TE Dilution and funds raised

Possibility of $300M cash injection and FEOC compliance

T1 Energy just announced two concurrent raises

• $140M common stock offering

• $120M convertible notes due 2030

IF there is over allotment then $21M for stocks and $18M for convertible debt can be further bought.

The total amount raised could reach $299 million if the underwriters exercise their full over-allotment options

We will probably know within 24-48 hours if this raise was successful or not.

They claim that it will be used for the following

• FEOC compliance by Dec 31

• Build-out of G2 Austin (first 2.1 GW)

• Working capital + debt repayment

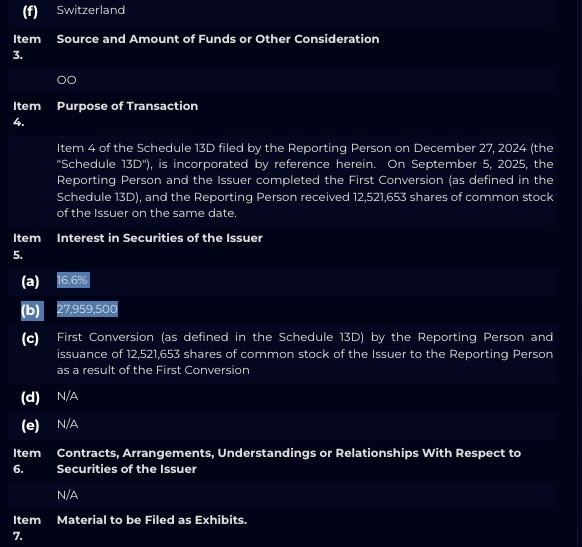

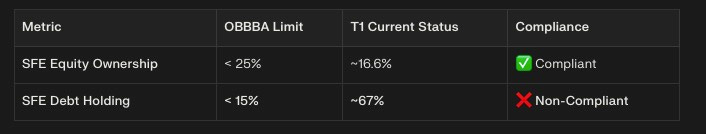

Trina initially received a 9.9% stake (approx. 15.4 million shares) for it’s factory and then additional 12M shares. Total is about 27M shares bringing the total to 16.6% in the last filings

However, Trina’s ownership is nowhere close to <25% required. So that’s not it.

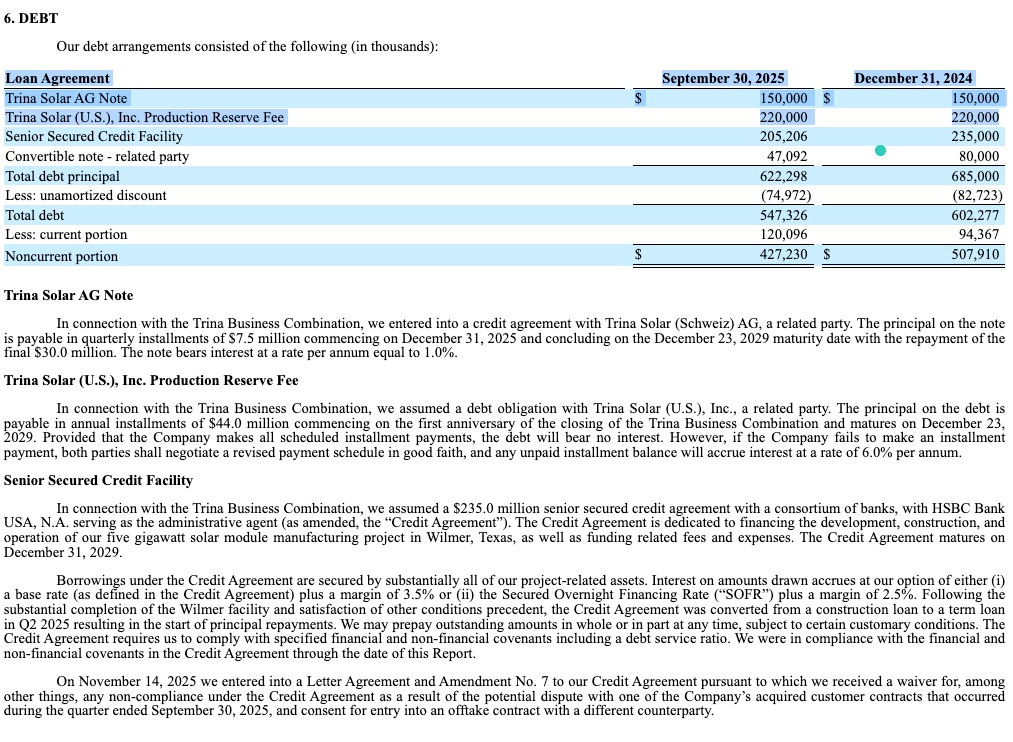

Then I looked into their latest 10Q and found that Trina does own a lot of T1/TE’s debt.

