$TE/T1 Deep Dive 3 (There might be a positive suprise tommorrow)

Time sensitive. Q3 Earnings in a few hours

TLDR:

Polisilicon prices have bounced off it’s lows from June 2025. competetion in the TopCon tech has eased up a little bit in this quarter

There might be a suprise announcement about SPAC merger with ALUSSA 2 for the remaining funding of G2 phase 1

TE’s Topcon Tech vs, FSLR CdTE. The only 2 players in quest for Vertically integrated US solar production

HOUSEKEEPING:

I am keeping all my research free, so its not so nice to take these insights and paywall them in your own substack. It takes substantial amount of time to produce these.Moving onwards, I am considering paywalling some content to deter this behavior

If you haven’t already, I suggest you start with Deep Dive 1 and Deep Dive 2

INSIGHT 1

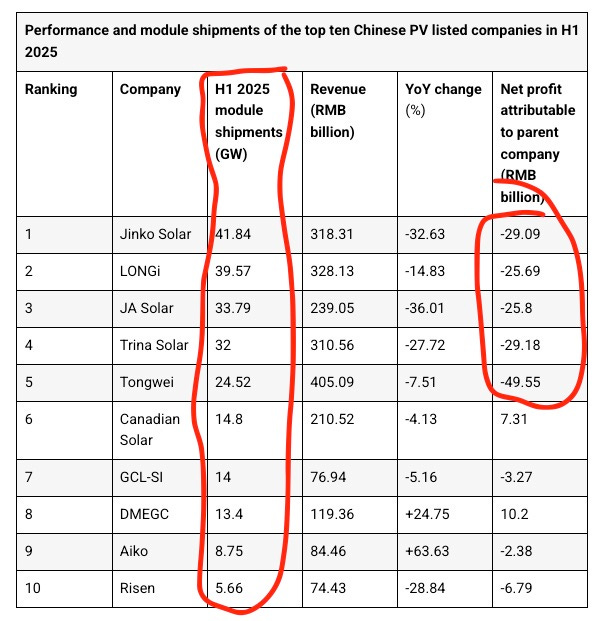

There is a lot of fear that the 4 Chinese big-dawgs are selling Solar panels at a loss in H1 2025

News outlets including Reuters, Bloomberg, and PV Magazine reported that losses across the five biggest producers (including LONGi, Jinko, Trina, JA Solar, Tongwei) for H1 2025 ranged from CNY13 billion to CNY17.3 billion ($1.8–2.4 billion)

Notice the GW module shipments. And here we are, getting excited about 10GW in 2 years time frame for TE. The Chinese are playing a completely different ballgame.

Interestingly only $CSIQ and DMEGC made profits. This is obviously very scary fact.

- How will $TE be profitable then?

- How can they do what all the other Chinese mass producers couldn’t do?

To answer these questions, lets look at the reasons as to why this oversupply happened?

Destructive price war: Cutthroat “involution” slashed prices to win share, pushing margins below zero.

Tariffs bite: U.S. trade barriers piled on costs and choked some export routes, squeezing margins further.

Demand dip at home: China’s 2025 subsidy reforms cooled installations, pressuring prices and volumes.

Tech transition: Old PERC lines winding down, new high-efficiency lines not fully online—efficiency and capacity in limbo.

Policy whiplash ahead: China’s planned end to the 13% VAT export rebate by Q4 2025 yanks a key price support, forcing repricing and investment resets.

This tells me that there were a lot of factors that contributed and the Chinese industry will consolidate soon enough and prices will rebound.

