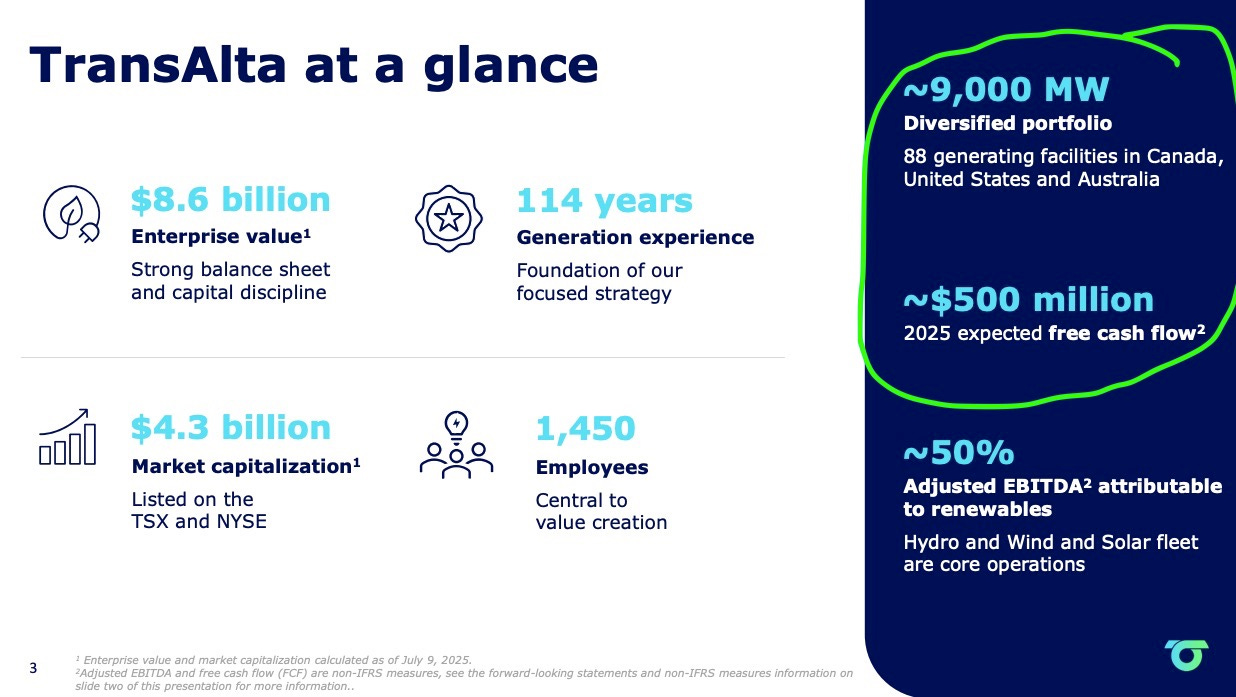

Transalta ($TAC $4B) has 9GW of energized power trying to make a pivot to AI HPC

Least riskiest and most undervalued in the AI/HPC data centre pivot market. A deep dive

DISCLAIMER: I initiated little at $14.7 to start tracking. You might get opportunity to buy again at $12-13. Earnings was a big miss.

Don’t ever FOMO. None of this is FA

TLDR:

Alberta’s “Texas of Canada” policy + TransAlta’s 9GW (bonkers) of energized power and sites are the fastest path to scale AI data centers, with material re-rating potential

It’s all about the power rush right now.

THESIS:

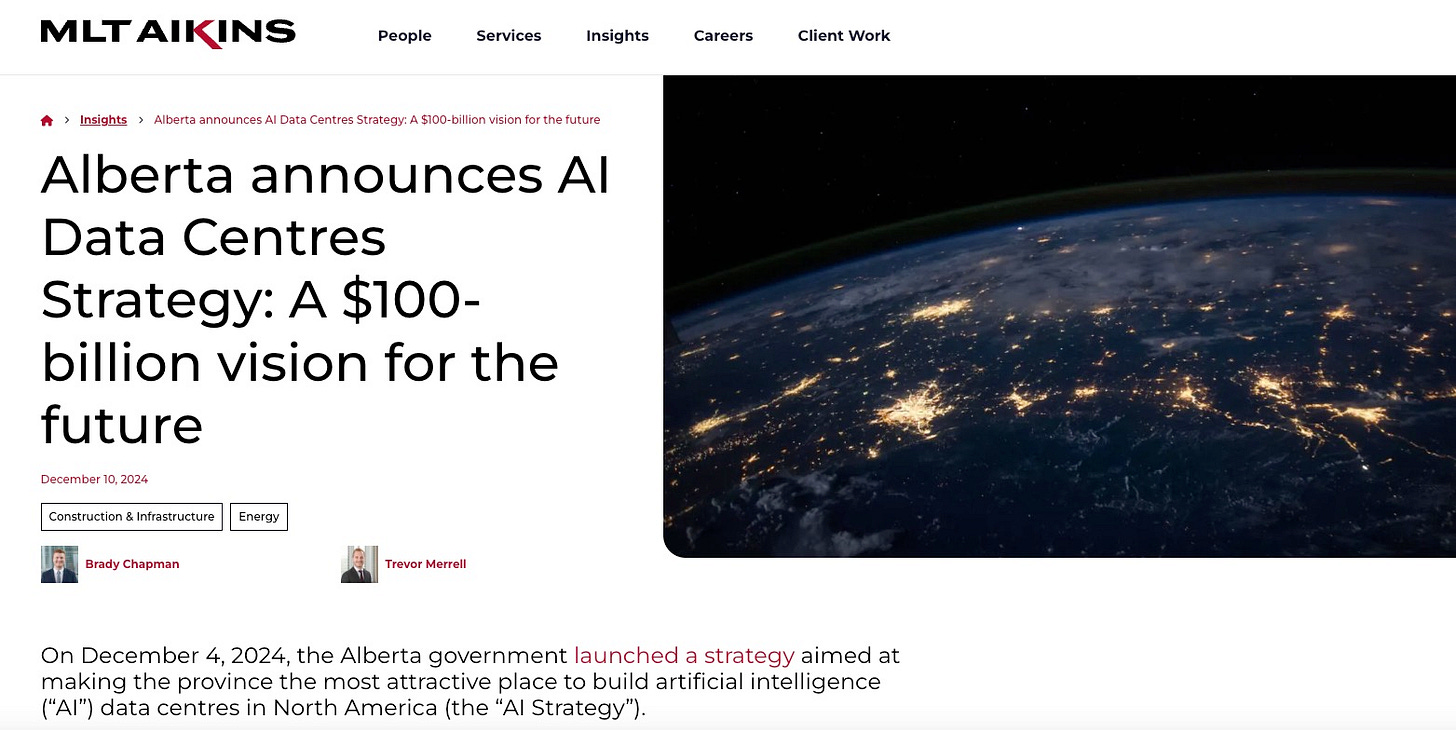

Tailwind: Alberta state is the Texas of Canada. It wants to attract $100B in AI data centre investment. For perspective the population is only 4M

