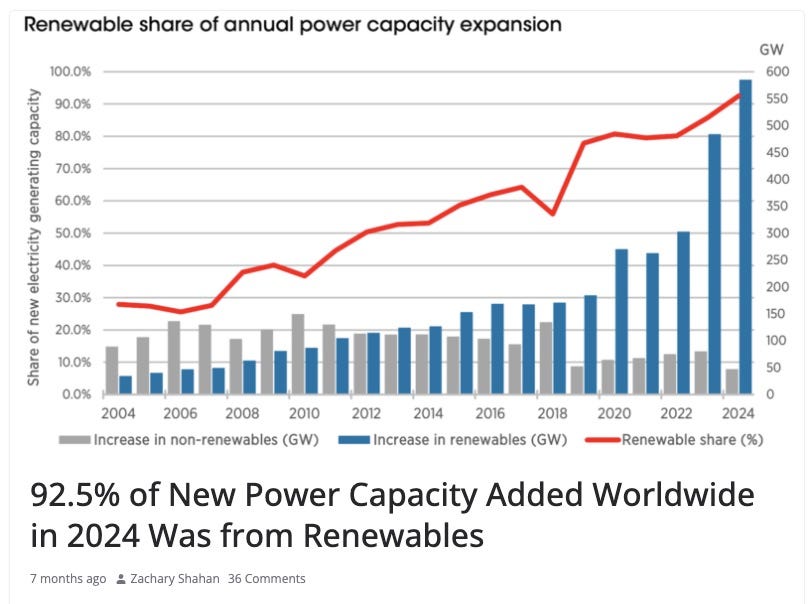

91% of net new Electricity generating capacity in US came from Solar. NO matter the political policies, capital markets will find ways to do what is right. Globally, 90% of net new capacity came from Renewables.

92.5% of net new capacity globally came from renewables. If you are more of a chart person. Here you go. Enjoy!

THESIS:

T1 Energy is one of the most vertically integrated solar manufacturers in the United States, with the cleanest supply chain in terms of Chinese dependency.

T1’s roadmap targets 70%+ U.S. content modules by 2027 and $650M-$700M EBITDA run rate with integrated G1 and G2 plants.

The following 3 trends are coming together at the same time.

— AI power hunger that requires fast on premise power

- Unprecedented trade protection and de-globalization for Energy security.

- Manufacturing re-shoring. T1 is the America’s most advanced solar manufacturing platform. Expected to support ~6,000 U.S. jobs across T1, Corning, Hemlock

Following points are important to take note of

- 2025 production sold out at low end: 2.6 GW

- 473 MW merchant deal with a top U.S. utility secured

- There is no crazy dilution

- FSLR (28B market cap Biggest solar competitor in US) is priced at 4.3X NTM EV/revenues VS only 1.13 for TE.

Current Supply Chain Structure

1. G1_Dallas Module Facility (Operational)

- 5 GW annual production capacity

- Currently operational since acquisition from Trinasolar in December 2024

- Produced 1,222 MW through August 2025

Looks like a big something to me.

Only about 1-1.5 years ago, it used to look like a green pasteurized field.