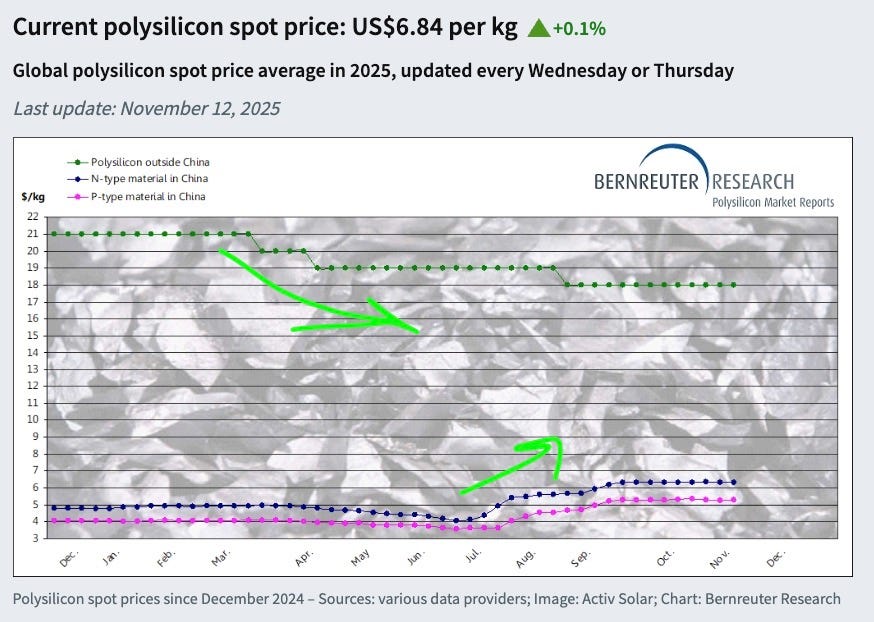

Well well, lets check out the prices of Polisilicon, an important material in Solar wafers.

There are two trends that plays in our favor. Polysilicon in China seems to have bottomed from July and has rebounded already 50-70% This means there is more demand and stabilization.

Secondly, Polysilicon outside china (which is 5X more costly) is slowly reducing. Both these trends combined, TE might have a little favorable time this quarter.

I love that it literally bottomed July, so that might not be appreciated by the markets yet. for this quarter.

INSIGHT 2

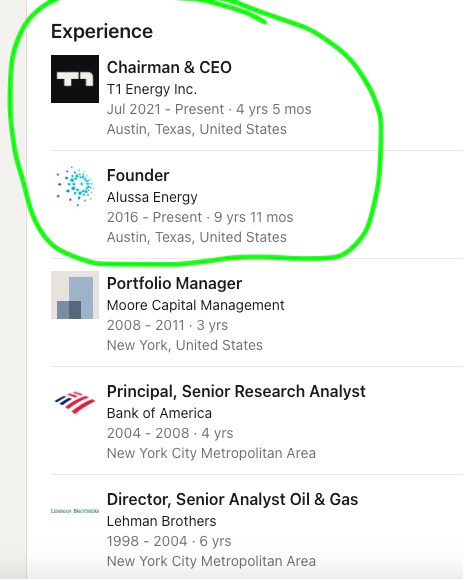

Remember Alussa I Energy corp in 2021? FREYR raised SPAC money ($850M) with them. Mr. Barcelo was the man behind it.

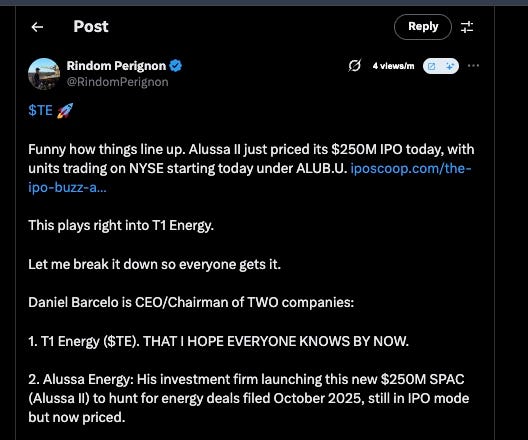

Now after 4 years, they filed a new SEC filings today. Literally half a day before earnings announcement tomorrow.

Daniel Barcelo, the current CEO of TE/T1 is the also the head of Alussa Energy. The timing is super suspicious.

The two filings from 2019 and 2025 are EXACTLY the same.

Original SEC filing from 2019: https://sec.gov/Archives/edgar/data/1781115/000121390019024877/f424b4112619_alussaenergy.htm

Now compare it to 2025 filings: https://sec.gov/ix?doc=/Archives/edgar/data/2041493/000121390025102171/ea0217506-21.htm

Exactly identical. It’s like as if they didn’t want to pay anymore lawyer fees because they know they were going to do the same thing again. This delay of 6Nov to 14Nov 2024 could be to accommodate the IPO filing of ALUSSA II.

