Incredible multi bagger opportunity in Solar

An Asymmetric solar bet. The new $TE

If you liked my deep dive on T1 Energy (TE), you’re going to love this one. If T1 is the golden child of the solar revolution, this company is the scrappy cousin who figured out how to hack the system.

“Made-in-USA” Pivot & Supply chain strategy in the Solar sector

It’s under $300M Enterprise Value ($250M Mcap + $35M bank loans)

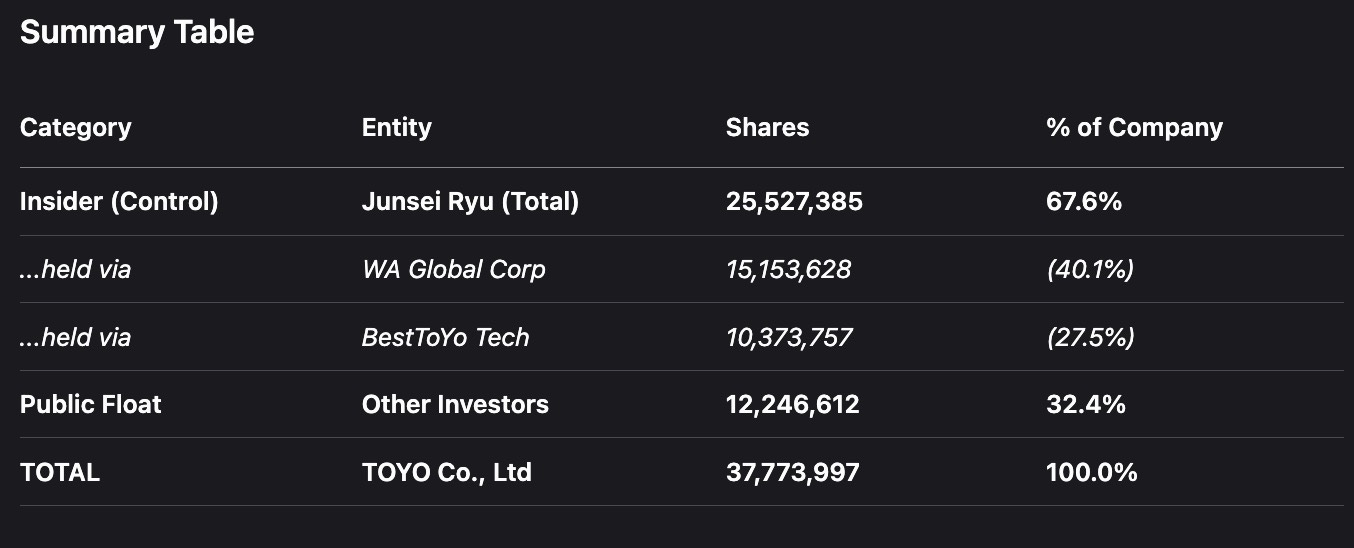

Insider’s own >80% of the stock and Float is under 20%

Experienced growth of 300% in 2024, and then >100% in 2025. Revenues in 2025 are $350M+

2027 Expected EPS is 50% of the current share price (Insane!!). Trading at 2X times 2027 Expected EPS

Virtually no Analyst coverage

This stock is fairly illiquid so please don’t hit buy button immediately. Assess the risk of chasing and be responsible

The stock is $TOYO

This company figured out how to combine:

1. Cheap African hydro-power

2. US Polysilicon (to keep Uncle Sam happy)

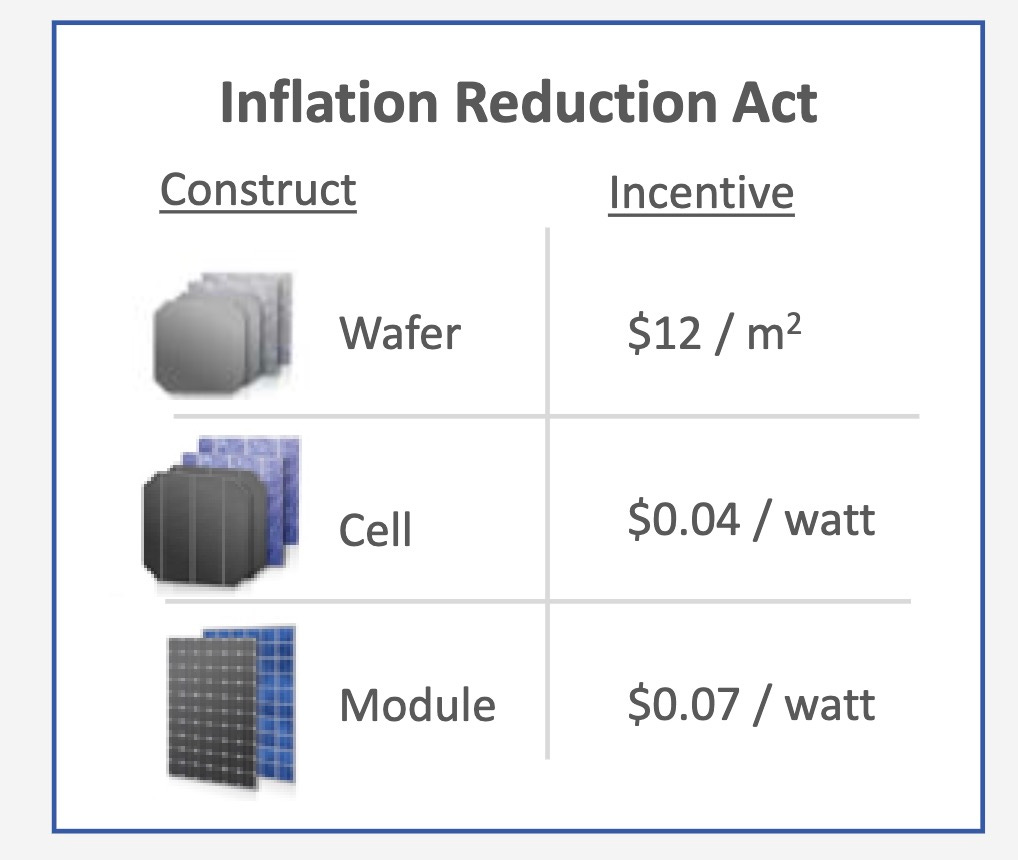

3. Texas final assembly (to get the tax credits $0.07/watt)

4. Vertically integrated Solar supply chain

The result? A Vertically integrated Solar stock trading at under $300M Enterprise Value with insider ownership so high it looks like a dictatorship.

