$TE T1 Energy Deep Dive (Part 2)

Fully diluted capital is 50% higher, but no-one is talking about the powered Giga Arctic factory that can be repurposed into an AI data centre

Disclaimer. Nothing is financial advice. Go look for an entry point instead. AI was only lightly used to proofread and fact check

If you have not read my part 1 on $TE, I would highly recommend you to read that Part 1. Here is the link

Part 2 explores further the bullish and the bearish cases. I cite certain accountings and important insights from the SEC filing.

This article is quite long since I found a lot of things and writing helps me build conviction on my investments. Hopefully it does the same for you.

TLDR:

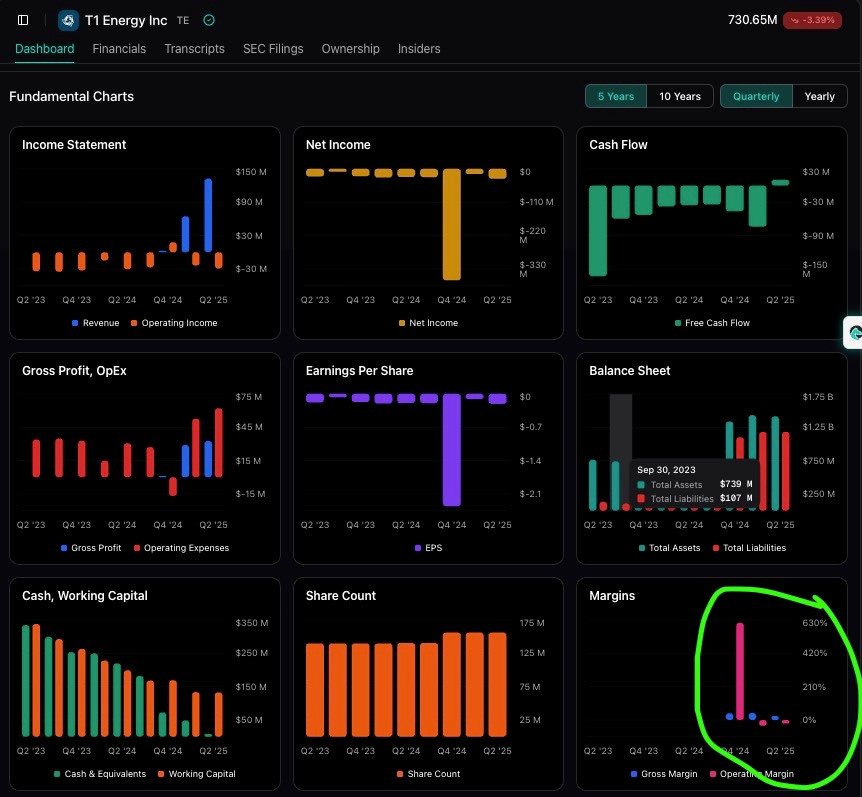

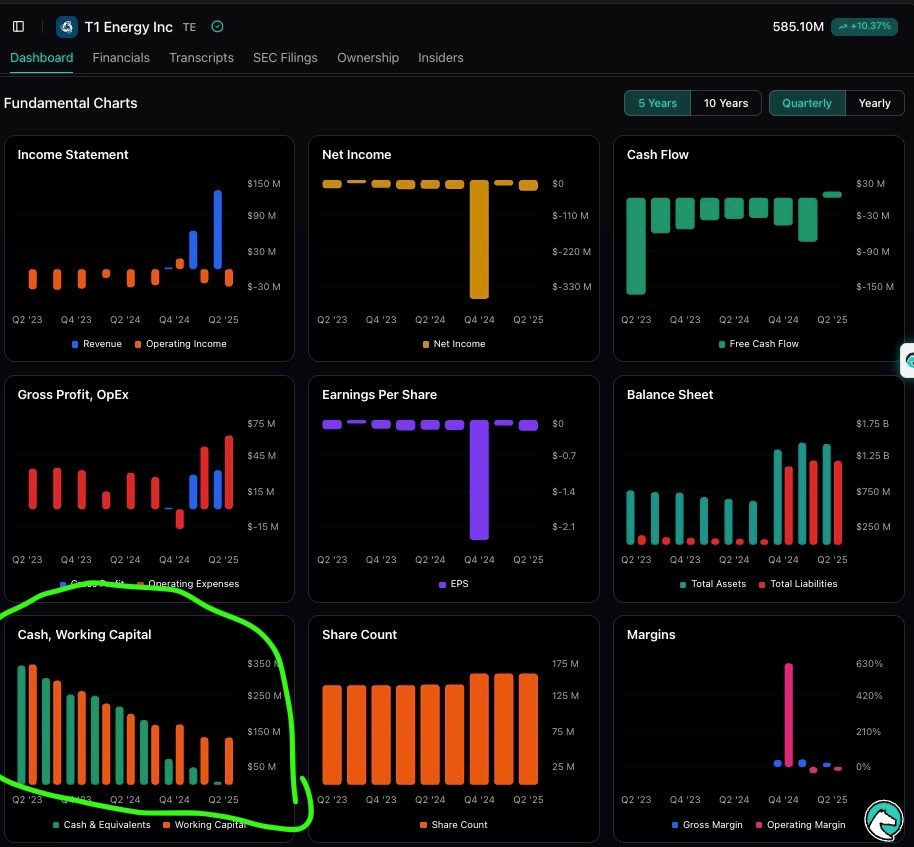

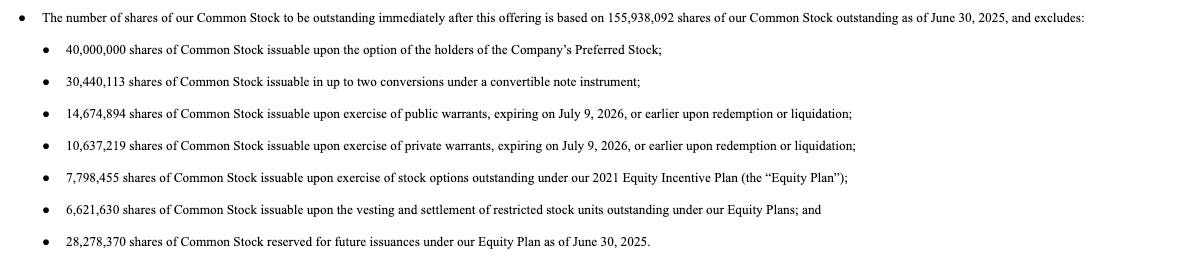

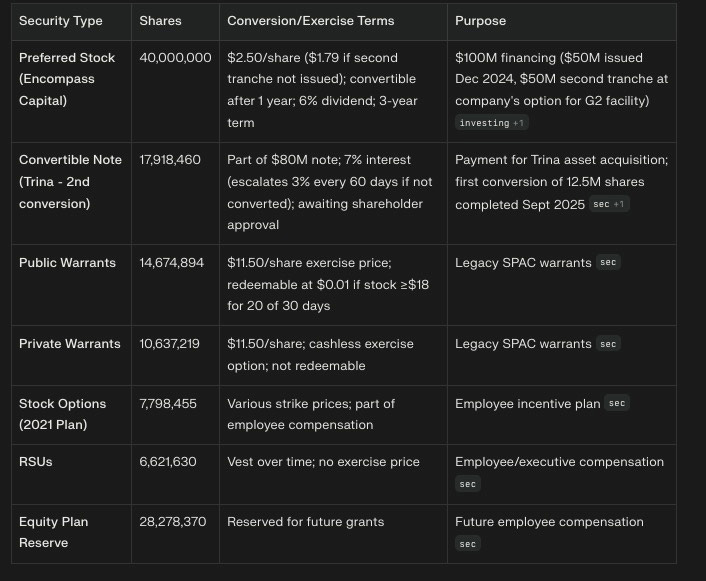

T1/TE looks undervalued with a meaningful upside ahead, but its headline market cap of $700M is misleading. On a fully diluted basis, the market cap is roughly 50% higher, around $1.1B. Warrants and SBC might not convert so this is the most conservative calculations.

Also, most analyses seem to miss the potential value of the PowerShell Giga Arctic project. If that asset is realized, it could add several hundred million dollars beyond whats currently reflected.