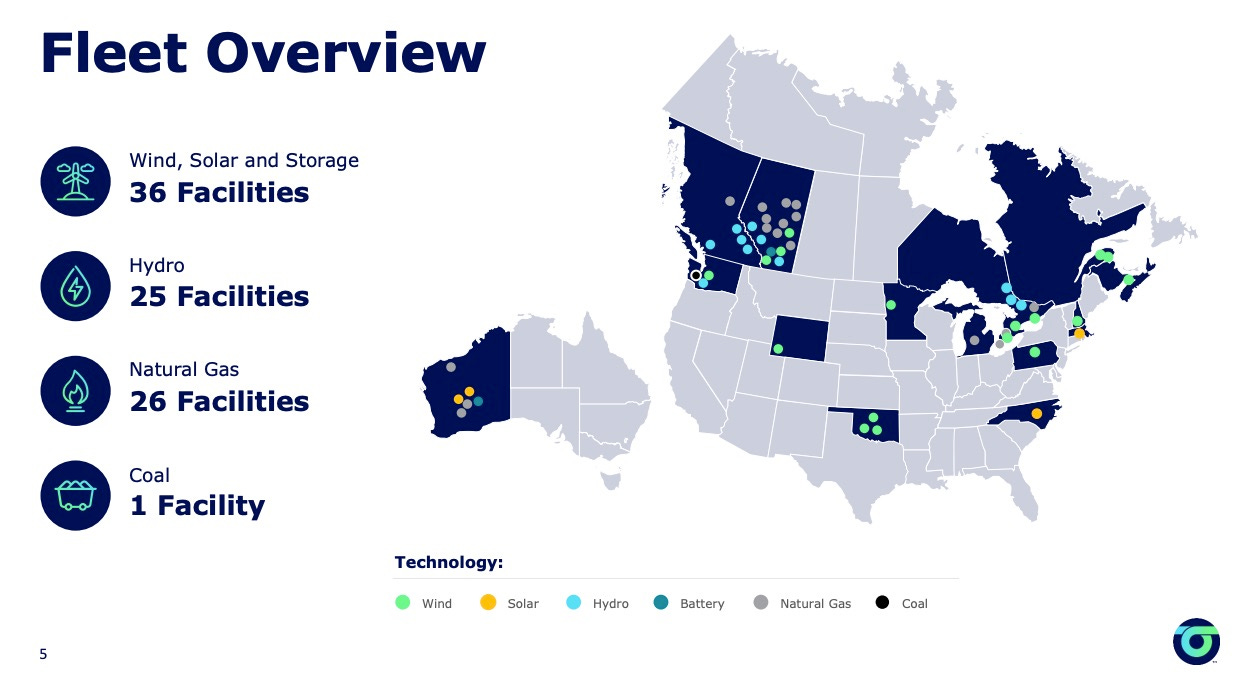

They control 9,000 MW of gross installed capacity across 88 facilities in Canada, the United States, and Australia. Delievered $1.25 EBITDA in 2024. So not the usual no revenue shit Crypto miner play.

They have so much excess capacity behind the grid.The quickest in my opinion in the North American subscontinent

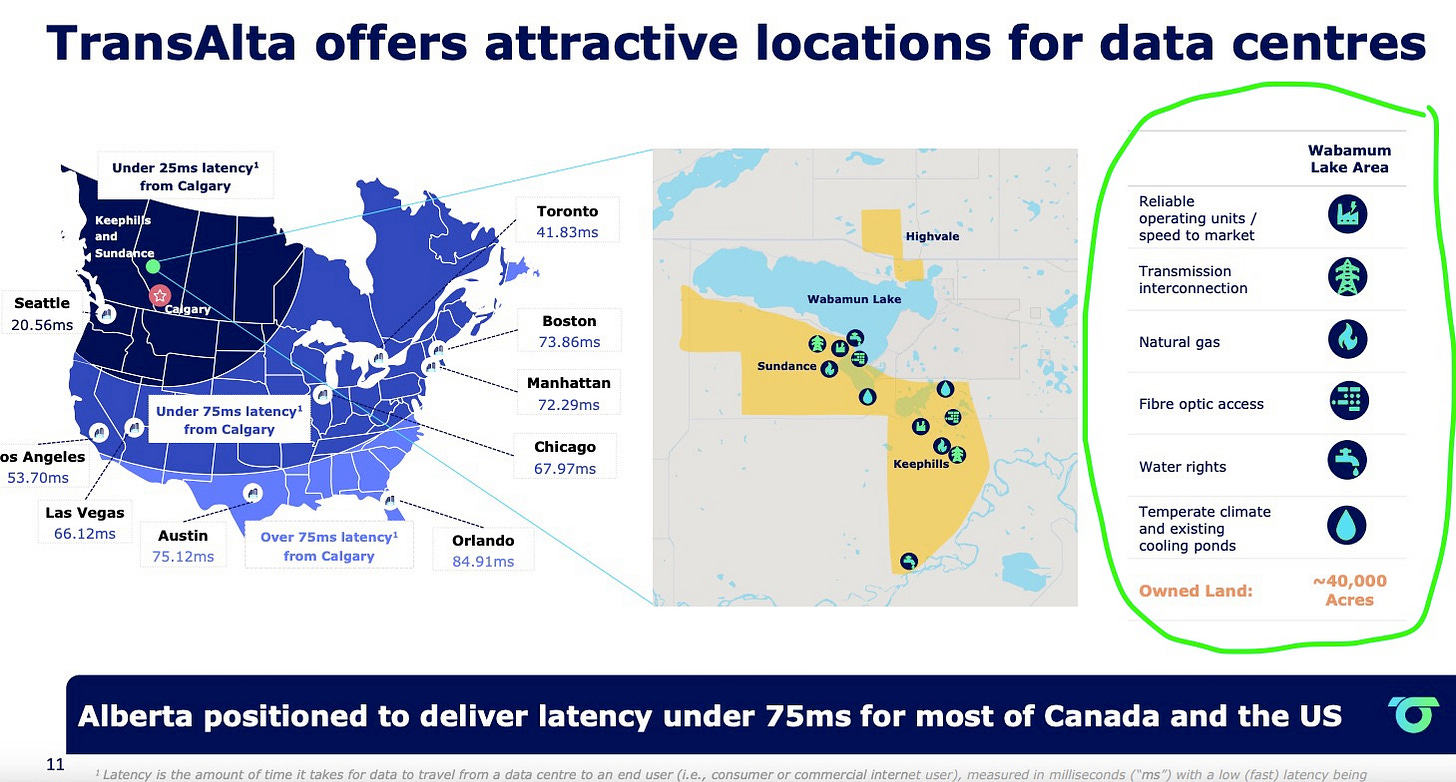

They also sit close to major fibre routes, which means data can move quickly to the US

They already own >52,000 acres of land tied into the grid. Quick data centre greenlighting

Canada hasn’t seen crazy AI data centre boom yet. Their government has already said, if you wanna build a data centre here, you bring your own energy. (Only now has the US started to do this with its policy posturing)