2. G2_Austin Cell Facility (Under Construction)

$850 million investment, 5 GW annual capacity

- Production starts: Q4 2026

- Advanced TOPCon solar cell technology

FUNDAMENTALS

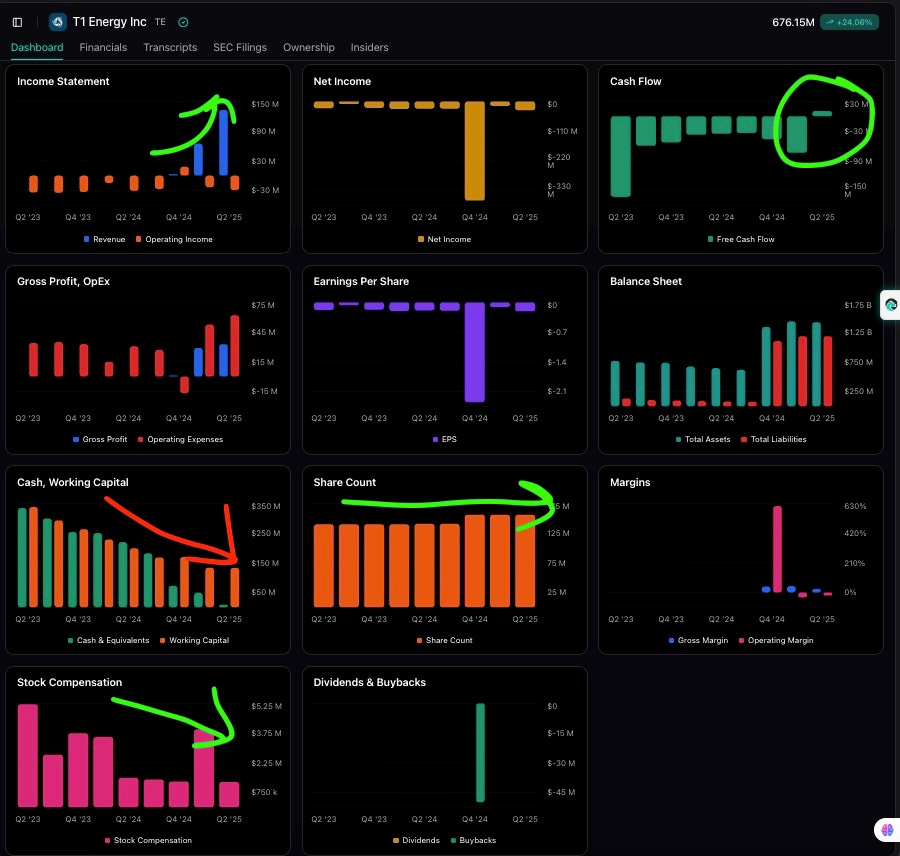

We are about to release this software soon, so you can see this foryourself.

Positives:

- Massively improving Revenues.

- Turned cash flow positive last quarter

Negative:

- The company has taken on approximately $0.5 billion in debt

- Debt increased due to G2 build out

Insight 1: The AI story is no longer about chips, its about Power Shortage. And that Solar and storage seen as the fastest, cheapest grid power sources

Recently, Market’s started to appreciate that its all about power and not just GPU’s anymore.

Newer chips deliver significantly better performance per watt, so the extra power consumed by older, inefficient chips ends up costing more in the long run.

Here’s the timestamped moment where this discussion about amortization, depreciation, and efficient power utilization in data centers took place.

“If I have a data center and it’s 50 megawatts and I have this much capacity in it at some point even though my chips in it have been depreciated and I’m running them at zero cost, power plus zero depreciated cost, it makes sense to move them out because the new chips are so much faster, so much better, use so much less power, I get so much more dollars per and so that’s the question”

— Andrew Feldman Cerebras CEO

While Goldman Sachs projects 160% data center power demand growth by 2030, the market hasn’t connected this to domestic solar manufacturing. T1’s G1 Dallas facility can produce 5GW annually—enough to power 2.5 million homes or 15-20 hyperscale data centers. With companies like Microsoft signing 20-year renewable PPAs, T1 sits at the intersection of AI’s insatiable appetite and America’s energy independence imperative.

Ever seen software companies make 20 year deals before?