Content:

- Bullish Points

- Bearish/Risk Reasonings

- Deep Dive into the history of T1/TE

- Major Thesis. Securing US domestic supply chain and Investments into Talon PV.

- Margins at FSLR. Why is it so good?

Appendix (For Paid subscribers for savvy details)

- Details of the debt and equity raise in detail. Full dissection.

- Insights about the Giga Arctic that could get purposed into an AI data centre.

- Details about the Chinese Solar companies profits.

In the last final PART 3, I will dive deeper into the PV tech. Topcon tech.

Now lets get into each of these points

Bullish:

1. Even with Trump administration’s anti renewable back drop, US is securing it’s energy independence. Solar has a big part to play here FSLR($25B) and TE($700M) are the ONLY pure play US Solar stocks in the block.

Since the passing of the IRA in 2022, Domestic annual nameplate capacity for Solar modules increased by over eightfold 800%

Joe Biden’s policies secured the path to America’s solar energy independence. Trump is continuing to do so by leaving the 45X incentives intact.

Now ramping up just the modules is not enough. The entire supply chain’s gotta be upgraded so that any weak links can be eliminated in the path to pure independence.

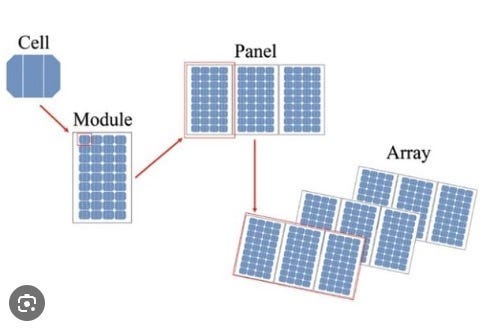

This is how the supply chain looks like:

Polysilicon → Wafers → Solar Cells → Modules → Installation

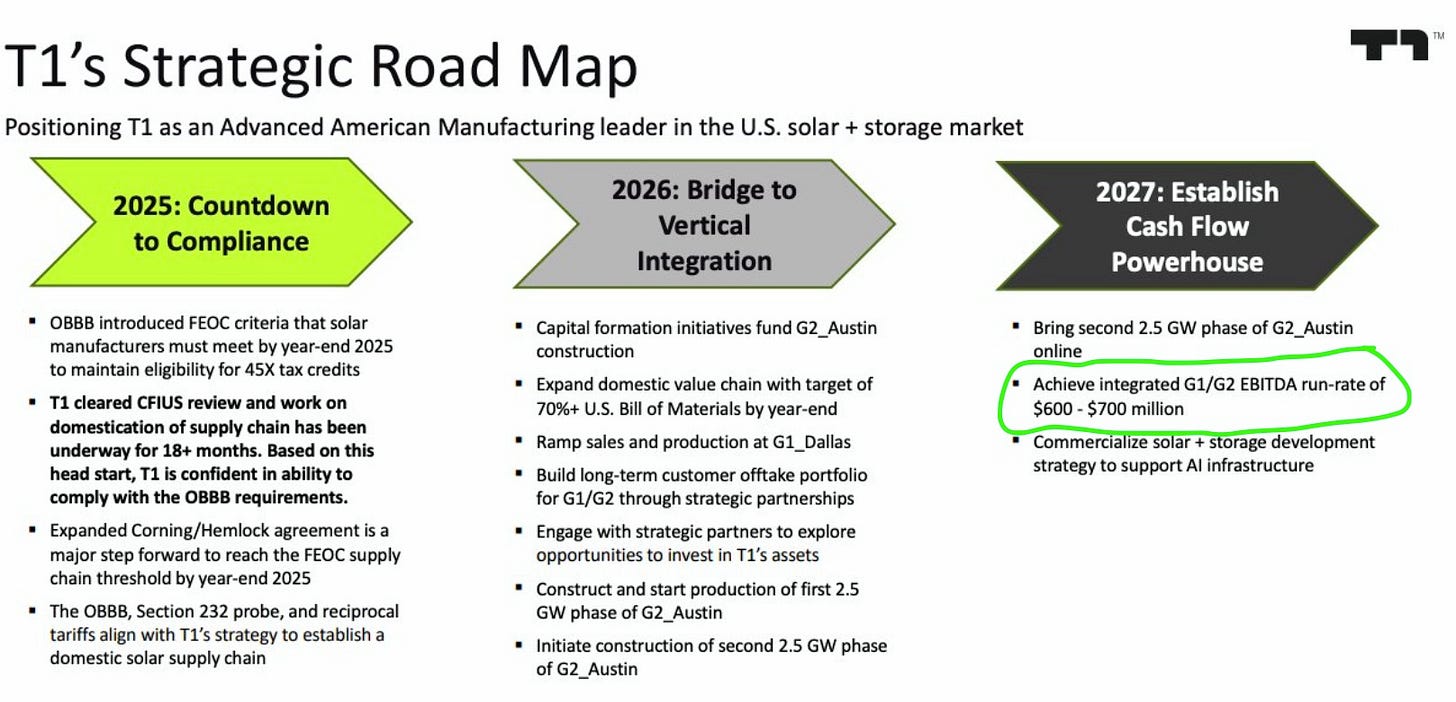

TE’s G2 factory is going to tackle cell production. It is trying to be vertically integrated so that it can stack it’s subsidies and control it’s own destiny.

US is STROOONG and independent!!

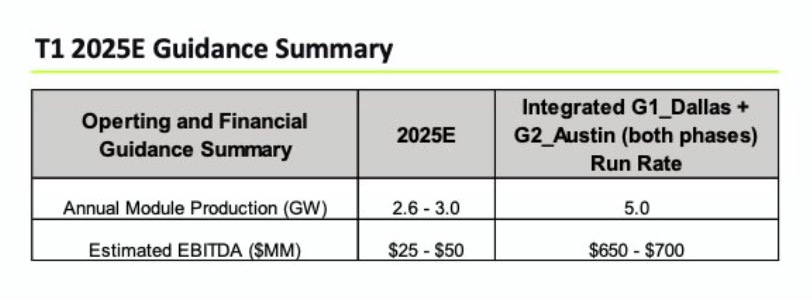

2. T1’s roadmap targets 70%+ U.S. content modules by 2027 (Hitting the 45X requirements) and $650M-$700M EBITDA run rate with fully operational G1 and G2 plant(Phase 1). This is an insane guidance in 1-2 years.

In the company’s Q1 2025 earnings release, T1 explicitly stated:

“There are no changes to T1’s projected $650 - $700 million annual run-rate EBITDA estimate based on optimized production at G1 Dallas and G2 Austin.”

T1 reiterated the same target in its Q2 2025 (August 20, 2025) results:

“There are no changes to T1’s projected $650 - $700 million annual run-rate EBITDA estimate...”

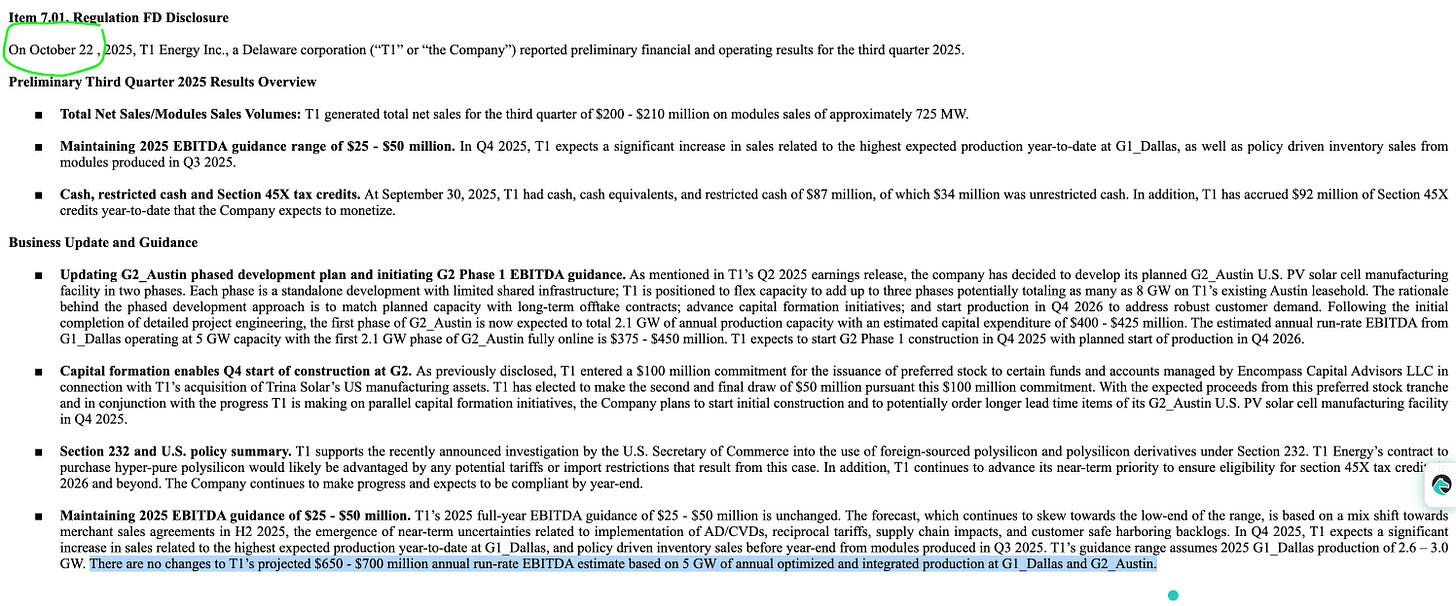

Most recently, in the October 22, 2025 preliminary Q3 results announcement, T1 maintained this guidance:

“There are no changes to T1’s projected $650 - $700 million annual run-rate EBITDA estimate based on 5 GW of annual optimized and integrated production at G1_Dallas and G2_Austin.”

Gotten a little repetitive, but WE the vigilantes will hold the management accountable.

15-20X guidance on EBITDA in 2 years? Am I reading this right? If anyone thinks differently please let me know.

3. 2025 production sold out at low end of production at 2.6 GW. Remember: For every 1GW they sell, they get roughly 100-150M in credits

This means there is a lot of demand for their modules in light of 45X OBBB requirements.

Here they said this.

T1 generated total net sales for the third quarter of $200 - $210 million on modules sales of approximately 725 MW.

and has accrued $92 million of Section 45X credits year-to-date that the Company expects to monetize.

Also after reading this, my expectations are that H2 2025 should bring in significant revenue.