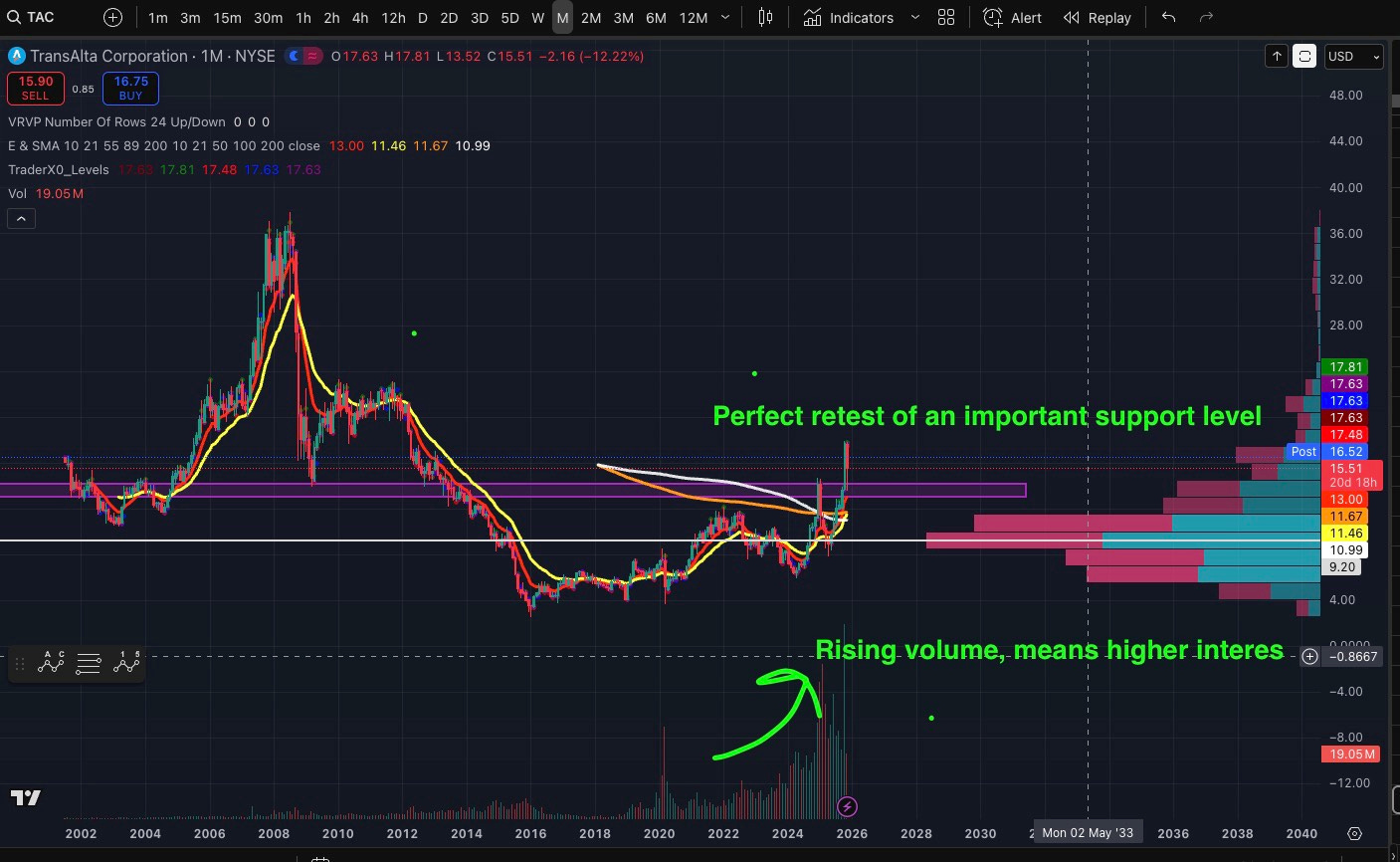

A quick Technical Analysis (TA) check, whether it’s worth our time to research.

Perfect retest of an important level.

Rising volume meaning high interest

Price staying above 10EMA

Simplicity in life and in TA is what makes things Mama Mia!!

Okay so why did the stock crash 20% on Q3 earnings yesterday?

TransAlta (TAC) missed Q3 2025 earnings estimates by a wide margin, posting an EPS of -$0.01 to -$0.02 versus the $0.12 consensus and revenue of $615 million versus $849 million expected. The shortfall was due to lower Alberta power prices and unfavorable market conditions, despite strong operational availability and hedging efforts.

Also,the timelines around the Alberta data center are uncertain, which rattled investors. Investor Day is now pushed to Q1 2026, and a partner’s filing pointed to a 2030 “in-service date” that to spooked the market.

Management called 2030 a “worst-case” scenario on the call. They and their customer are still targeting 2027–2028, while the partner works through transmission bottleneck analysis.

The company is progressing toward a final MOU with partners, which suggests this is normal project work rather than a red flag.

Market over reacted. Relax guys. Work’s in progress

Okay seems worth our time, lets get deeper. Here’s a snapshot of all the assets in it’s fleet.

INSIGHT #1

There are multiple benefits of being in Alberta as an Energy company trying to build AI data centers

a. Cold air that significantly reduces your cooling costs. Estimated to be about 5-15% total costs.

b. Alberta’s AI/HPC Ambitions: The Alberta’s government aims to attract $100 billion in AI-driven data center investment over the next 5 years

c. Alberta is the TEXAS of Canada with policies favoring behind the meter generation. About two years ago, Alberta’s Premier Danielle Smith stated that data center developers must sign deals with generating companies to “bring your own electricity, bring your own generation.”

This article was 2 years ago!!!

According to an article in DCD published on June 05 this year:

The Alberta Electric System Operator (AESO) has launched an interim approach to large load connections. The new approach is expected to enable the connection of up to 1.2GW of large load projects, including data centers, between now and 2028.