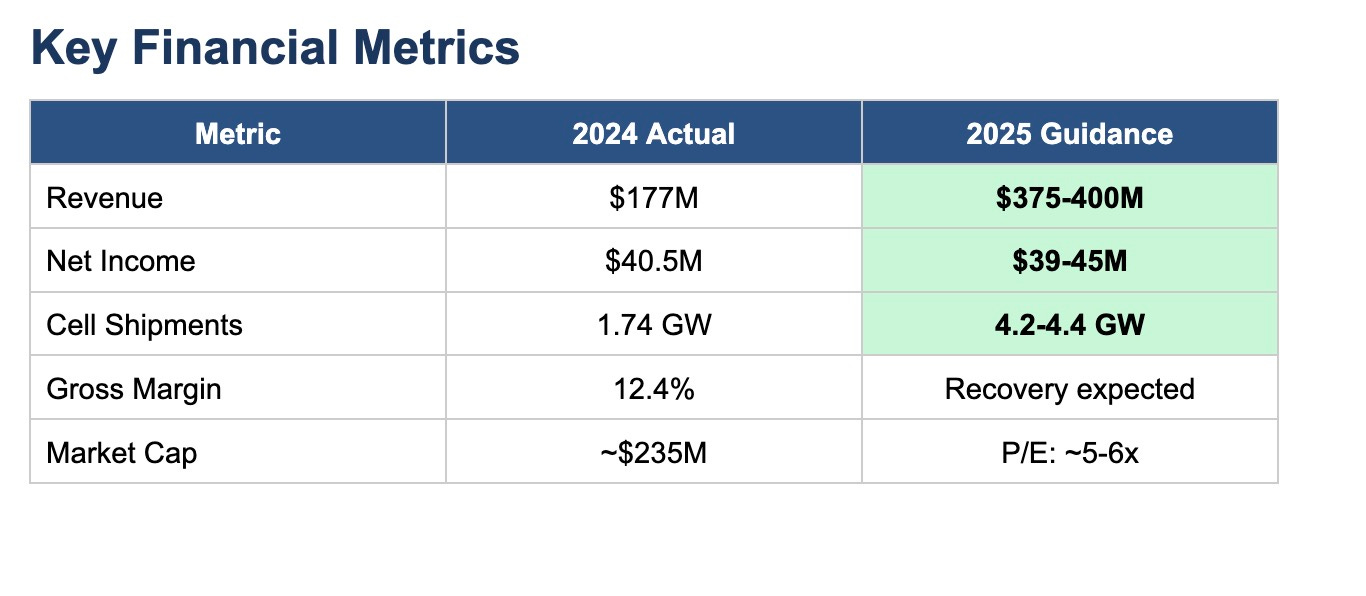

Investment Thesis: Asymmetric risk/reward with 2025 guidance implying ~$375-400M revenue (with 4.2- 4.4 GW) and $39-45M net income at a market cap of only ~$235M (P/E ~5-6x)

INSIGHT 1: THE MATH IS NOT MATHING

Enterprise Value (EV) < $300M

2025 Revenues ≈ Guided for $360-$400M

2027 Projected EPS ≈ $3.61

Wait, pause.

The stock is trading around $7-8. The projected 2027 earnings are $3.61.That means this thing is trading at roughly 2x 2027 Earnings.

How much would you pay for a stock in hot sector growing massively?