T1 expects a significant increase in sales related to the highest expected production year-to-date at G1_Dallas

4. No one is talking about this bullish point. Key important pumpamental factor

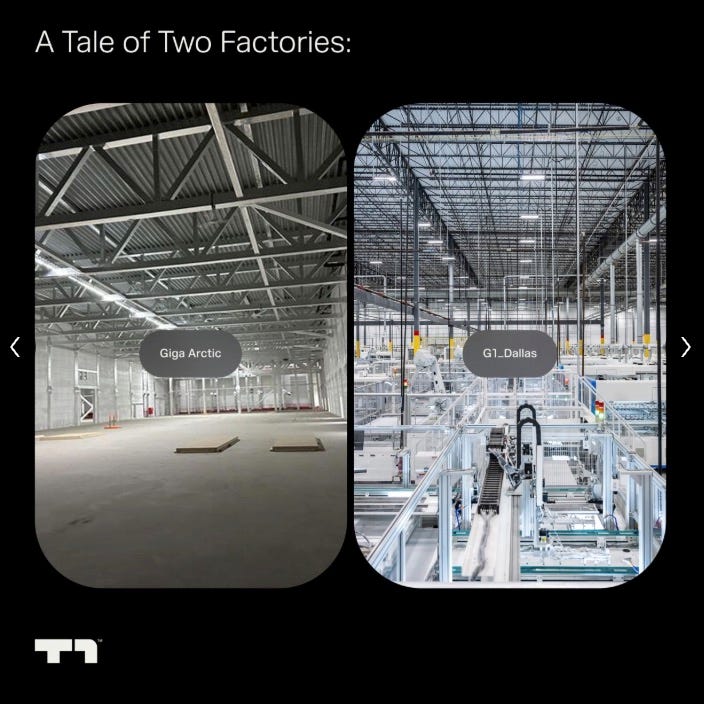

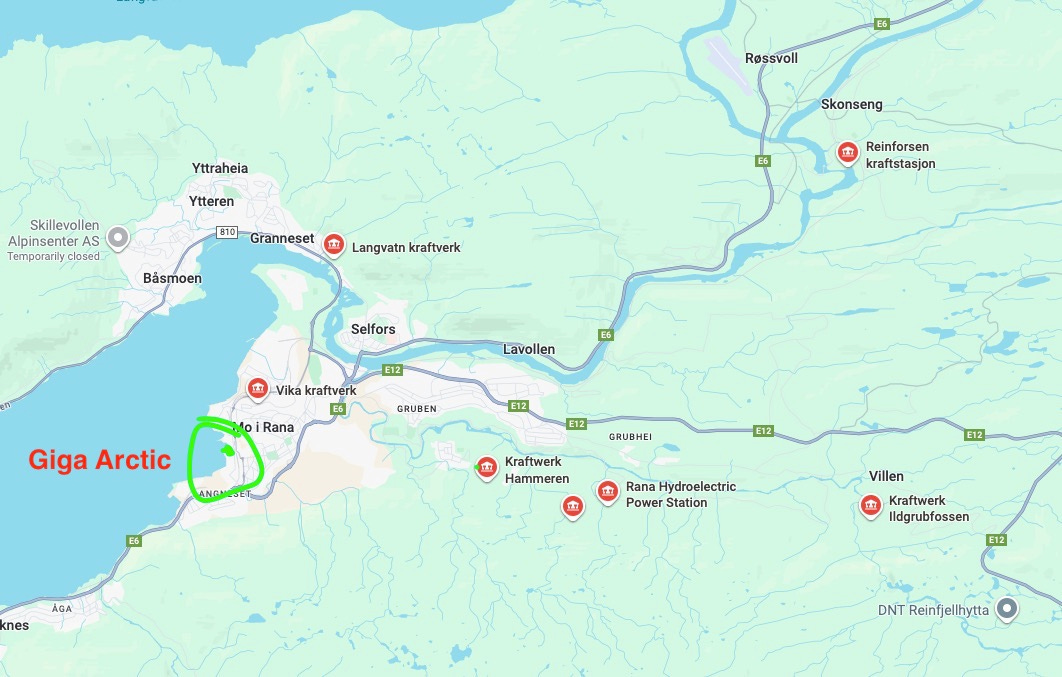

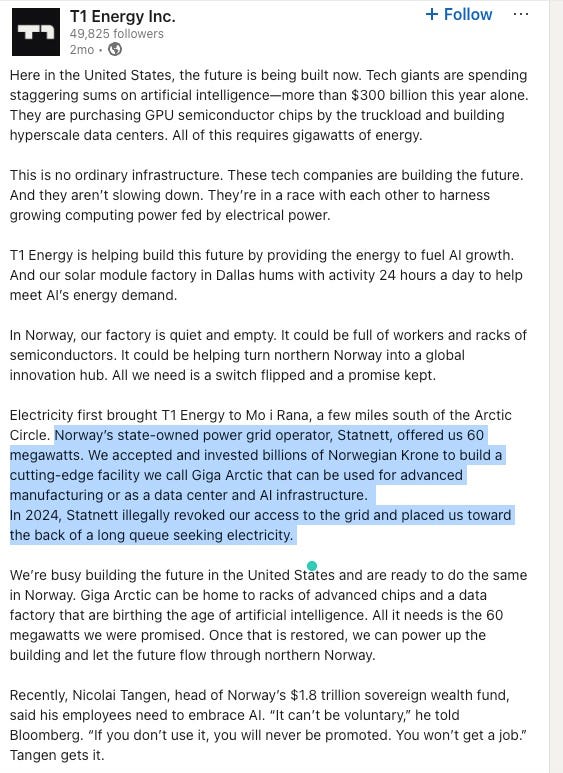

They got an empty Power shell called Giga Arctic in Norway. A 120,000 square meter battery gigafactory in Mo i Rana, Norway that was formally commissioned in 2022. But it can be now pivoted into a AI Data centre facility