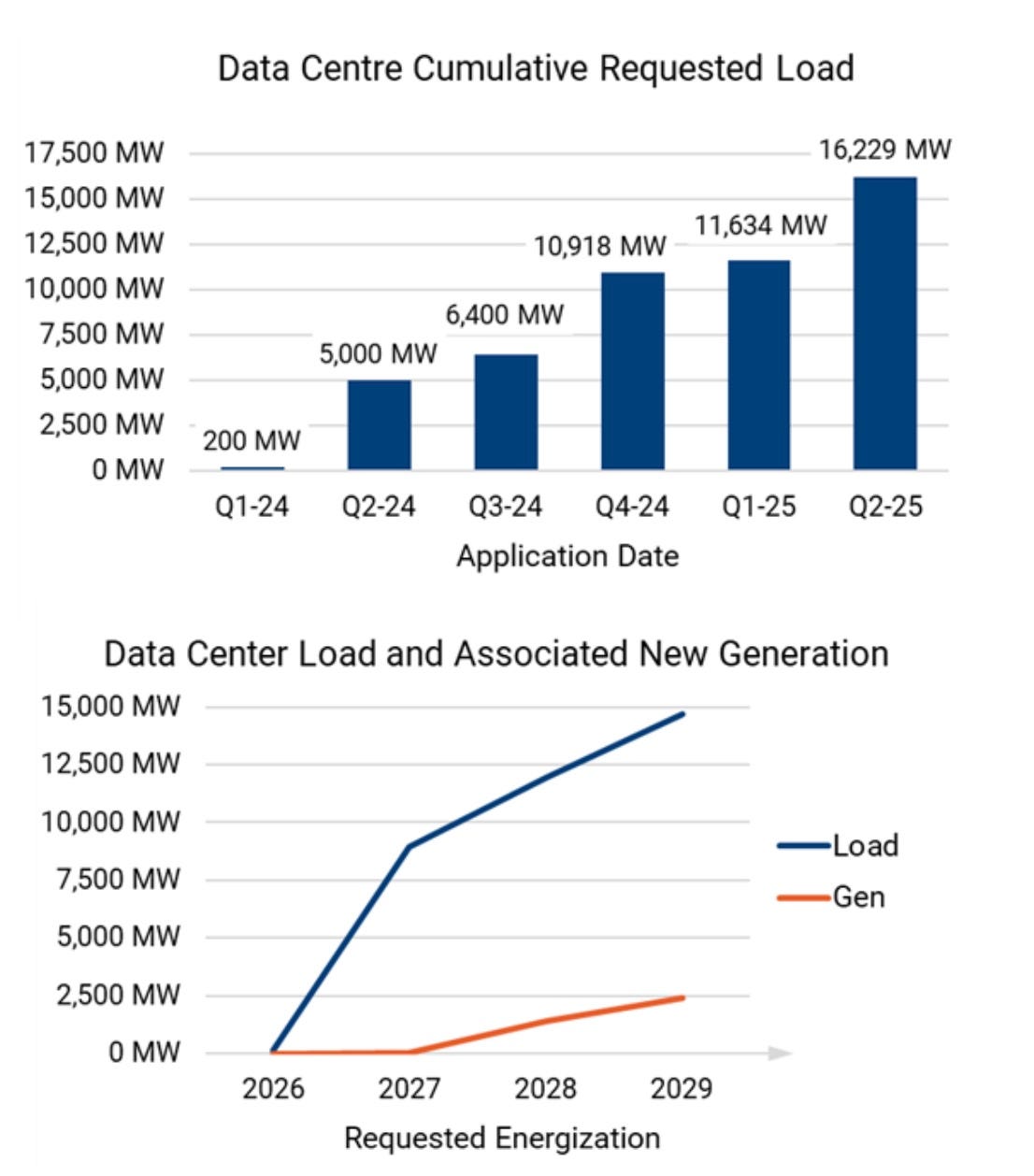

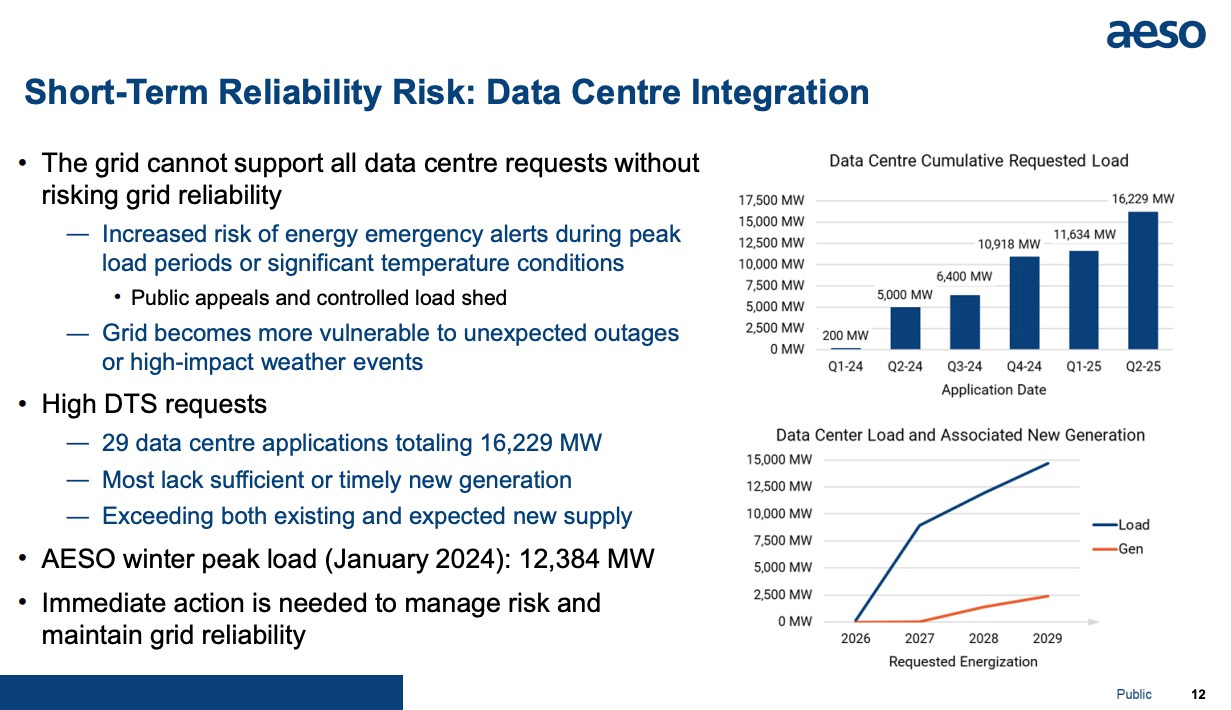

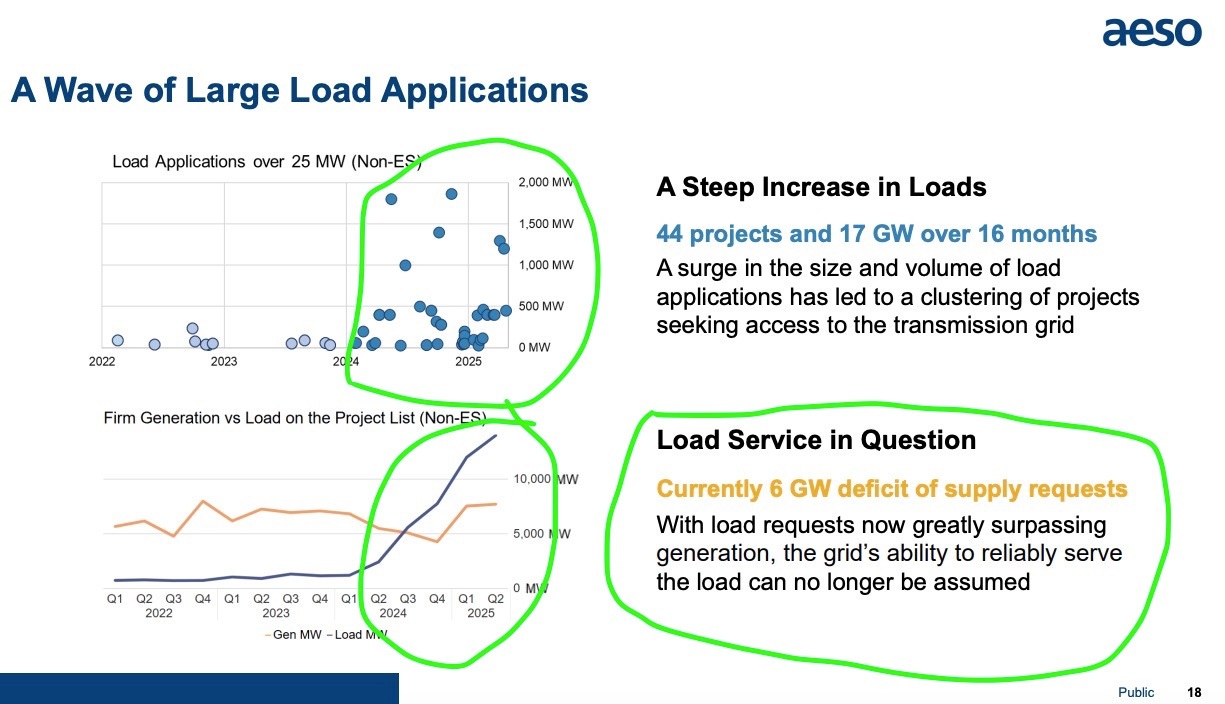

AESO (Grid operator at Alberta) is seeing unprecedented Power requests with backlogs for years. Look at how it outstripping generation requests

TransAlta’s Competitive Advantages:

Behind-the-Meter Model: Offers 90% dedicated power directly from generation assets, bypassing transmission constraints

Turnkey Sites: Sundance 6 (401 MW) and other sites prepared with water, land, fiber, and substation infrastructure

This is such an Important point. It’s not the GPU’s that are the bottlenecks. It’s the powered shell, or real estate that is powered that is in extreme shortage.