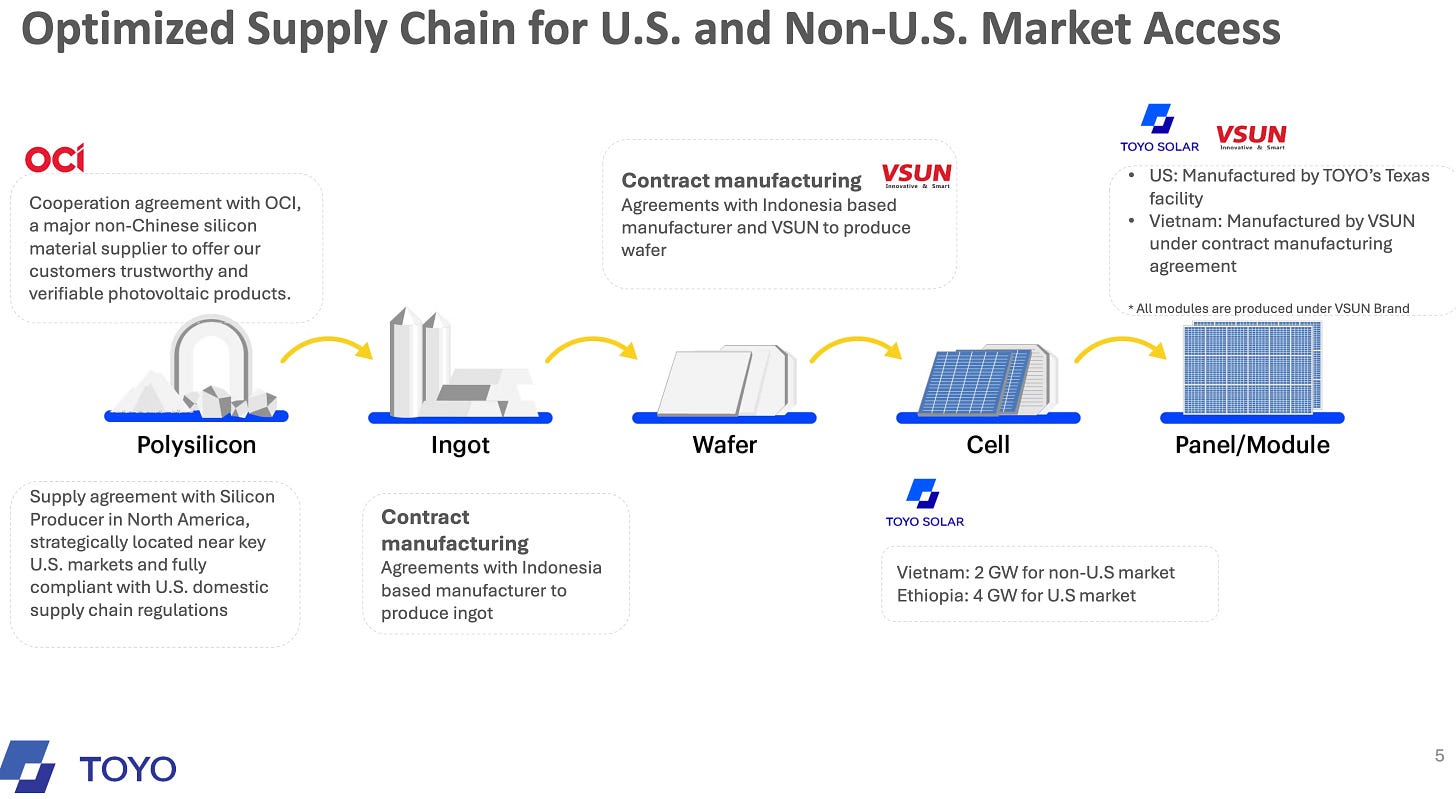

INSIGHT 2: THE SUPPLY CHAIN HACK

Trump slapped a 42069% tarriff on Vietnam. The Giga chad Junsei Rye (CEO of TOYO) pivoted the supply from Vietnam’s plant (4GW) for non US. Also ventured into onshoring jobs to America and build Solar supply in the US.

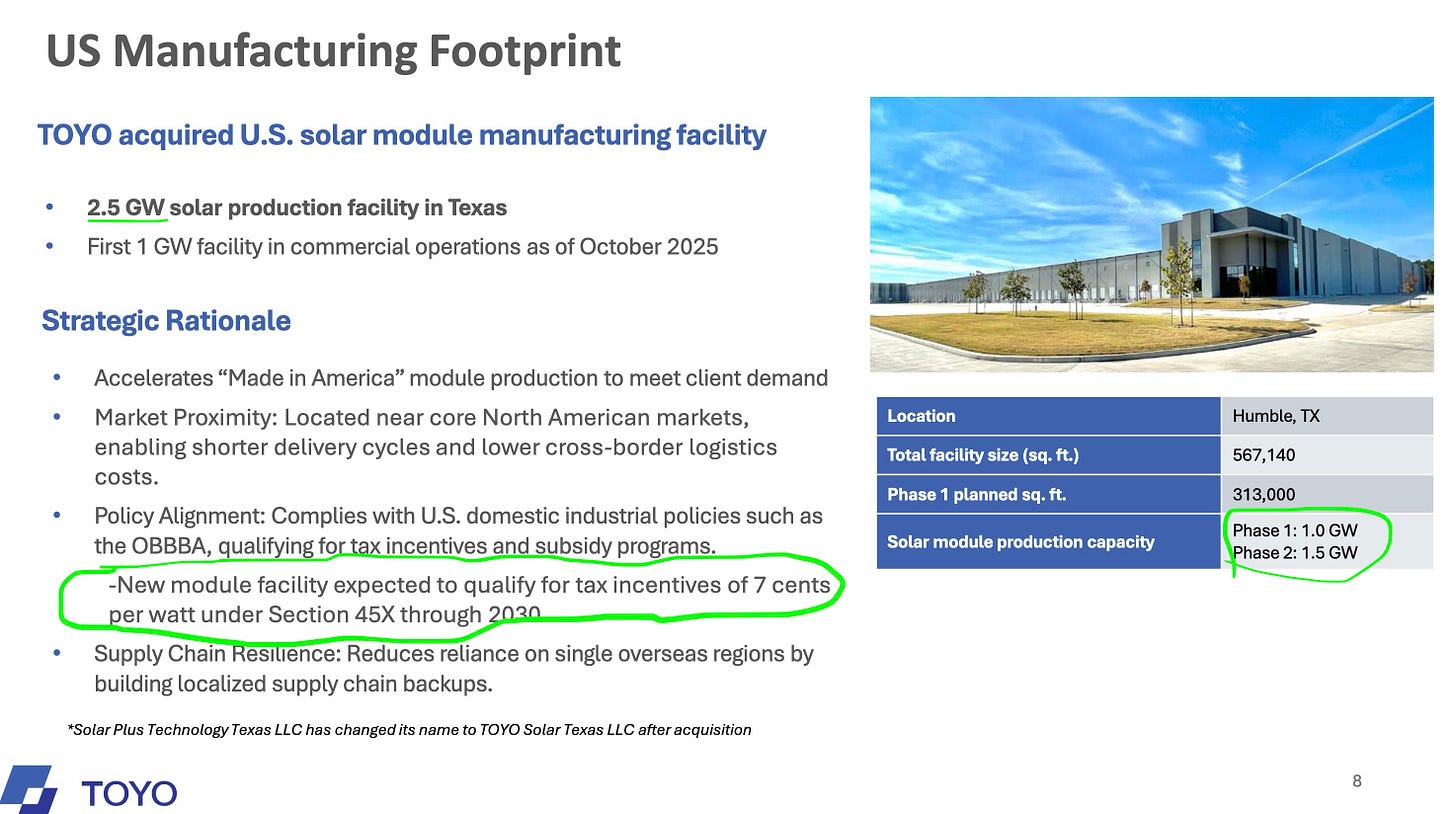

Toyo had acquired Solar module facility from Solar cell in Nov 2024. It’s planned to scale to 1.5GW by 2026, 2.5GW by 2027,then finally to ramp to 6.5GW by 2029. They acquired it cheaply because there was no money in Solar back then and everyone was bankrupt

The Texas facility only began commercial deliveries in mid-October 2025. So it’s ramping up only now

TOYO’S GAMEPLAN:

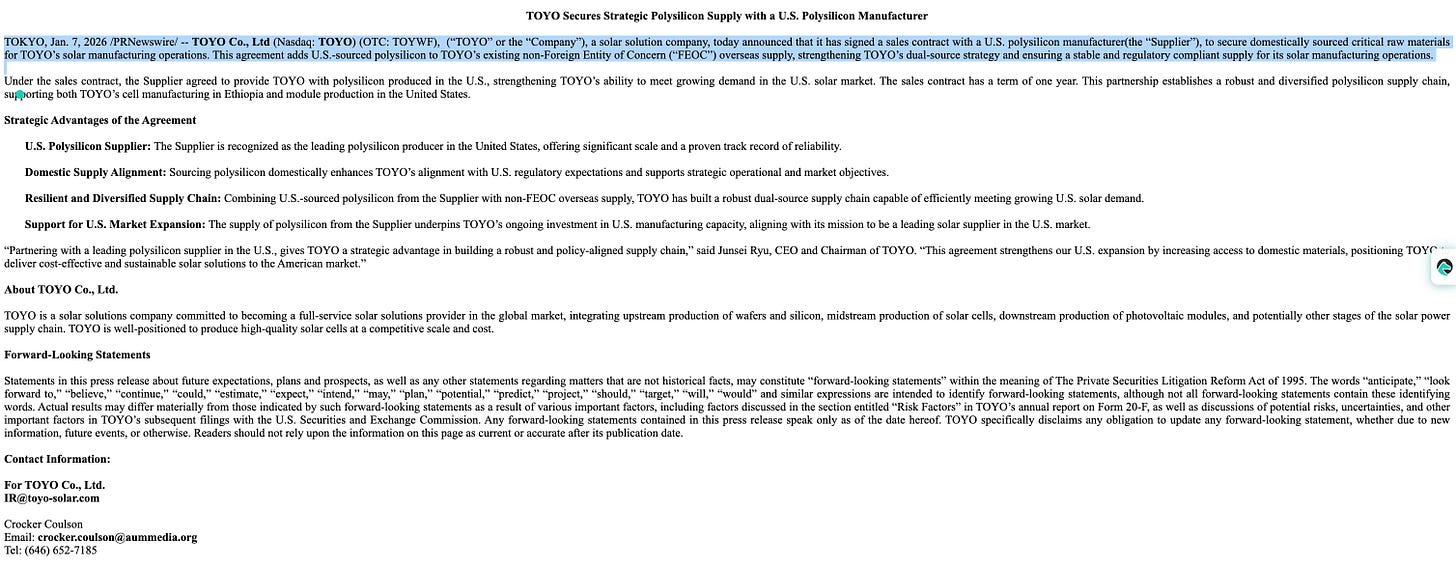

• Step 1: Buy Polysilicon in the US (Signed a deal Jan 7, 2026). This keeps the “Forced Labor” police (UFLPA) happy.

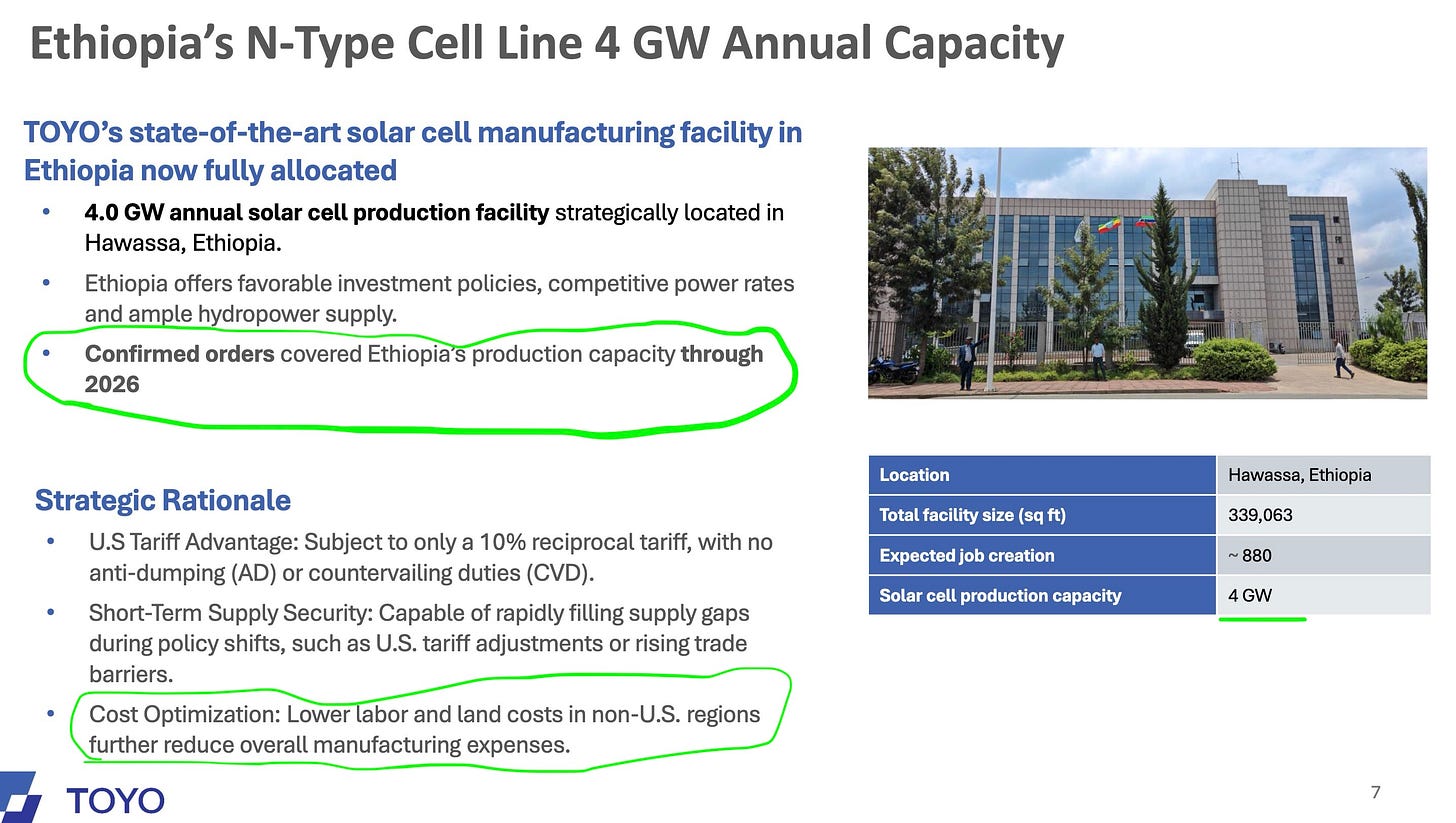

• Step 2: Ship it to Ethiopia. Why? Because Ethiopia has massive hydro-power dams (cheap electricity) and labor costs that make China look expensive. Also, no AD/CVD tariffs.