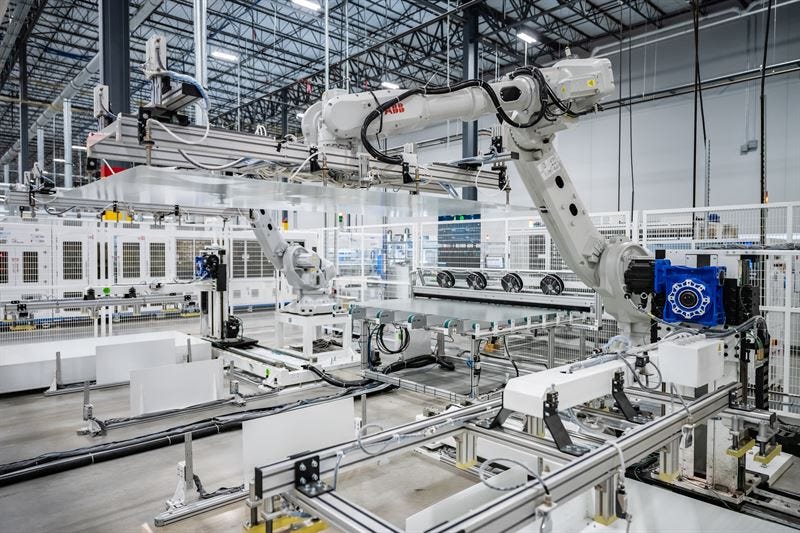

Construction began on a planned 29 GWh battery cell factory, with FREYR sanctioning the project by June 2022 and securing over $1.6 billion in debt financing, including €400 million in loan guarantees from Norway’s export credit agency Eksfin.This image is from Sep 2022.

Before you get too bullish, let me show you a quote from Corweave’s CEO Michael Intrator, talking about how Power shells/infrastrcuture to set up AI data centre is the biggest bottle neck in the previous earnings

At the end of the day, right now, it’s the powered shells that are the choke point that is causing the struggle to get enough infrastructure online for the demand signals that we are seeing, not just within our company. It’s the massive demand signals that you’re seeing across the industry.

He felt the need to reiterate

It is a market that is really working hard to try and balance it is it there are fundamental components at the powered shell, at the power in terms of the electrons moving through the grid, at the supply chains that exist within the GPUs the supply chains that exist within the mid-voltage transformers. There’s a lot of different pieces that are constrained. But, ultimately, the piece that is the most significant challenge right now is accessing powered shells that are capable of delivering the scale of infrastructure that our clients are requiring.

So, here is a Linkedin post from their official company account talking about the pivot

https://www.linkedin.com/posts/t1energy_here-in-the-united-states-the-future-is-activity-7357035159608545282-ypZe/Although they are alleging that Statnett took away their promised 60MW power and that they only just need to turn the switches on. The factory is located right next to the 500MW hydro dam.

There is still a few issues to consider which I discuss in Apendix.

Technically the stock looks like they almost bottomed

Bearish/Risks

Section 232 polysilicon tariffs could be clarified by ‘end of the month. This is unclarity for their current supply chain.

The proposal came from the Coalition for a Prosperous America (CPA), which suggested $0.20/W tariffs on solar modules, $0.10/W on cells, $0.07/W on wafers and $10/kg on polysilicon imports and a TRQ threshold of 30GW for silicon cells, wafers and ingots and 40,000MT of polysilicon from “trusted allied countries with secure, non-Chinese-controlled supply chains.”

Even though some argued that the tariffs are too high, it remains to be seen what the actual numbers turn out to be.

FSLR is completely immune to this, since they are producing cadmium telluride (CdTe) thin-film modules.

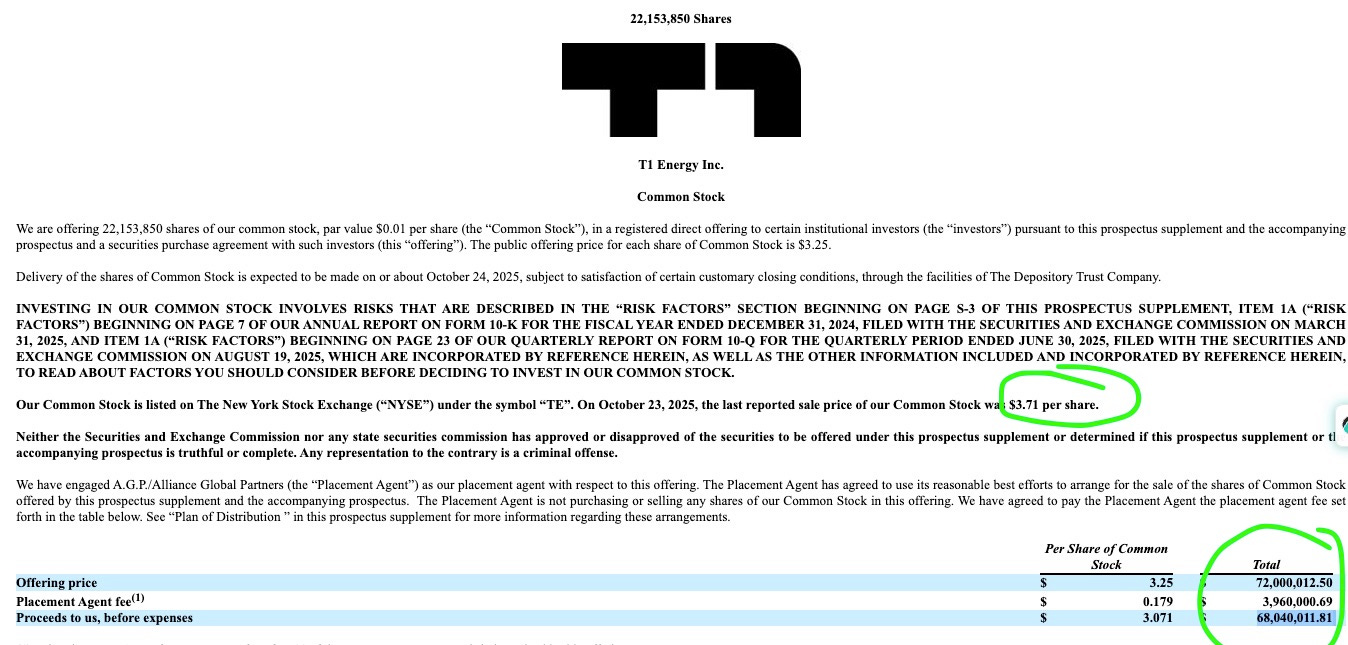

The Enterprise value and dilution is a lot higher than everyone thought or expects. They might need to raise a lot more in funding. G2 phase 1 would need $400M in investments. They have secured about $125M in last weeks raise. I will deep dive into it in the appendix