MEANING: ALUSSA II might provide the remaining funding of $250M for G2 phase 1 for very little dilution.

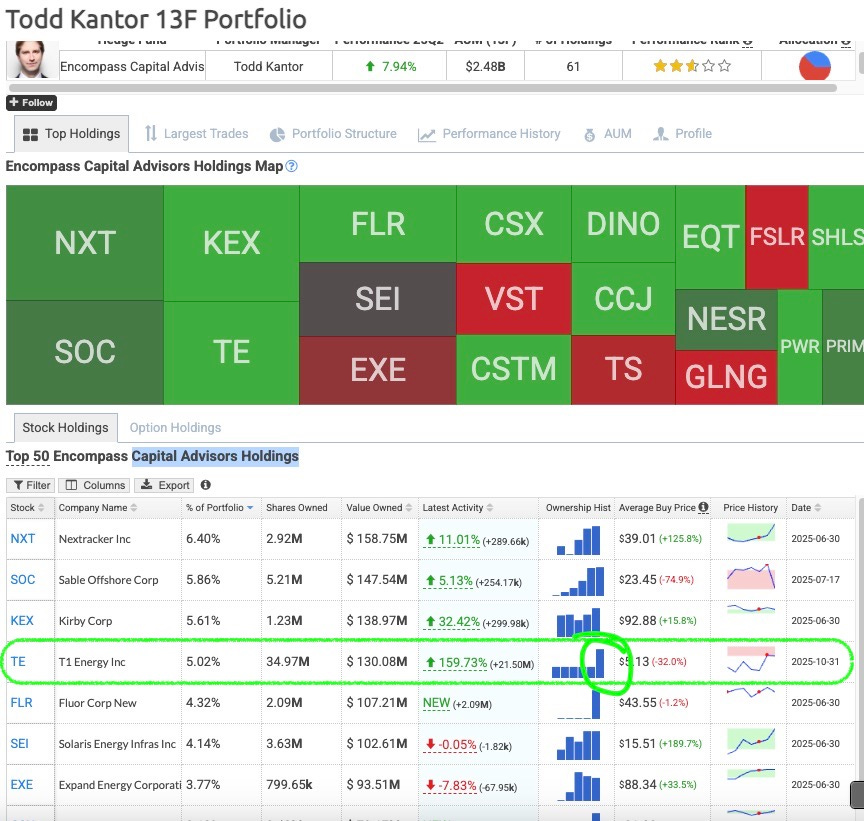

Also interesting to note, Encompass Capital Advisors Holdings are the SPAC sponsors of Allusa. IF you look at their 13F filing. They are heavily focused on Energy and industrials.

The last spike in number of shares is due to the capital raise of $72M and $50M convertible debt about 3 weeks ago.

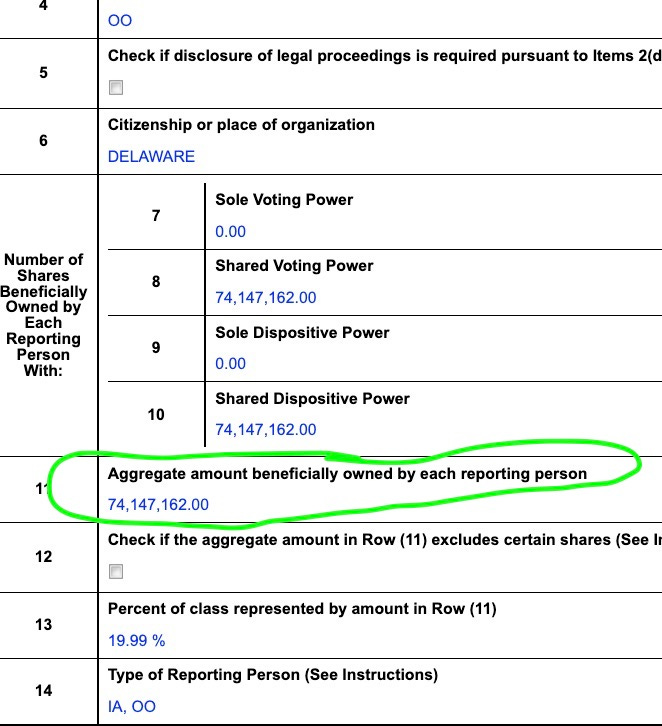

I spent more than an hour trying to understand how much shares do they own in total. I am still confused because it says in the SEC documents they own 74M for 19% stake. Also 61M number is thrown around.