Here is Corweave’s CEO Michael Intrator, talking about how Power shells/infrastrcuture to set up AI data centre is the biggest bottle neck in Q2 2025

At the end of the day, right now, it’s the powered shells that are the choke point that is causing the struggle to get enough infrastructure online for the demand signals that we are seeing, not just within our company. It’s the massive demand signals that you’re seeing across the industry.

He felt the need to reiterate

It is a market that is really working hard to try and balance it is it there are fundamental components at the powered shell, at the power in terms of the electrons moving through the grid, at the supply chains that exist within the GPUs the supply chains that exist within the mid-voltage transformers. There’s a lot of different pieces that are constrained. But, ultimately, the piece that is the most significant challenge right now is accessing powered shells that are capable of delivering the scale of infrastructure that our clients are requiring.

Flexible Supply: Can offer mix of baseload (hydro, cogen) + peaker backup for 99.999% uptime. They are a mammoth and have a lot of flexibility

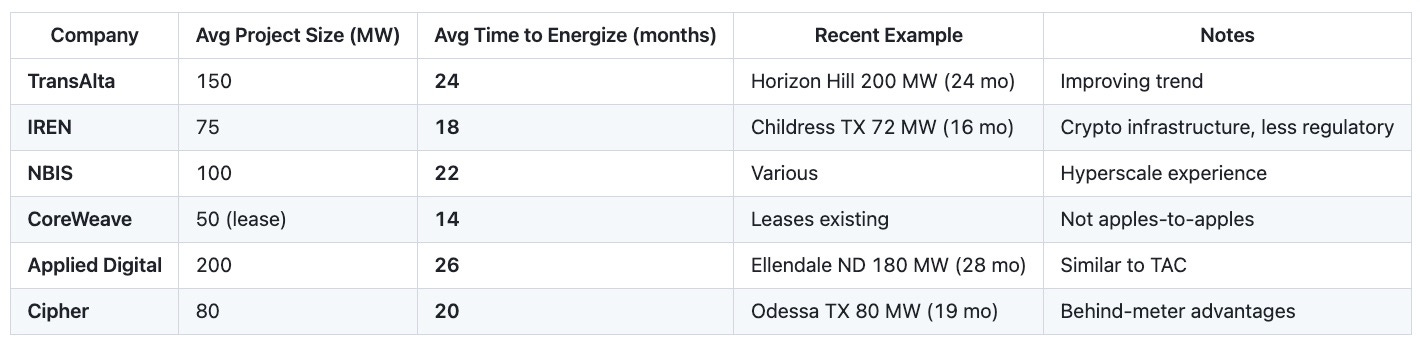

Speed to Market: 18-24 months vs. 36-48 months for greenfield builds

INSIGHT #2

As you know, I love to do conservative napkin math.

TransAlta’s rough valuation is at $492k per MW of energized power , based on its $4.43 billion market cap and 9,000 MW capacity. Even if you take EV value ($8B) it’s still comfortably below <0.9M/MW

This is significantly undervalued.

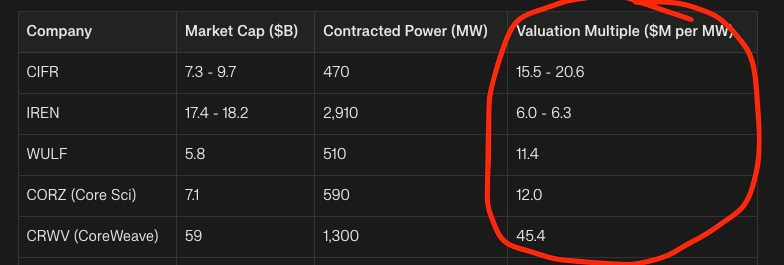

Lets take some of their famous peers:

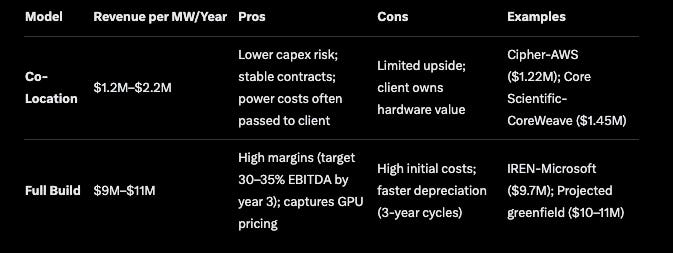

Neoclouds often hybridize, starting with co-location to fund expansions into full builds, driven by AI demand. Figures can vary by contract length (3–15 years), power efficiency (e.g., 4–7¢/kWh), and utilization (50–100%)

In a co-location setup, Neo Cloud may simply rent space in a data center, bring its own GPUs, and manage them independently.

Of course there are a lot nuances to think about. For eg. they obviously lack the expertise to build AI data centers themselves.

Here are some important aspects of contracts.

As an investor in $TAC, you gotta have some premonition about the following questions

What would their partnerships look like?

Are they going to provide co location and ONLY sell the powered shells?

How are they going to bridge for new power since AESO claims they will only allow 1200MW until 2028, even though there is 16GW waiting for interconnection?

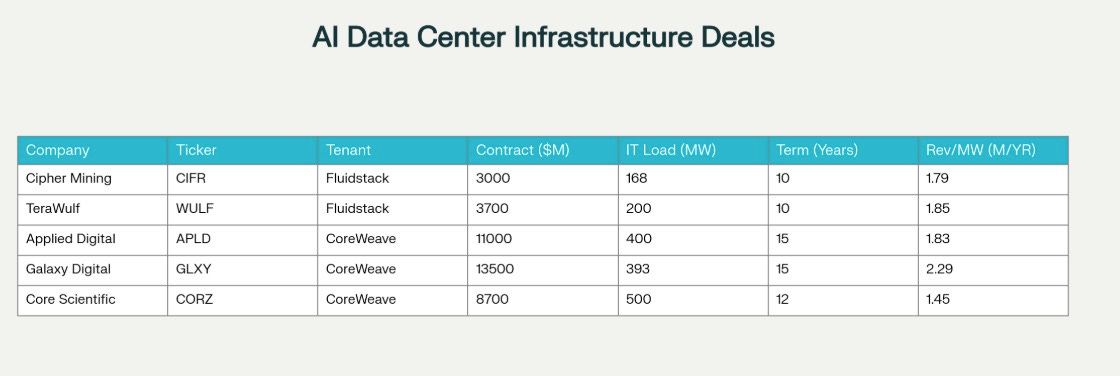

Look at how co location deals for their companies and their partners are valued at. I asked Perplexity to compile this data.

Now $TAC are exploring to convert their power into high margin data centre hubs. Contracts are still up in the air, but For sure, margins in the future will be much higher than it is now.