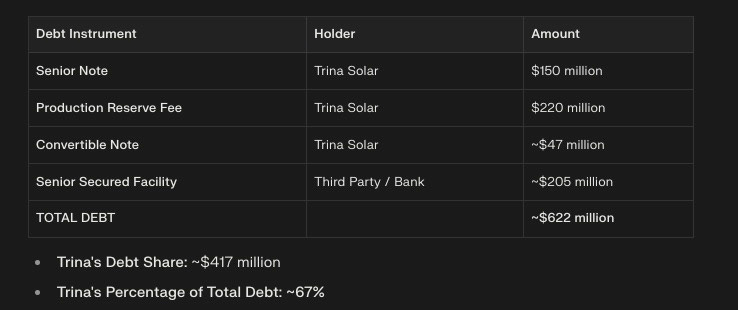

Or here is an easier to read summary. And Bingo, here in lies the issue. Trina holds 67% of TE’s debt.

Under OBBBA, an entity is designated a “Foreign Influenced Entity” (FIE) and ineligible for these credits if:

15% or more of its total debt is held, in the aggregate, by “Specified Foreign Entities” (SFEs).

So this needs to be sorted out. The unfortunate thing is that 220M or 1/3 of TE’s debt was near zero. We gotta look at the new terms for it’s debt.

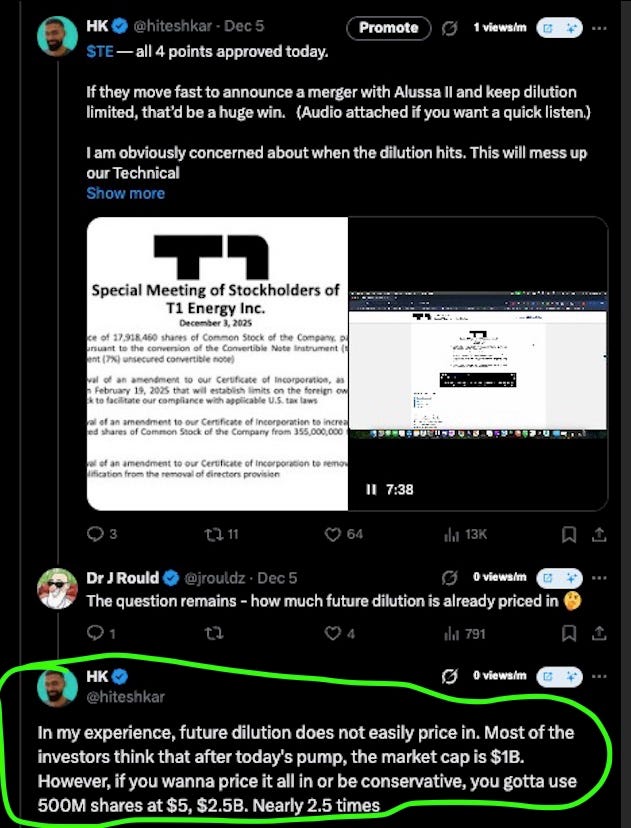

The important thing to remember here is that there was no mention of the exact price at which convertible note will convert into shares. So we don’t exactly know how much dilution from that one.

Here are my assumptions. Stock offering could be at at $5, then the dilution due to it would be 28M shares so approx 12%. Convertible note will have much less dilution. So overall I would put this dilution at 15-18%. (Rough calculation since the full terms are not public yet)

All of this to get 300M cash injected. This is not a bad deal at all.

Remember that just 1.5 months or so ago, they raised with stock offerings at $3.25. That price looks so good today already doesn’t it? It sent the stock crashing down 18% or so from $4.6 to $3.5

EOSE and ASTS have done the same in the past and it’s stock price is at much higher price now. In the long term it will work out. Ofcourse it can linger for a few weeks or days.

Lastly, I must say that I am impressed by these announcement hitting perfectly at key levels. Last announcement at 1.6 fib levels. Previous raise was when the stock hit 200MA at $5.3 from below.

If you been following me on X, you wouldn’t have been suprised that Dilution hit and that it wasn’t priced in.