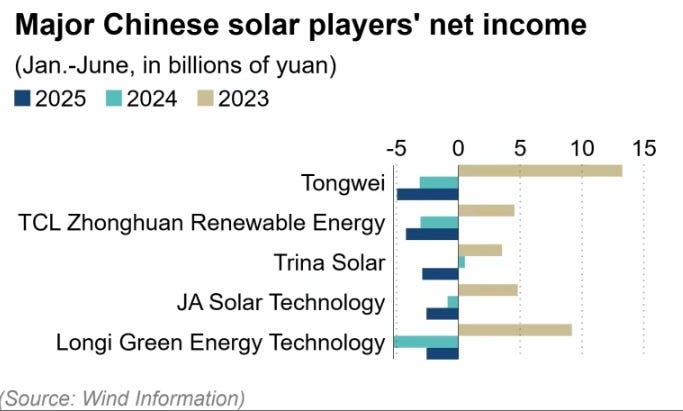

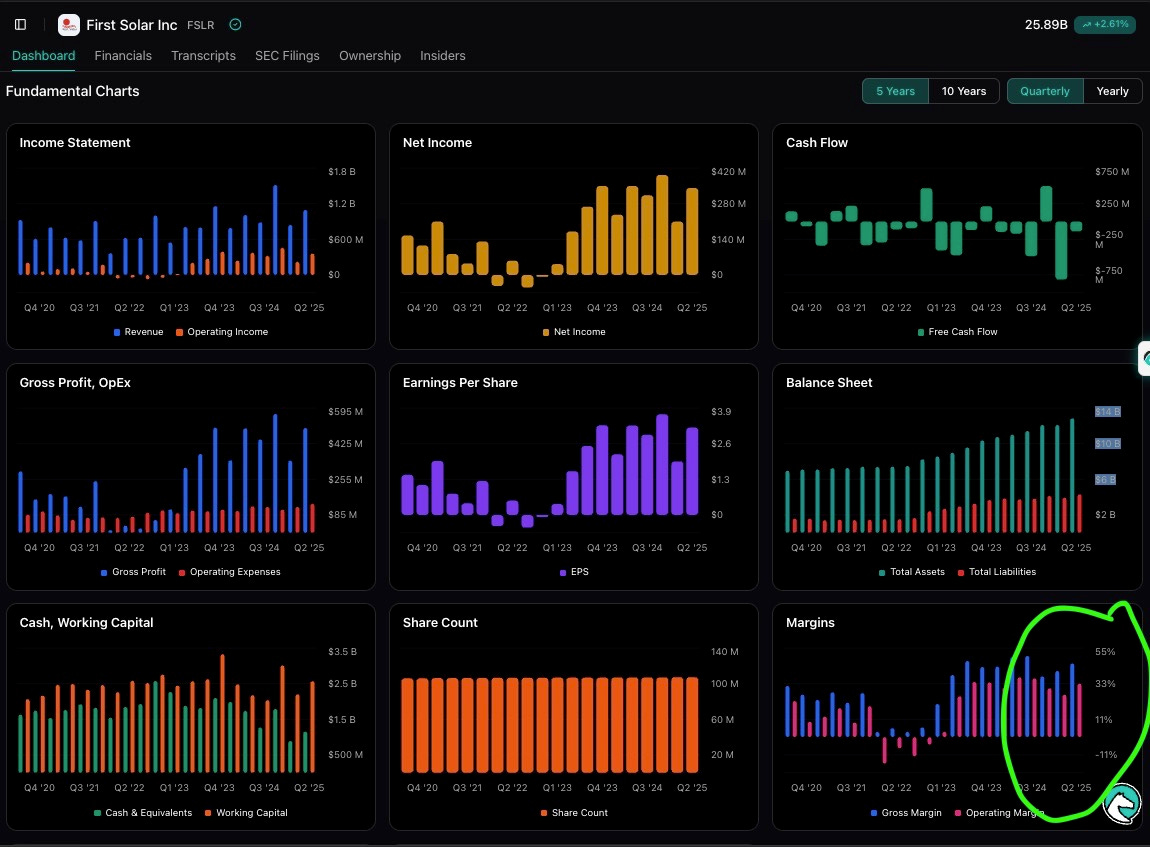

Margins are non existent. It doesn’t help that the top Chinese PV producers have been selling their products for losses in the last year. In comparison, FSLR’s margin is stupendously good.

Bears argue that first Solar manufactures high-margin CdTe modules with proprietary technology. T1 manufactures commodity TOPCon crystalline silicon modules—a technology not proprietary to T1 and competing against global manufacturers

Leading Chinese companies have made only losses in 2025. There might be a glut in the industry

The Complex History of FREYR/T1 Energy Saga:

A story of Pivots and Abandoned Plans

The relationship between FREYR Battery (now T1 Energy) and its European operations represents one of the most dramatic strategic pivots in history of pivots

The Original Vision: Norwegian Battery Champion (2018-2022)

FREYR Battery was founded in 2018 with ambitious plans to become Europe’s battery manufacturing powerhouse, using 24M Technologies’ SemiSolid battery tech. Adrenalin was high and they raised $704M via SPAC. Yes Yes the same ponzi Chamath started.

The main show was Giga Arctic in Mo i Rana, Norway. A planned 29 GWh battery cell factory with an estimated capital cost of $1.7 billion. By June 2022, FREYR had sanctioned construction with identified debt financing of over $1.6 billion, including €400 million in loan guarantees from Norway’s export credit agency Eksfin.

However, just like many dead cleantech projects back then, it wasn’t easy to raise money and then make money in this space

2023: First Cracks Appear

In November 2023, FREYR paused construction of Giga Arctic, citing the need for European government subsidies that remained out of reach and deciding to focus on the US market instead. The company had spent approximately $64 million in Q1 2023 alone, with 75% allocated to Giga Arctic.

In August 2024, CEO Tom Einar Jensen told investors that cheap Chinese battery oversupply made it impossible to raise money for battery manufacturing. The company announced it would pursue “less capital intensive opportunities” including module and pack assembly rather than cell production.

By September 2024, FREYR formally paused battery cell production in Norway and fired 700 workers from Giga Arctic alone

They tried to bring 24M MIT tech into production and failed. Realizing that its wayy too expensive and gave up.