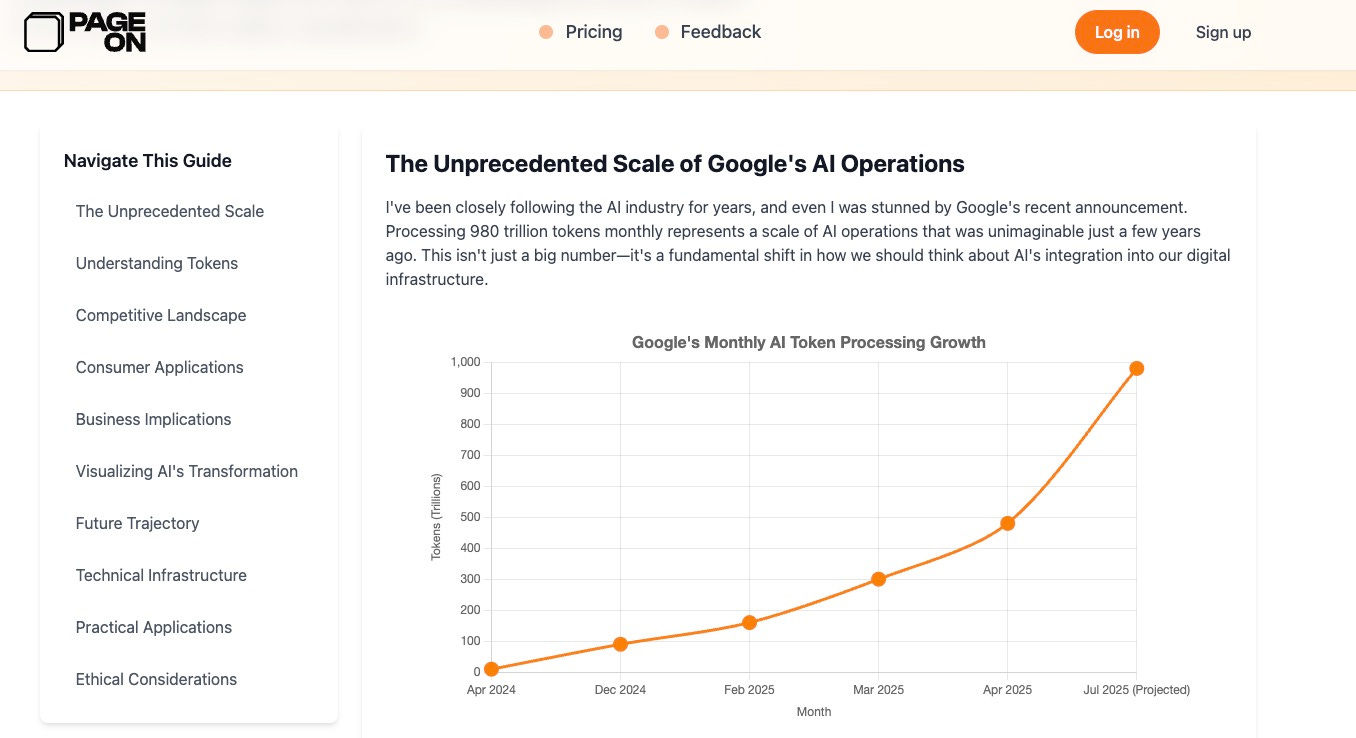

Also keep in mind that Google’s token consumption is exponential right now.

Insight 2: Absurd tariffs are placed on Solar panels

Markets are starting to understand that long term, producing in the US is a big moat.

3,529% tariffs on Cambodian panels, 813% on Vietnamese. Combined with existing Section 201 (14%) and reciprocal tariffs (up to 49%), Chinese manufacturers face absurd tariffs.

This is economic warfare designed to reshore manufacturing permanently.

T1’s stock surged 476% from lows precisely as these tariffs took effect in June 2025. The market is finally pricing in the moat. But its still undervalued.

INSIGHT 3: The Solar Cell Shortage is the bottleneck for US production

While the US has 56.5GW of module capacity, only 2GW of cells production capacity are operational right now.

T1’s planned G2 Austin facility (5GW cells, $850M investment) hits production in H2 2026—exactly when FEOC rules kick in, making Chinese cells toxic for IRA credits.

No other U.S.-based manufacturer has a cell line ready to feed those module factories; most cells still arrive from China or Southeast Asia.

Why it matters now

Under the Inflation Reduction Act’s FEOC (Final Assembly in the U.S.) rules, only modules assembled using U.S. cells qualify for the 10% domestic content bonus on top of the base 30% Investment Tax Credit (ITC) through 2029. Imported cells disqualify the entire system.

T1’s G2 Austin solar cell plant (5 GW capacity, $850 M capex) is slated to begin production in Q2 2026, just as developers lock in 2027-2030 projects to capture the full 40% ITC

The math: Domestic content bonus adds 10% to the 30% ITC. On a $1B utility project, that’s $100M-300M in extra tax credits for using T1’s cells versus imports.