• Step 3: Turn Poly into Cells in Ethiopia.

• Step 4: Ship Cells to Houston, Texas.

• Step 5: Assemble Modules in Houston.

Result: You get a “Made in USA” module that qualifies for the 45X tax credits ($0.07/watt), but your cost basis is pretty good.

They are essentially laundering US polysilicon through cheap Ethiopian electricity and bringing it back home as a value-added product. It’s geopolitical arbitrage at its finest.

Have a look.

When compared to TE, they don’t get $0.04/Watt for producing the solar cells yet. However, think of them as G1 facility in the US.

Here is a great slide to understand what the current incentives are. Read my first deep dive on TE to get a clearer picture on credits

So even though they might miss out on $0.04/watt for cells, they can easily make it up for lower land and labor cost for the solar cells in Ethiopia

Now they signed a sales contract with a U.S. polysilicon manufacturer, to secure domestically sourced critical raw materials for TOYO’s solar manufacturing operations. This agreement adds U.S.-sourced polysilicon to TOYO’s existing non-Foreign Entity of Concern (“FEOC”) overseas supply

The company claims that they will be eligible for 45X. Let’s pray and hope that they are right. And that their customers/credit buyers believe it too.

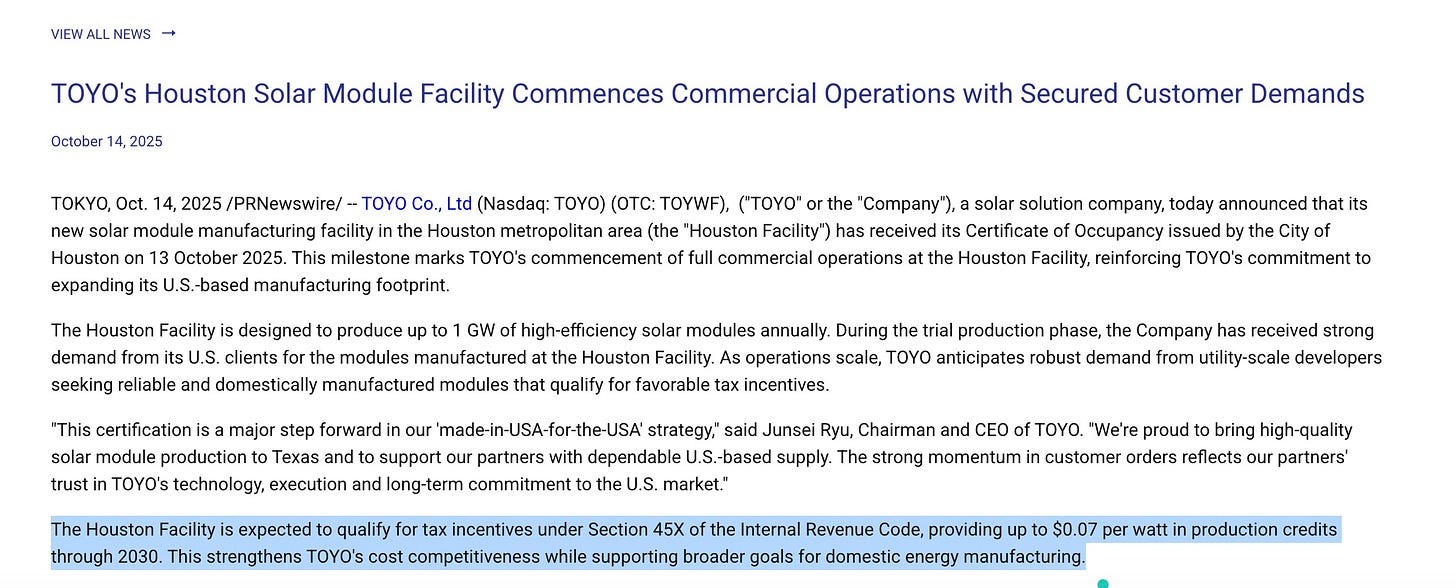

“During the trial production phase, the Company has received strong demand from its U.S. clients for the modules manufactured at the Houston Facility. As operations scale, TOYO anticipates robust demand from utility-scale developers seeking reliable and domestically manufactured modules that qualify for favorable tax incentives.”

“Expected to qualify for tax incentives under Section 45X of the Internal Revenue Code, providing up to $0.07 per watt in production credits through 2030. This strengthens TOYO’s cost competitiveness while supporting broader goals for domestic energy manufacturing.”

INSIGHT 3: Growth and Demand is through the RooF!!!