A Big Pivot in Motion

By early 2025, FREYR underwent a dramatic transformation. Almost the entire management team was replaced, and the company reemerged under a new name — T1 Energy.

November 2024: The Solar Acquisition

FREYR completed acquisition of Trina Solar’s 5 GW solar module factory in Wilmer, Texas for $340 million. The facility employs over 1,000 people and began production in November 2024.

February 2025: Complete Transformation

Relocated: Headquarters moved from Norway to Austin, Texas

Strategic Reset: Cancelled the planned $2.6 billion Giga America battery factory in Georgia

Asset Sale: Sold the 368-acre Georgia site for $50 million, netting about $22.5 million

Reality Check: Despite the big 2022 announcement, construction never started

Current Status: What Remains in Europe?

Norway Operations:

T1 Energy still maintains a presence in Mo i Rana with the CQP facility, but production has been paused. The company is exploring converting Giga Arctic into a data center or AI hub rather than battery production. T1 had already invested a lot in Giga Arctic infrastructure plus the CQP facility. which they have written down by $312.9M in their SEC filings.

Finland CAM Project:

This is where the situation gets murky. While FREYR received the €122 million EU grant selection in October 2024, several critical factors remain:

Not Finalized: Selection was in Oct 2024; but still no confirmation by mid-2025).

Conditional Nature: Grant is conditional on partners/criteria.

Company Focus Shifted: Company shifted focus to U.S.; exploring options for EU assets.

Uncertain Partnership Status: Partnerships unclear: Aleees JV fizzled; FMG status uncertain.

Competing Project: FMG pursuing €774M CAM JV with Easpring (groundbreaking Apr 2025)

Can They Proceed Individually?

The critical question is whether FREYR/T1 can move forward with the Finland CAM project given their complete pivot to US solar manufacturing:

The €122 million EU grant likely requires demonstrating a committed partner structure and feasibility—difficult for a company that has abandoned battery operations

Theoretical Possibility:

The Previous CEO still has his job as European Battery operations and is not fired.

Also this Linkedin post seem to suggest that they have not fully given up on their Battery ambitions.

Securing the Supply Chain

TE/T1 Energy invested minority stake into Talon PV. I am almost fully quoting Will norman’s article here

Both T1 Energy and Talon PV are building solar cell manufacturing facilities in Texas. T1 Energy is building a 5GW site in Rockdale near Austin, and Talon PV is building a 4.8GW plant in Baytown.

T1 Energy did not disclose the stake it has acquired or the value of its investment. The companies have entered into a Simple Agreement for Future Equity (SAFE) and “remain in discussions to potentially deepen the strategic relationship in the future”.

“We are excited by the opportunity to invest in another American solar energy project that complements our G2_Austin development,” said Daniel Barcelo, T1 Energy’s CEO and chairman of the board. “Expanding the output of American solar cells is necessary to support energy security, achieve regulatory compliance and build an American solar industry based on advanced manufacturing and cutting-edge solar technology.”

However, Talon PV has acquired a TOPCon IP portfolio from cadmium telluride (CdTe) module manufacturer First Solar, which it told PV Tech Premium would clear the way for commercial TOPCon cell production in the US. It is unconfirmed whether the two companies plan to share intellectual property after the investment.

Also the deal with Corning to source US-made polysilicon and silicon wafers is significant They are big and talked about T1 in their earnings call quite a bit. Combined with its planned cell and module production facilities, the deal would see a fully US-made silicon solar supply chain realised and would mark a significant moment in the country’s PV manufacturing industry.

Margins at FSLR

Quite INSANE margins for a Solar producer. That too in the US.

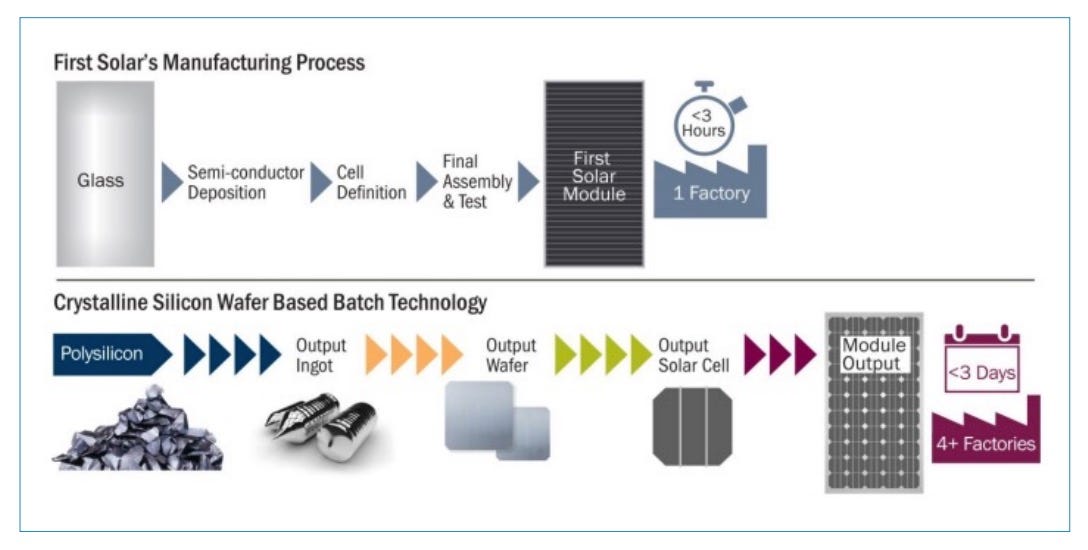

FSLR’s manufacturing process is fully vertically integrated. Modules are manufactured from sheets of glass to a finished module, under one roof, in about 4.5 hours. Typical crystalline silicon modules are manufactured using the batch processing technique. One module can take up to three days for production, in pieces, across up to four factories (sometimes in different countries and/or continents) with less stringent oversight of the manufacturing process.

They clearly has fewer steps. However, their tech is not as efficient. Meaning they miss out about 4-5%. For big solar farms, this can amount to significant numbers.

I will be doing a deep dive into the PV tech in PART 3.

Okay so I recently discovered that they are planning to dilute shares further and raise the upper limit to 500M this shareholders vote. Also found certain bits of information quite appaling.

Secondly, I also dove deeper into the valuation of Giga Arctic.