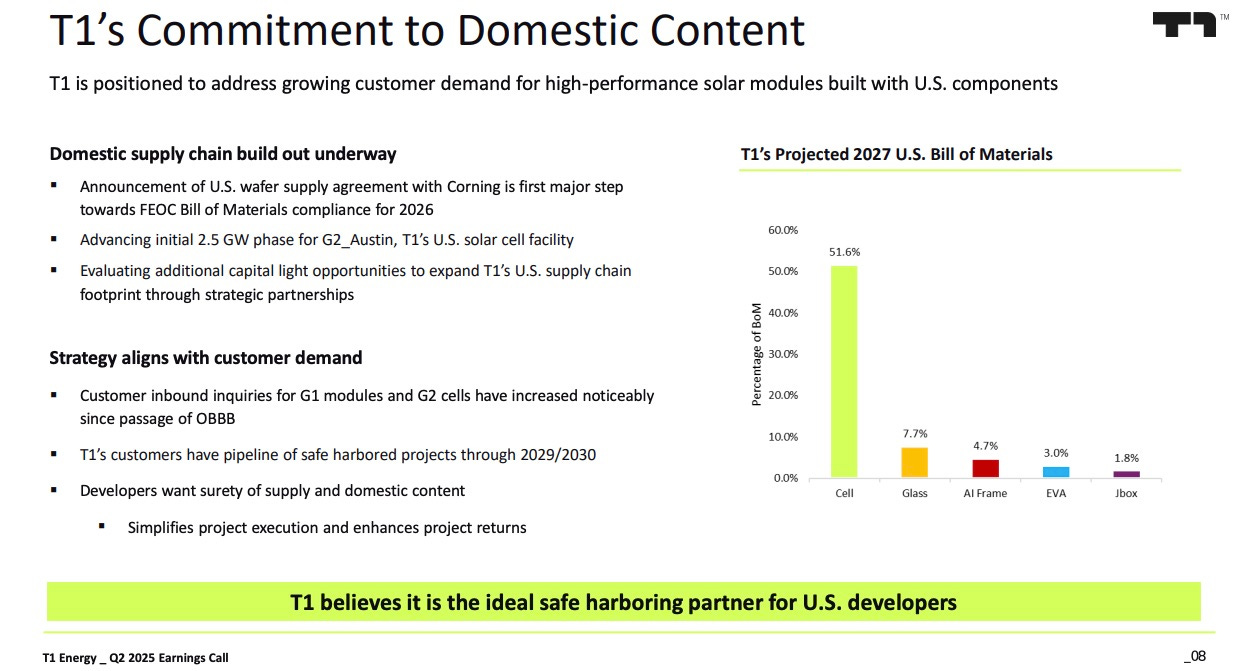

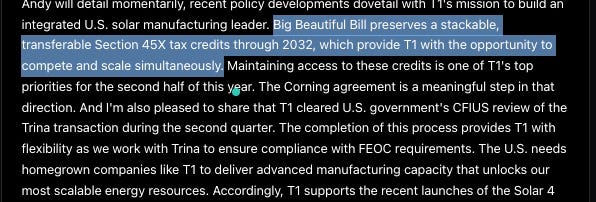

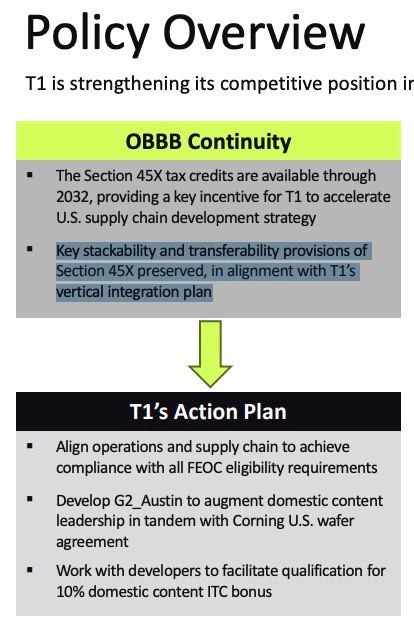

Insight 4: Section 45X incentives for Solar are preserved till 2032. And the incentives even stack as you vertically integrate

Markets still underestimating the scale of manufacturing credits.This is an excerpt from the transcript.