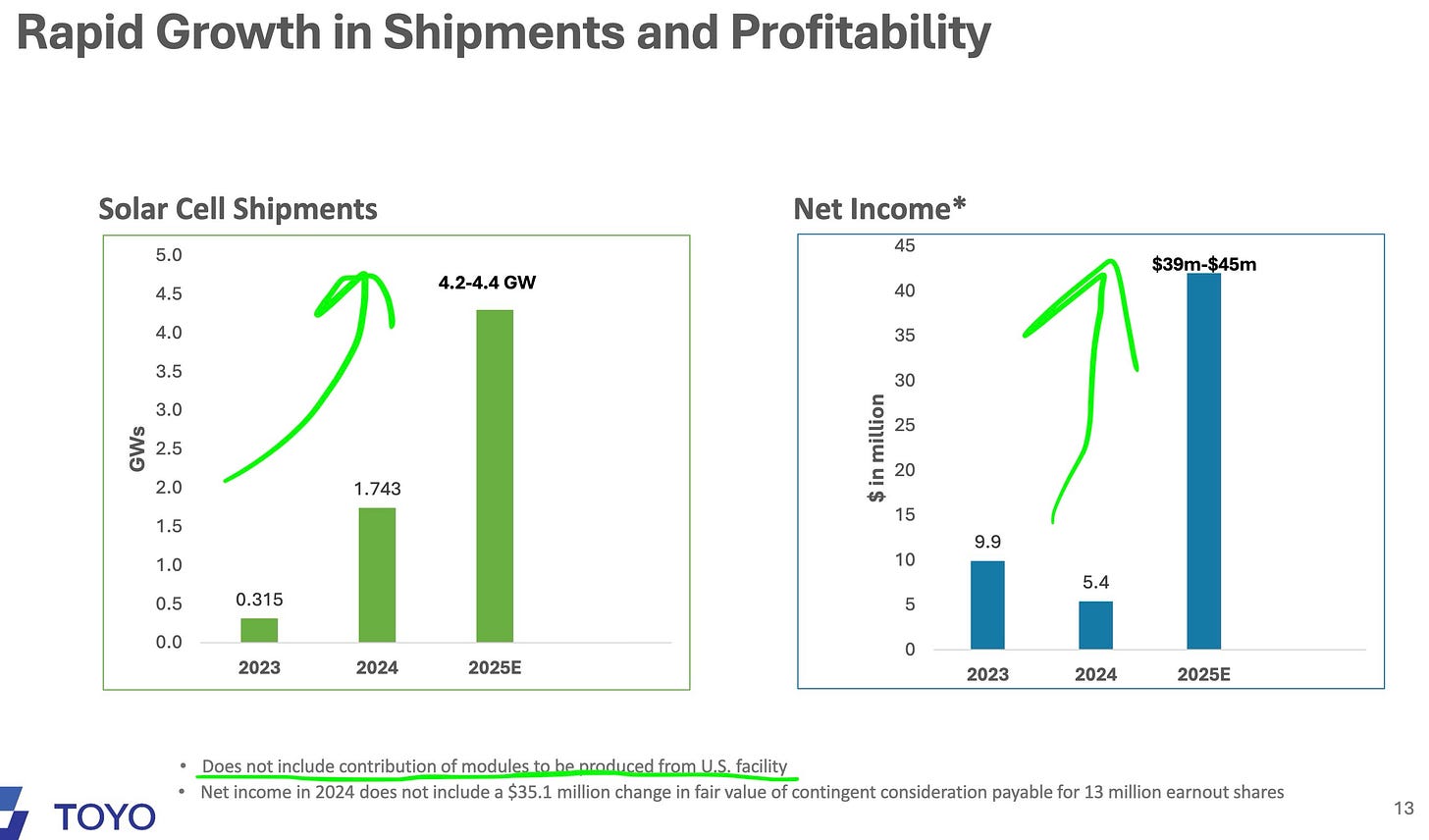

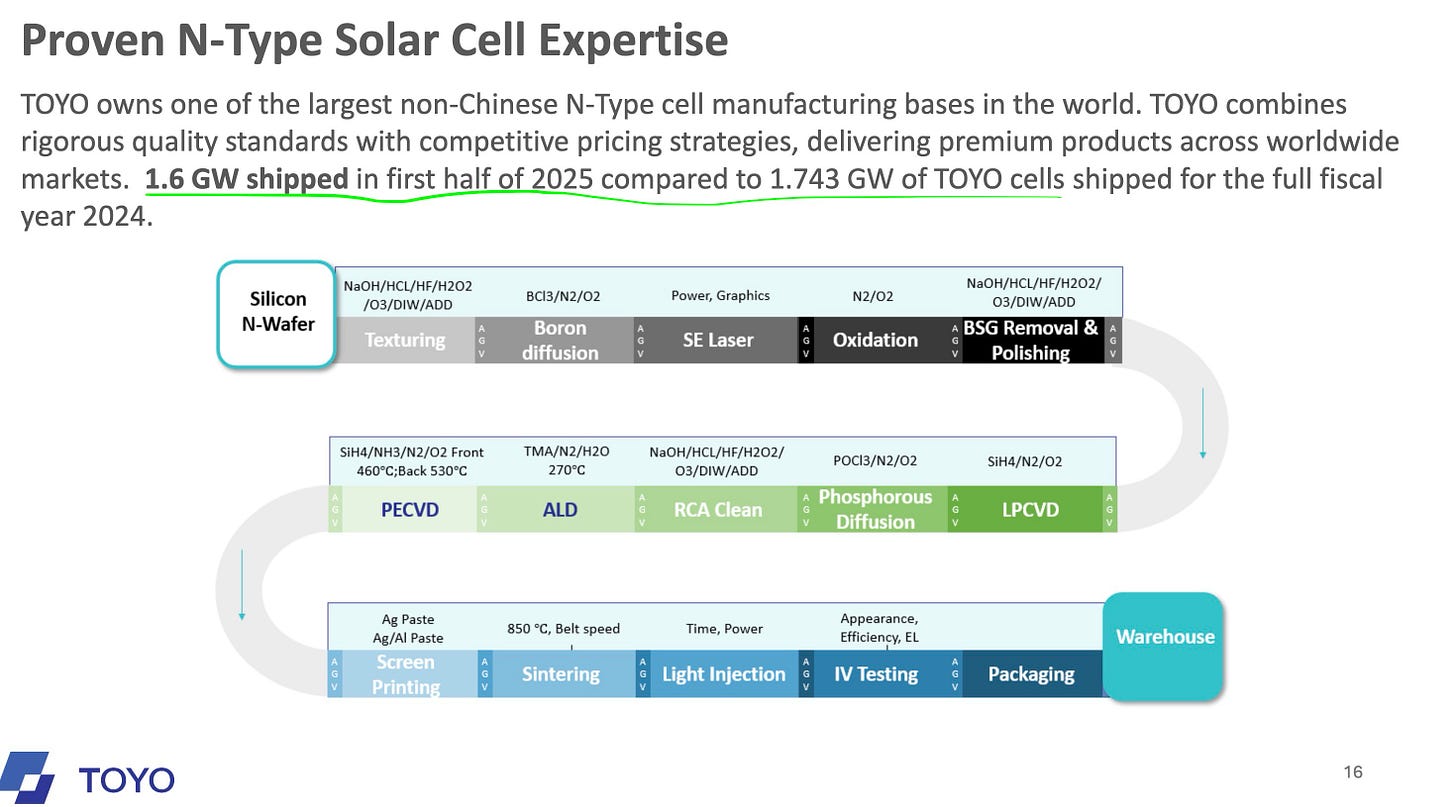

They shipped as much Solar cells in H1 2025 as they did in it’s entire 2024 Fiscal year of operation. These babies can really scale!!