INSIGHT #3

I am not a modeling expert, but here are some of my estimations for what the business could be worth.

Economic Model:

Land Lease: $50,000 - $100,000/acre/year (200-400 acres typical = $10-40M/yr)

Power Lease: $1.0 - $1.5M per MW per year (equivalent to $114-171/MWh at 100% utilization)

Ancillary Revenue: ±$85M, Grid balancing, backup power services

Total Revenue Potential: $1.2 - $1.8B annually for 1,200 MW allocation

Incremental EBITDA: $900M - $1.35B (assuming 75% EBITDA margin)

Implied EBITDA Multiple:

If valued at 10x (conservative) =$9-13.5B incremental EV

$9-13B just for the Data centre business.It’s obviously an over assumption that they will get 1200MW of new power. But I wonder how much can they repurpose without needing AESO’s permissions. They have filed for 650MW of new power for Datacentres as of 6/25. So assumed 1200MW total plus or minus.

Timeline & Probability:

Q4 2025: AESO executes Demand Transmission Service contracts (expected mid-September completion, now delayed to Q4

Q1 2026: TransAlta signs definitive agreements with 1-2 hyperscalers (Stock crashed after earnings Q3 because this got delayed. I would say it will happen with 60% probability

Q2-Q3 2026: Site prep and infrastructure build begins

2027-2028: First data centers operational (400-600 MW initially)

2028-2029: Full 1,200 MW build-out (if successful)

Probability-Weighted Value:

60% chance of securing 600 MW @ $1.2M/MW/yr = $720M annual revenue × 10x multiple = $7.2B EV × 60% = $4.3B

30% chance of securing 300 MW @ $1.0M/MW/yr = $300M annual revenue × 10x multiple = $3.0B EV × 30% = $0.9B

10% chance of no deal = $0

Expected Value: $5.2B incremental EV so atleast a double from here

INSIGHT #4

Market is mispricing that AESO (Grid operator in Alberta, the ERCOT of Alberta) will provide much higher interconnection with the help of Batteries and reduce the grid instability during peak hours.

Alberta has about 16GW waiting interconnection approval. AESO came out and said they are planning for only 1.2GW until 2028

Woah? Boooring!!

Grid stability is their major concern.

But this will be rethought. Market’s skeptical but they will be able to get in much more GW in. This is not getting priced in that AESO will end up approving much more GW of interconnection.

This is how

Stick a battery on the data-centre: charge it off-peak, dump it back during the evening rush, and your “new” load barely shows up on the grid’s peak meter.

It’s plug-and-play: $TSLA Megablocks or $FLNC, or $EOSE are factory-built, already running near Grande Prairie, and can be on-site earning money well before the 2027-28 crunch.

Regulation hack: AESO’s 1,200 MW cap targets peak demand; if you bring your own battery and commit to peak-shaving/DR, you skate around that limit and unlock extra revenue streams.

For years they have had more generation than load. But this flipped a few a quarters ago. This is unprecedented.

They have a 400MW battery in interconnection study right now.

Batteries will have a big role to play to service all of that load requests

This source offers a great deal of information about AESO’s thinking. Just look at how Load demand is overtaking gen. This is insane.

INSIGHT #5

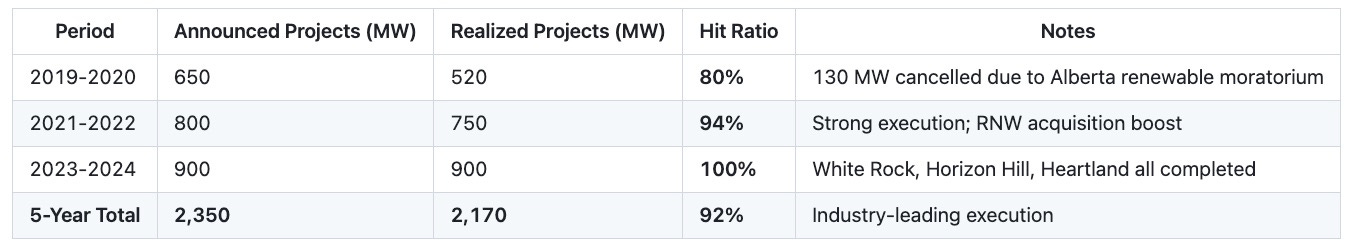

Their track record and Management execution is on point.

Speed to energize is comparable to a Bitcoin miner. Which in amazing for a traditional Utility company. Don’t forget about the Sundance 6 site which might be even online in 18 months.

Transalta seems like they do what they say they will do. Just Look at their track record

I don’t got no trust issues when I can see your past.

( I like wrong grammar. so forgive me)

These are historical Alberta’s Pool Prices:

2019-2020: $55/MWh (oversupply from new wind)

2021: $95/MWh (coal retirements, demand recovery)

2022: $135/MWh (natural gas price spike, Ukraine war)

2023: $88/MWh (normalization)

2024: $82/MWh (continued stability)

2025E: $75-85/MWh (new Heartland supply pressure)

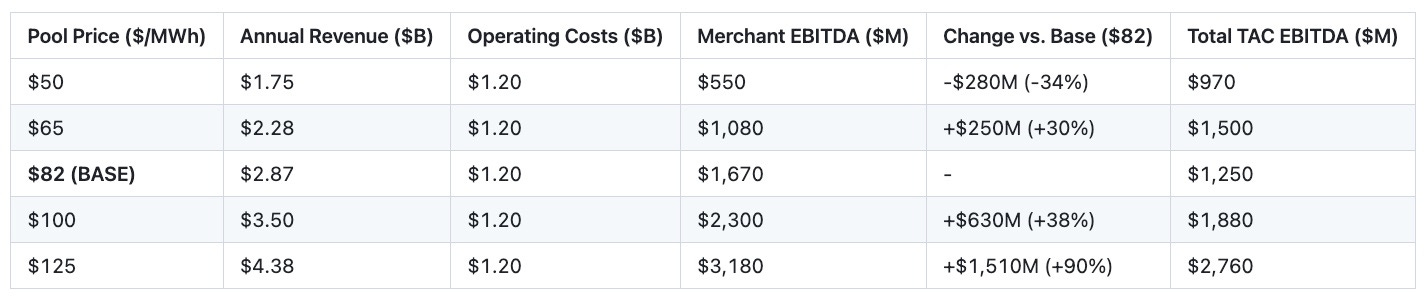

EBITDA has shown some Sensitivity in the past to Alberta Pool Prices (based on 4,000 MW merchant exposure)