45X provides $0.07/watt for modules, $0.04/watt for cells. At full capacity (5GW modules + 5GW cells), T1 will generate $50-100M annually in transferable tax credits. This is just a start. These credits are cash-equivalent and can be sold to tax-hungry corporations at 85-90 cents on the dollar.

Yes, the Incentives stack on each other. Stackability is delicious!! Section 45X and ITC Domestic Content Bonus

The cell producers and the module producers each qualify for separate tax credits under Section 45X of the Internal Revenue Code:

PV cell manufacturers receive $0.04 per watt-direct current (W DC) of cells produced and sold in the U.S.

PV module manufacturers receive $0.07 per W DC of modules produced and sold in the U.S.

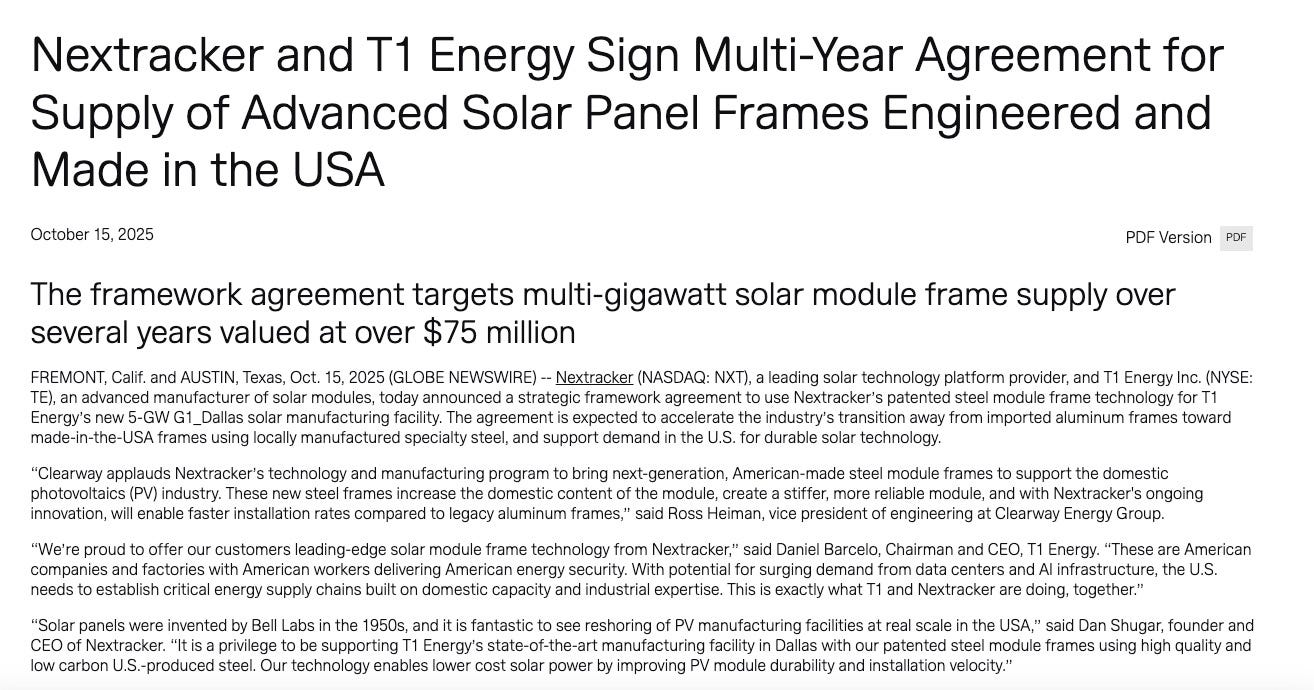

Insight 5: Partnership Validation Solves Execution Risk

Market is pricing TE at 700M-800M like a startup. But these closed serious partnerships are real validations

The recent $75M Nextracker partnership and Corning supply agreement aren’t just deals—they’re blue-chip validation. Nextracker (NXT) has a $13.8B market cap, and Corning (GLW) is a $75B industrial might

These partnerships provide technical expertise, supply chain security, and customer validation T1 couldn’t achieve alone. Corning said this in their earnings call.