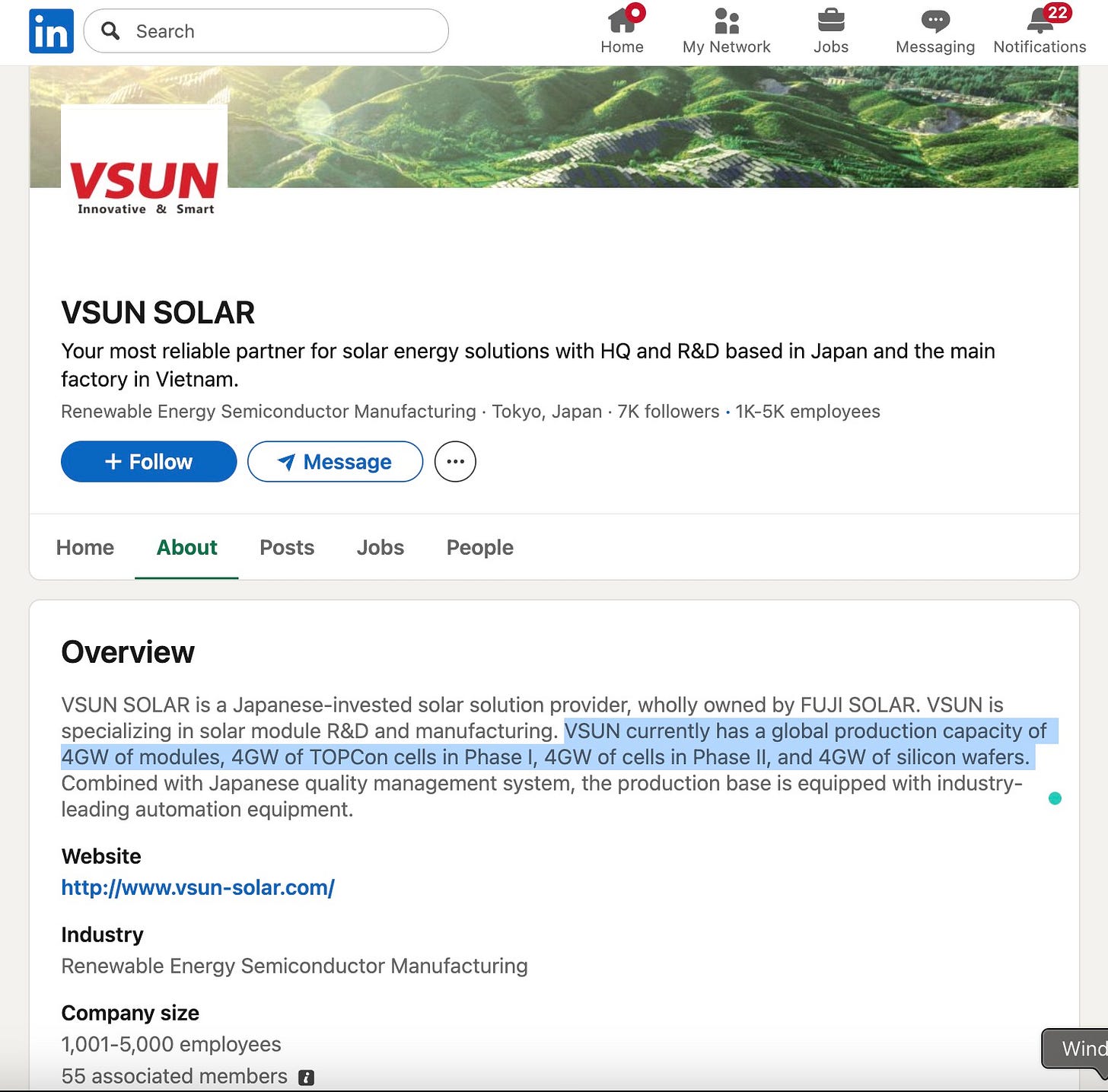

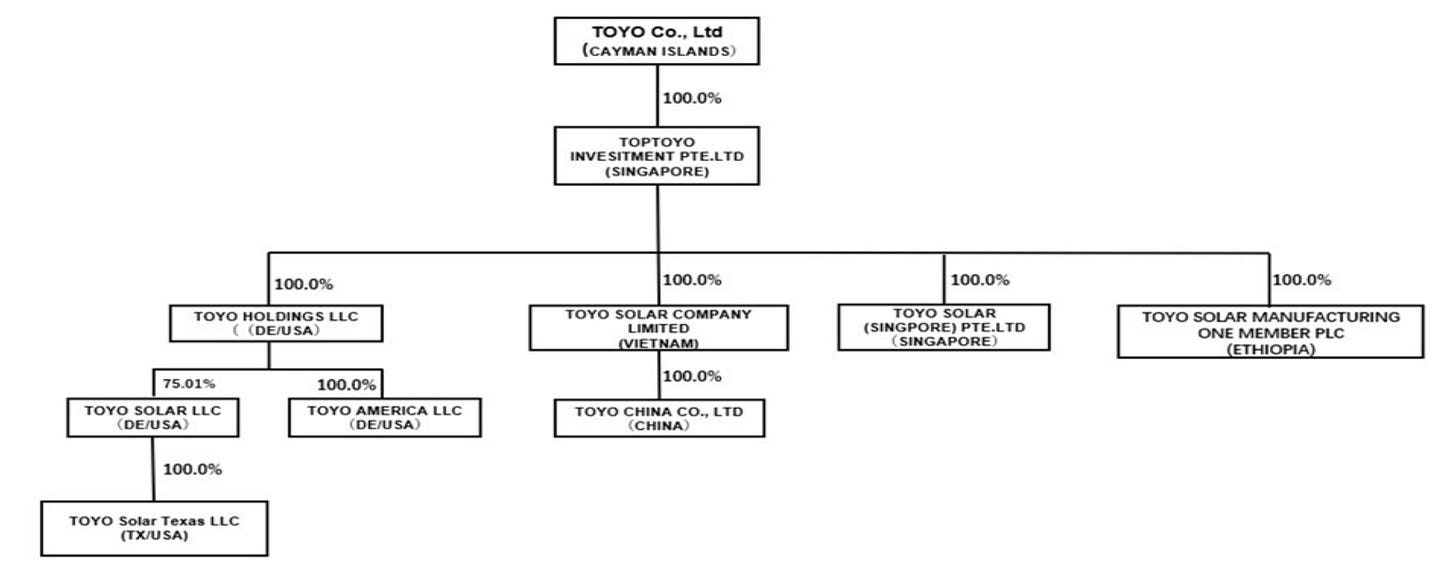

They just coalesced with sister company VSUN. I will probably make a deep dive 2 to get into the spaghetti of subsidiaries. However for now, focus on the growth and distribution of VSUN.