APPENDIX

I posted about asking the shareholders for 50% further dilution on X.

Company asked to have the capability to dilute if the need arises from 355M to 500M. Asking for permission to have the authority to dilute by 50% Vote on 2nd of Dec 2025

It’s understandable ofcourse, but annoying none the less. They need to raise $800M total for G2 full facility. They have now secured 120M for phase 1 that requires $400M

You can see that cash is dwindling

But the working capital is good, and they will be entitled to around $200M worth of credit soon. So why ask for this much dilution already?

Okay lets look at the capital raise, they just did

Here is the Capital Raise Summary

$72 million: Raised through a registered direct equity offering (selling common stock to institutional investors).

$50 million: Expected to be raised via a convertible preferred stock issuance (a type of preferred stock that can convert into common stock), announced on October 22, 2025.

Total capital expected soon: Approximately $122 million ($72M + $50M) to fund the first 2.1 GW phase of the G2_Austin project.

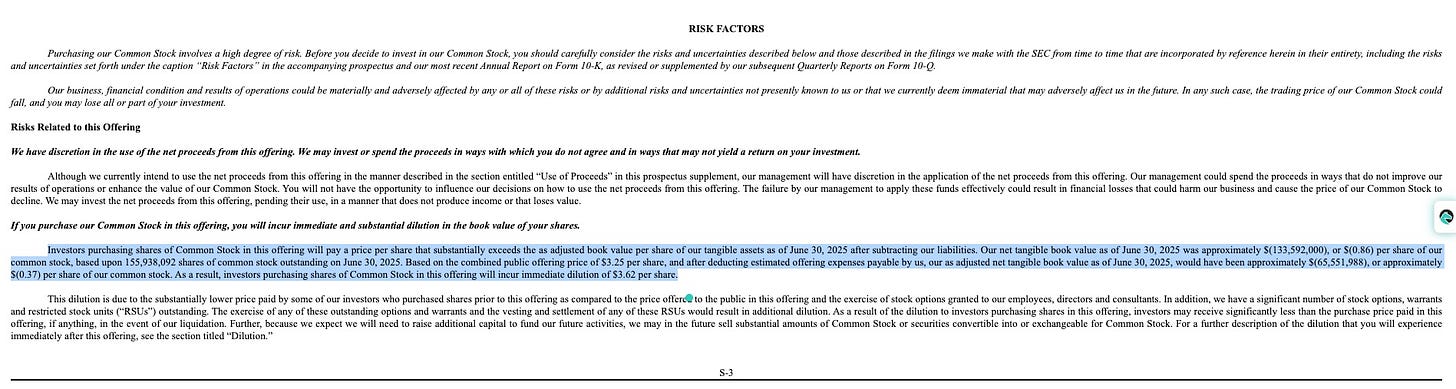

Here they are giving a little speech about how their book value is negative and that even after paying $3.25 per share, they are worth nothing immediately after investments.

After the Direct offering raise on 23 Oct, the total outstanding shares are 190M.

This is what I thought. However, there are about 98M shares more that are already given out. This is why they had to raise the ceiling so much sooner. So I would argue that total Fully diluted outstanding shares is already around ±300M.

Here they are clearly reiterating how they have pretty much exhausted the 295M of allowed outstanding shares. 190M already outstanding and they point the gun at us reinforcing about what they can actually still do. Lets account for that extra 98M shares

Warrants: 25M (These are NOT so concerning because stock gotta 3X before they are exercisable)

Stock based compensation: 7.8M + 6.6M + 28.2M = 42.6M

Not everything should be considered as outstanding since we don’t know what strike prices, however, it isimportant to consider them as the worst case.

I Asked Perplexity to make a table for conditions under which these extra shares can become common shares.

Okay now on the topic of Norwegian Assets. Here are the two facilities they built

Giga Arctic (planned 120,000 m², Mo i Rana)

Customer Qualification Plant/CQP (13,000 m², Mo i Rana)

This image is from Sep 2022 of Giga Arctic.

I looked at their 10K from 2024 to understand how the company is valuing their Norwegian facilities.

The Giga Arctic and CQP facilities in Norway were written down by $312.9 million in 2024.

I am willing to bet that if they are able to successfully curry favor (restore power) with the Norwegian politicians, they might be able to sell it for higher price than just $43M in assets.

Just look at it’s location. It is right next to a lot of Hydro power stations. Getting access to power to this facility is just a matter of Turning it on and having the right rapport with the government.

Norway has an acute shortage of Data centre power. Just like in the US. Even though they are energy rich, there are grid interconnections issues as well.

Breaking it down: Statnett (Norway’s grid operator) has reserved 17 TWh for projects with secured capacity, while another 27 TWh sits in the queue, waiting for grid availability that simply doesn’t exist. Meanwhile, 14 new data centers are under construction

Giga Arctic has lost its interconnection queue for power. I dont think that it is right for TE/T1 energy to claim any wrongdoing by Stattnett (The Norwegian public utility company. They were the ones who pulled out and eagerly ran into the arms of Papa America for 45X. However, this is a bet that I am willing to make that they might find the partner and will get immediate access to power for the shell infrastructure.

Also recently, Stargate Norway and Aker Nscale announced 250MW facilities. These companies might be prime to form partnerships and lease/sell these power shells.

LASTLY,

Leading Chinese solar companies have faced significant profitability challenges in 2025, with major firms like LONGi, Jinko Solar, Trina Solar, and JA Solar reporting billions of dollars in combined net losses in the first half of the year.

China’s focus on solar as a strategic industry drives continued capacity buildout and subsidized expansion, leading to oversupply and thin margins intentionally or unintentionally.

The companies primarily use advanced crystalline silicon technology, focusing on large, high-efficiency wafers and cells, especially leveraging TOPCon (Tunnel Oxide Passivated Contact) technology, which dominates around 70-80% of the solar cell market share in 2025.

Still one should remember that Americans dont wanna be blue balled like the germans!!

Also, I love that there was a lot of reiterations of the 600-750M of EBITDA and that their capacity is sold out, but it all depends on how trump’s administration agrees on tarriffs for Chinese solar panels.

The long trend of de globalization has begun, so these are two opposing forces in action.

You have the wrong picture of Giga Arctic. You're showing CQP.

Very interesting about the CAM factory. I should dig deeper into that.

What do you think the current share price should be?