”We expect to triple our solar sales run rate and plan to have 2.5B revenue stream in solar by 2027”

Lastly, Clearway Energy’s public endorsement of T1’s technology represents utilities betting their project economics on T1’s execution.

Partnerships in Energy industry don’t easily happen since they are career ruining or defining.

Valuation & Scenario Map

Base Case ($8-12/share): G1 Dallas reaches 4GW production, G2 Austin launches on schedule, 45X credits provide $400M annual cash flow by 2027. AI demand sustains premium pricing.

Bull Case ($20-30/share): AI power shortage creates supply emergency, T1 captures 15-20% pricing premiums, vertical integration from Corning wafers to Nextracker frames creates unassailable margins. Government designates T1 as critical infrastructure.

Bear Case ($2-5/share): G2 Austin financing fails, Chinese manufacturers find tariff workarounds, recession kills utility-scale demand. Company becomes acquisition target for strategic buyer.

Key swing factors: G2 financing decision (Q1 2026), FEOC rule enforcement, data center power demand acceleration.

Near-Term Catalysts & Long-Term Moats

2025 Catalysts (by date):

Q4 2025: G2 Austin final investment decision

Q1 2026: First 45X credit monetization ($50-100M)

H1 2026: Corning wafers begin shipping to G2

H2 2026: G2 Austin cell production begins

Enduring Moats:

Regulatory fortress: FEOC rules + tariff protection

Vertical integration: Only US company controlling polysilicon → modules

Geographic clustering: Texas manufacturing hub with skilled labor

Customer stickiness: 20-year PPA contracts with utilities

Risk Dashboard

Risk #1: Cash Crunch Before G2 Launch

The threat: Cash $8.5M, WC $133M, needs $850M for Gen2

Our take: 45X credits provide $300-500M bridge financing

Risk #2: Tariff Policy Reversal

The threat: New administration could reduce trade protection

Our take: Bipartisan support for reshoring; China hawks control both the parties

Risk #3: Chinese Circumvention Success

The threat: New routes around tariffs (Indonesia, Morocco, etc.)

Our take: US trade enforcement accelerating; each new circumvention gets plugged faster

TL;DR

T1 Energy is the only pure-play on three unstoppable forces: AI’s power hunger, China containment, and manufacturing reshoring. Trading at 1/3rd of First Solar’s multiple despite controlling America’s most advanced solar supply chain. G2 Austin decision in Q1 2026 will either create a $20+ stock or an acquisition target. The tariff moat is permanent; the AI demand surge is just beginning.

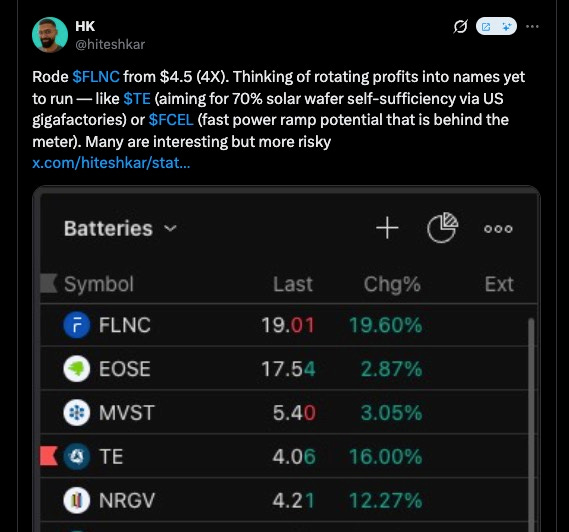

I bought TE at $3 and $3.8. Might consider to buy more if it gets to $4.6. Converted some of my FLNC profits into TE on 14 Oct. What perfect timing.

It’s run up big, so don’t chase. Look for entries around $3.8–4.4. If US-China tensions flare a bit, you might get lucky. Long term looks good. This move up was also with volume.

Bought a little more $TE as mentioned yesterday when it hit 4.3