INSIGHT 4: 82% INSIDER owned with Low Float

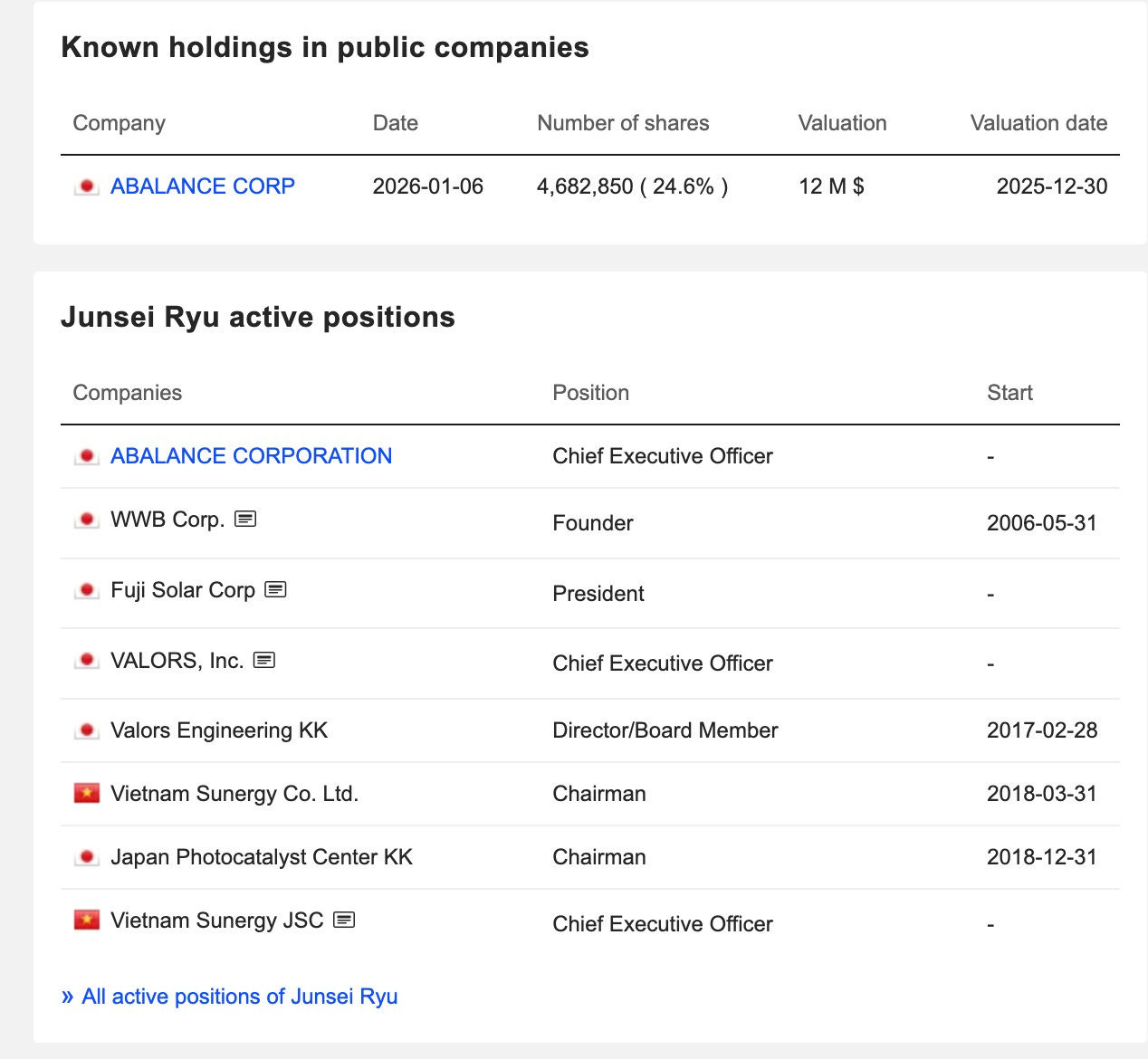

One man, Junsei Ryu, controls 67.6% of the company. The public only trades the remaining 32.4% (about 12.2 million shares). This is a highly centralized "low float" stock.

Some credentials on Junsei Ryu. I couldn’t find any interviews of him online, but he seems like a Solar Giga Chad to me

INSIGHT 5:RISKS

a. Jinko Solar Litigated TOYO on IP infringement. The company does not comment on what the damages could be.

However, keep in mind that everybody is suing everybody else for Topcon Patents. It’s an entire Suing-fest. OoooOO

b. Company claims FEOC compliance, but we have to see something real to fully de-risk the fact that the company setting is so convoluted.

CONCLUSION: It’s an Asymmetric Opportunity

If 2025 guidance is achieved ($375-400M revenue, $39-45M net income):

Forward P/E: ~5-6x (vs. First Solar at ~15x, JinkoSolar at ~5x)

Revenue growth: ~112-126% YoY

Price/Sales: ~0.6x on forward revenue

Bull Case

Tariff arbitrage proves durable and TOYO captures meaningful share of $30-40B U.S. solar module market

Section 45X credits at full capacity = ~$175M+ annual benefit by 2029

JinkoSolar patent suit settled or dismissed; TOYO continues growth

AI-driven energy demand accelerates utility-scale solar buildout

Target: 3-10x upside quickly (~$18-50/share)

Bear Case

JinkoSolar wins injunction, blocking U.S. sales of TOPCon products

Ethiopia loses tariff exemption or faces new trade restrictions

IRA modifications reduce or eliminate Section 45X benefits

Module price collapse compresses margins to unprofitability

Target: >50% downside (~$1.50-3.00/share)

P.S. Neils bought this stock to my attention. He is usually early and gets into very volatile names

DISCLAIMER:

I invested in this stock and is about 1/2 the current TE holdings. As I discover or get more information, I will get in bigger

How’s the valuation compare to TE ? Doesn’t seem that much better for the additional risk?

Hk keep going bro .thank you for putting so much effort for us .