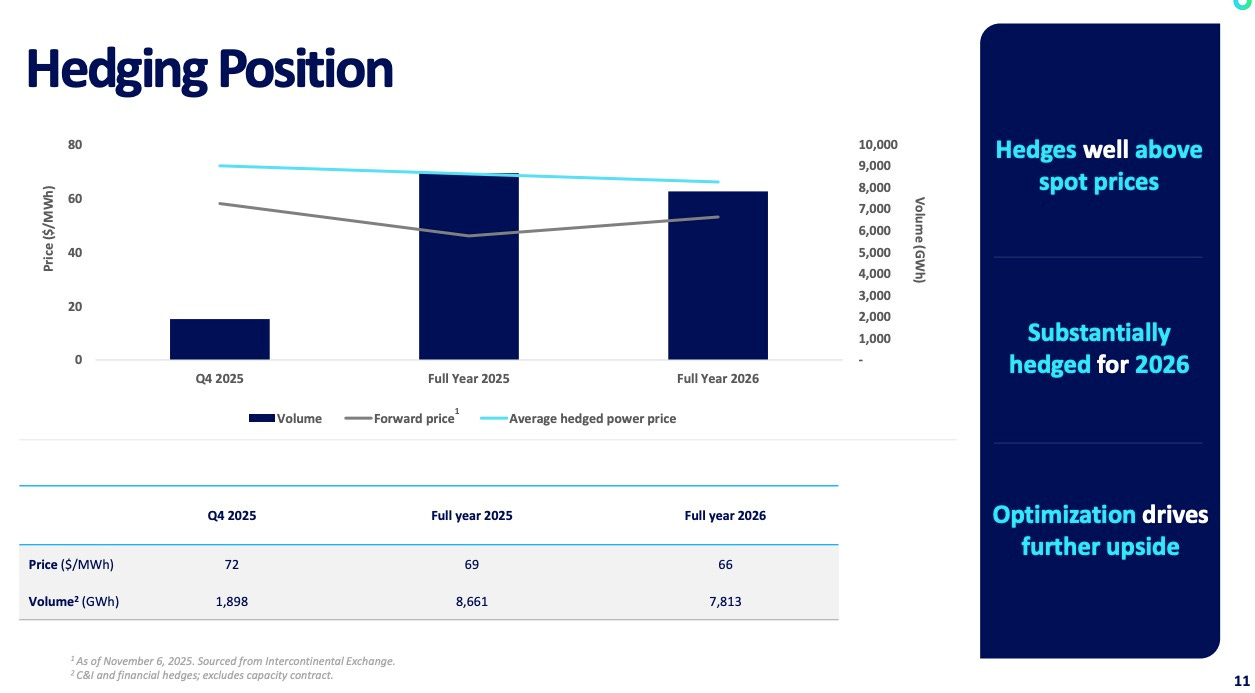

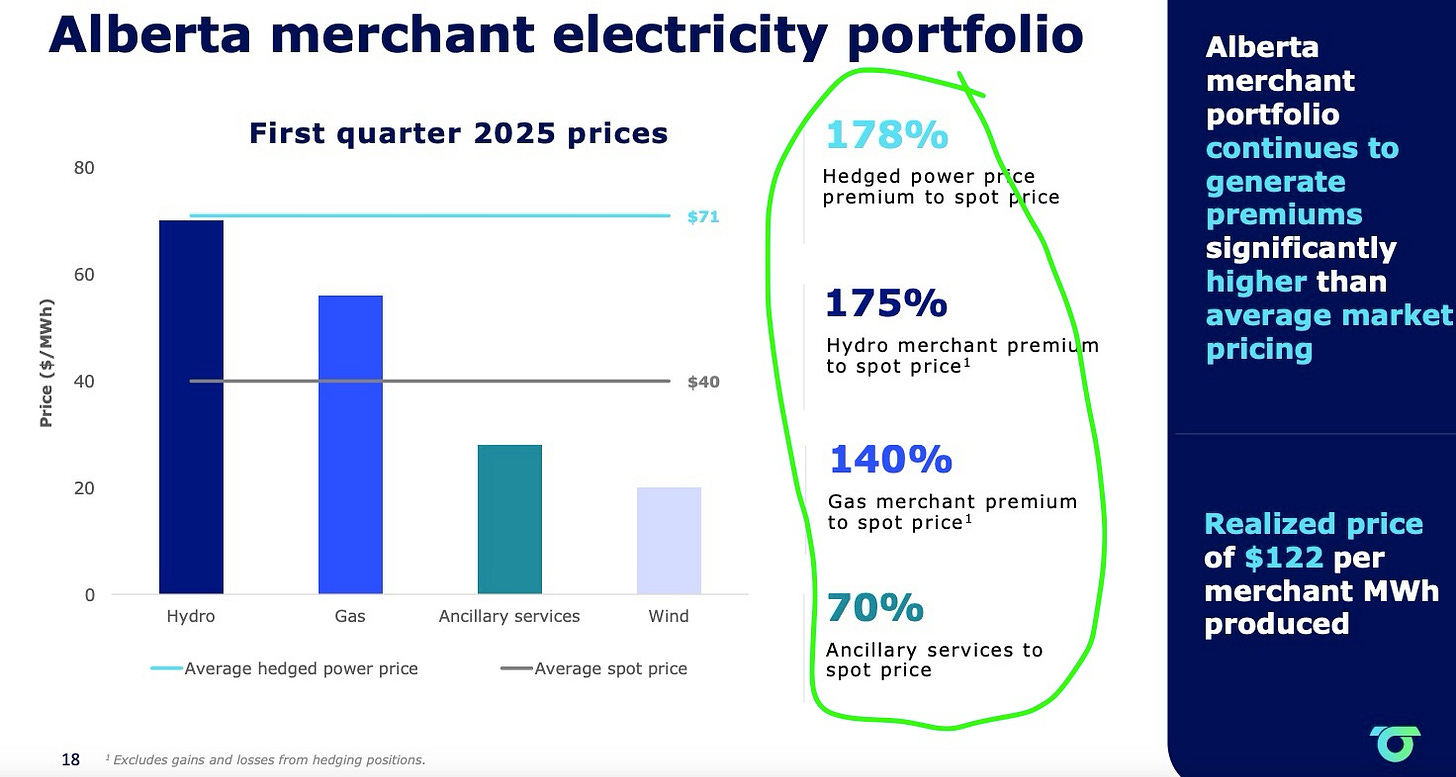

Still I am very surprised and happy to see that they squeezed much more $ revenue per MWh than the pool pricing in Alberta. They do this by employing a number of hedging strategies.

Even though, they missed expectations bigly, this gives me a signal that the management at TAC are A class and they know their energy business well. I mean, just look at this slide

Lets check further about the management.

Board & Executive Relationships:

John Kousinioris (CEO): Former ATCO executive; well-connected to Alberta business elite. Look at that sauve look!!!

EDIT: John will be handing over the reigns to the CFO. Which makes sense since the company has a lot of financial engineering ahead of them. The stock might have not liked that, this quarter was a big miss too.

Board Member: Lynn Ewing: Former AESO executive (2010-2018); direct insight into grid planning and maybe some influence too

Board Member: Martha Wyrsch: Former VP at Suncor; oil & gas ties critical for Cogen partnerships

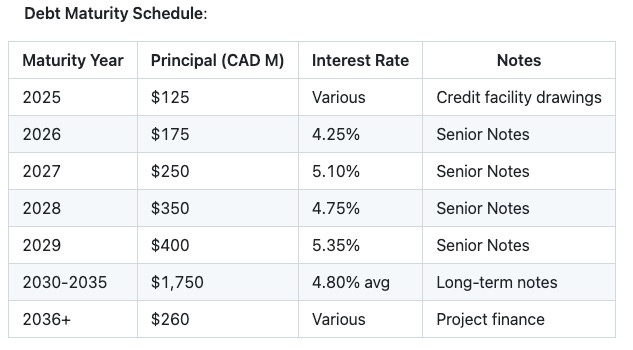

Lastly, also valuable to look at their debt structure to know if they will have a cash crunch soon. This is important because AESO is very touchy about providing approvals to non stable developers. They have been multiple eg. of projects started but then abandoned.