But that would mean an outstanding shares count of 350M. This is not the case right now. So maybe someone smarter than me can clarify.

Here is the link to the most recent 13D filing

https://www.sec.gov/Archives/edgar/data/1541901/000092189525002886/0000921895-25-002886-index.html

In any case, Encompass has substantial interest in $TE’s success.

This insight was originally found by Ringdom. An awesome analyst on X. Super sharp. Give him a follow for alpha

INSIGHT 3

Geographic variation matters significantly – TOPCon wins in most scenarios, but CdTe retains advantages in extreme heat + humidity environments and has better degradation profiles

LCOE is highly location and assumption-dependent – the same technology can have vastly different costs depending on financing, labor, land costs, and system design

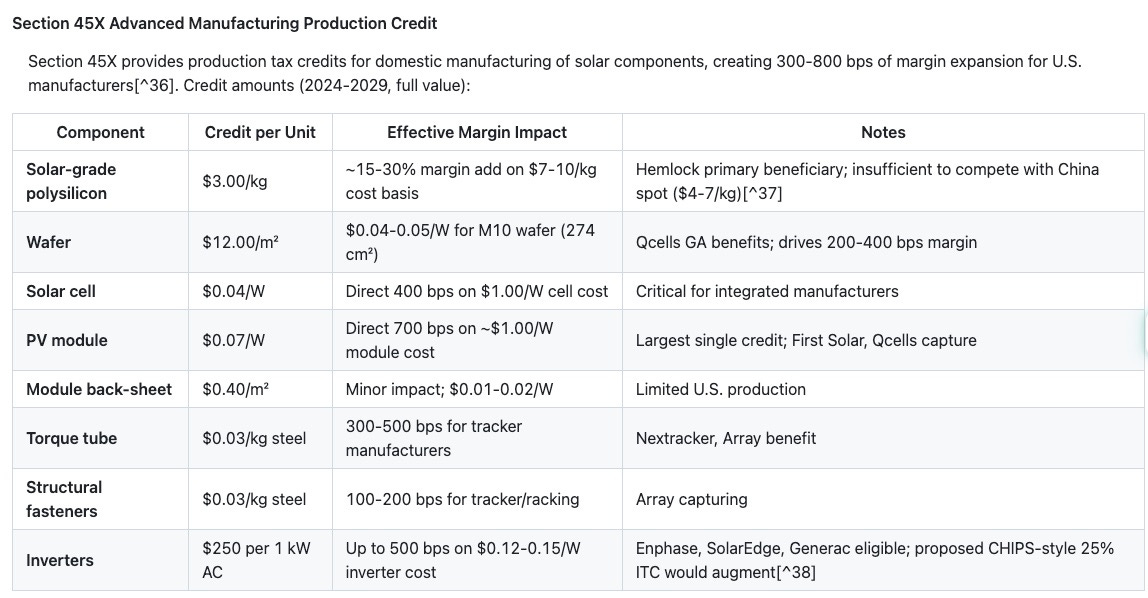

Before we start, lets look at the 45X details. These incentives are amazing for a vertically integrated player.

$FSLR has absolutely crushed it this year with margins and shareholders return. Their EBIT margins stand at 30%. Woat???Ask the chinese how they feel about that.

First Solar (FSLR) has taken full advantage of the credits. Over the past two years, they’ve generated more than $2.1 billion in net profit—coincidentally, about the same amount they received from the 45X subsidy.