Total Debt (as of Dec 31, 2024): $3.31 billion,

Current Cash: $162.8 million

This looks honestly not so bad. Clear and manageable.

RISKS

They are not able to make an agreement with a hyperscalers

META completes the deal with Capital Power (CPX). The market seems to think so.

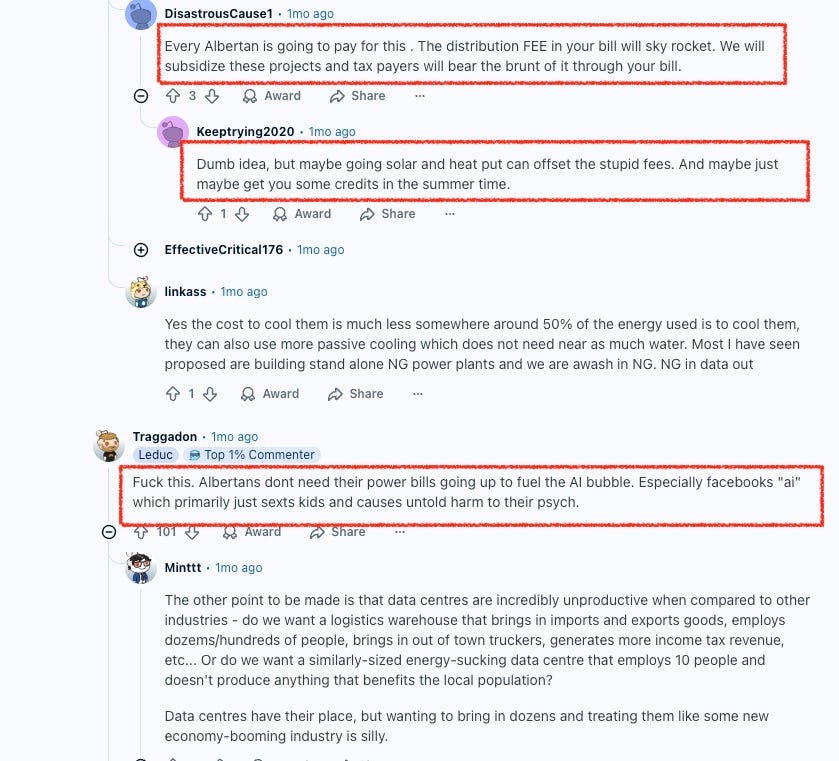

They get blocked politically to open data centres. I found a reddit post of albertans super unhappy about Meta’s potential deal to place a data centre there

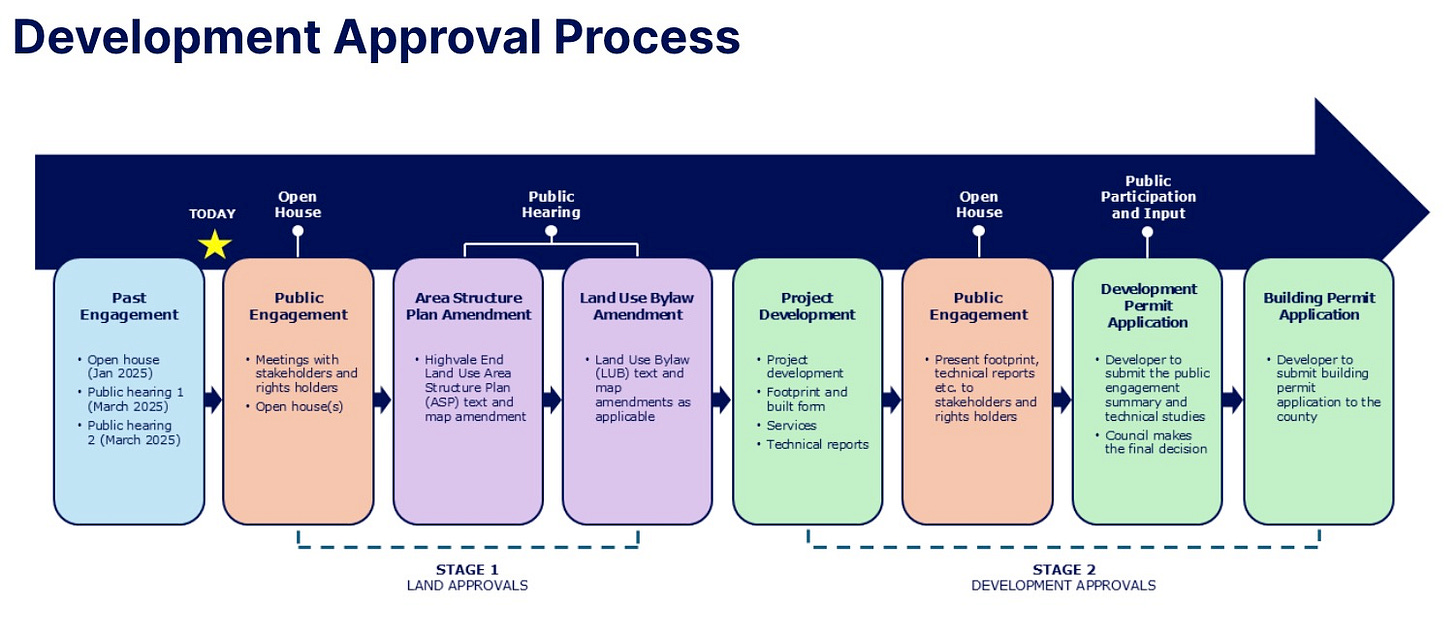

Red taping in Canada could be significant effort and it largely depends on the administration’s desire to will data centres in their jurisdictions. So wild card. Check the approval processes involved

Edmonton-based Capital Power also has two massive proposals in the AESO connection lineup, representing 1,500 megawatts of load for potential data centres to be co-located at its Genesee Generating Station.

Upside Case: If TransAlta converts 1GW to data center hosting at $100K/MW/month = $1.2B annual revenue vs. current $750M from same capacity = +$600M incremental revenue = ±$500M incremental EBITDA (75% margin).

This is at the core of the thesis for EBITDA almost doubling in a year.

REMARKS:

I didn’t go all in on this because I like to chase higher risk as well. But otherwise I think it’s a solid play with good returns especially after this 30-40% crash.

APPENDIX:

AESO Interconnection Process: Alberta moved to a cluster study approach in 2024 to manage queue backlog.

TransAlta’s Queue Positions:

Cluster 1 (2022-2023): All projects withdrawn or completed (100% success for completed)

Cluster 2 (2023-2024): 2 projects totaling 150 MW (battery) - 1 completed (100 MW), 1 in construction (50 MW, COD Q2 2026)

Cluster 3 (2024-2025): 1 project, 400 MW battery storage (SASR submitted; system impact study Q1 2026)

Required Upgrades for Cluster 3 Battery Project. All of this is doable pretty well. Some more Napkin maths on the interconnection costs

Transmission: $45M (new 240 kV line, 12 km) - 50% allocated to TransAlta, 50% to other cluster participants

Substation: $18M (new breakers, transformers) - 100% TransAlta

Total Interconnection Cost: $40M or $100,000/MW (typical for Alberta solar/battery)

Fee Deposits Paid: $8M (Q3 2024)

This earnings was a big miss due to energy prices. However, that could be an opportunity to explore further