Given this, and after a closer look at the margin drivers, I’m hesitant to draw firm conclusions about margin comparisons at this stage. (Opinion changed from deep dive 2)

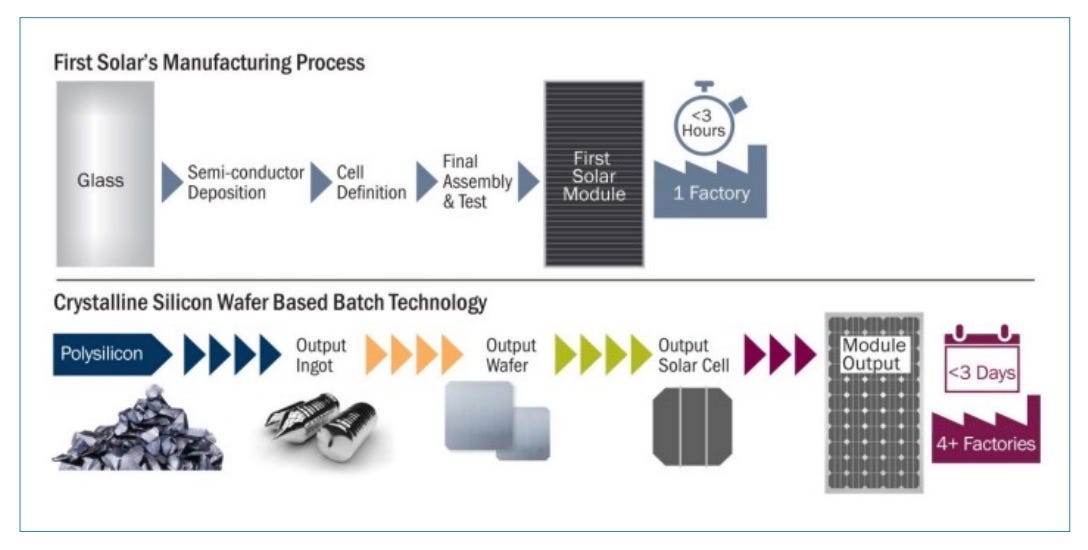

Their tech does obviate many steps and makes it easier to manufacture. So that’s kinda cool.

However, an important point to remember is that they are not as efficient as T1/TE’s tech.

Efficiency Records:

Trina Solar(TE) TOPCon: 27.8% (record set Nov 2024), 23% in field

First Solar Series 7: 22.3% efficiency, 19% in reality

Efficiency gap: ~4.3 percentage points in TOPCon’s favor

The advantage is about 4% in real world. Now this spread across it’s entire lifetime means considerably less electrons generated per acre

On the flip side, one advantage that FSLR’s Cdte has is that it is more reliable for extremely hotter temperatures. TE’s Topcon can do bifacial capture meaning it can gather energy from light that is reflected from ground.

The Reality is that LCOE calculations are dependent on locations and each tech has their own strengths. I asked Claude to do some calculations in different locations where they these type of plants exists. see it in APPENDIX

Conclusion: Topcon for most cases are more suitable because of higher efficiency. There is a reason why 70-80% of the Solar market in the world is Topcon. CdTe tech is 1-3% market share currently.

P.S. I am writing so many posts at the same time (slow burners). I don’t want to sacrifice on the quality, so they are trickling slowly.

APPENDIX

Example A

Phoenix Result: TOPCon $42.6/MWh vs. CdTe $49.7/MWh Winner: TOPCon (-14% LCOE advantage) Key Driver: Bifacial gain (+10.7%) outweighs CdTe’s temperature advantage

Note: If using unsustainable $0.096/W TOPCon pricing → LCOE drops to $0.034/kWh, creating a -32% gap. This is artificially distorted by Chinese overproduction.

Example B

Seville Result: TOPCon $48.0/MWh vs. CdTe $53.8/MWh Winner: TOPCon (-11% LCOE advantage) Key Driver: Tracker + bifacial synergy (+30% energy vs. fixed monofacial)

EXAMPLE C

Hamburg Result: TOPCon $63.3/MWh vs. CdTe $87.0/MWh Winner: TOPCon (-27% LCOE advantage) Key Driver: CdTe’s low efficiency cripples performance in low-irradiance climates; TOPCon’s bifacial gain + higher efficiency dominate.

EXAMPLE D

Ohio Result: TOPCon $47.5/MWh vs. CdTe $56.6/MWh Winner: TOPCon (-16% LCOE advantage) Note: IF domestic content bonus (+10% ITC) applies, CdTe gains additional $0.08/W advantage → LCOE drops to $51.2/MWh (still loses to TOPCon).

Thank you for gathering and sharing all the information with us, much appreciated!