GITLAB (GTLB) Why the market is wrong about this stock?

This came to my radar when I saw a very successful prominent investor lean into it heavy in the last 13F filings.

THESIS:

There is going to be more code, mode debugging, more security issues, and more developers in the world with GenAI like cursor, windsurf, codex etc.

Gitlab will continue to increase seats CONTRARY to the market belief. Over 70% of revenue growth coming from seat expansion rather than just price increases

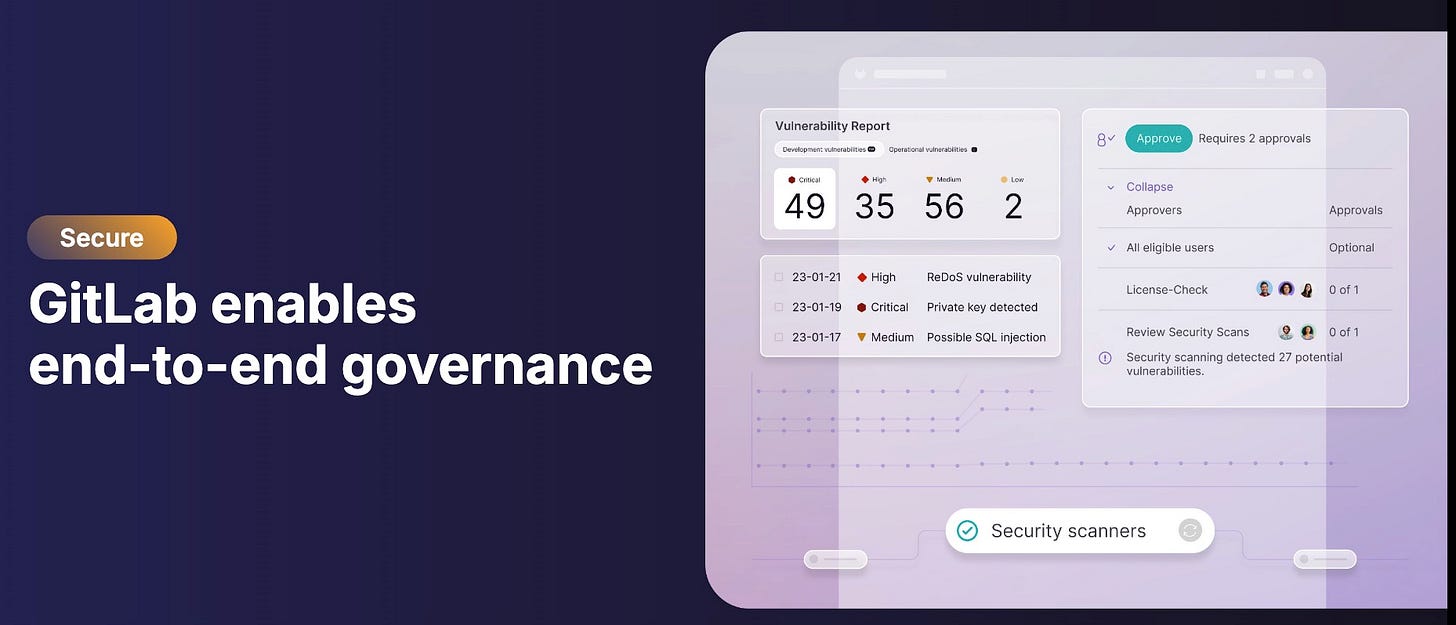

50M registered users and used by 50% of the Fortune 100 companies and has carved out a niche for On premise, full control, secure Open sourced software for change management in software

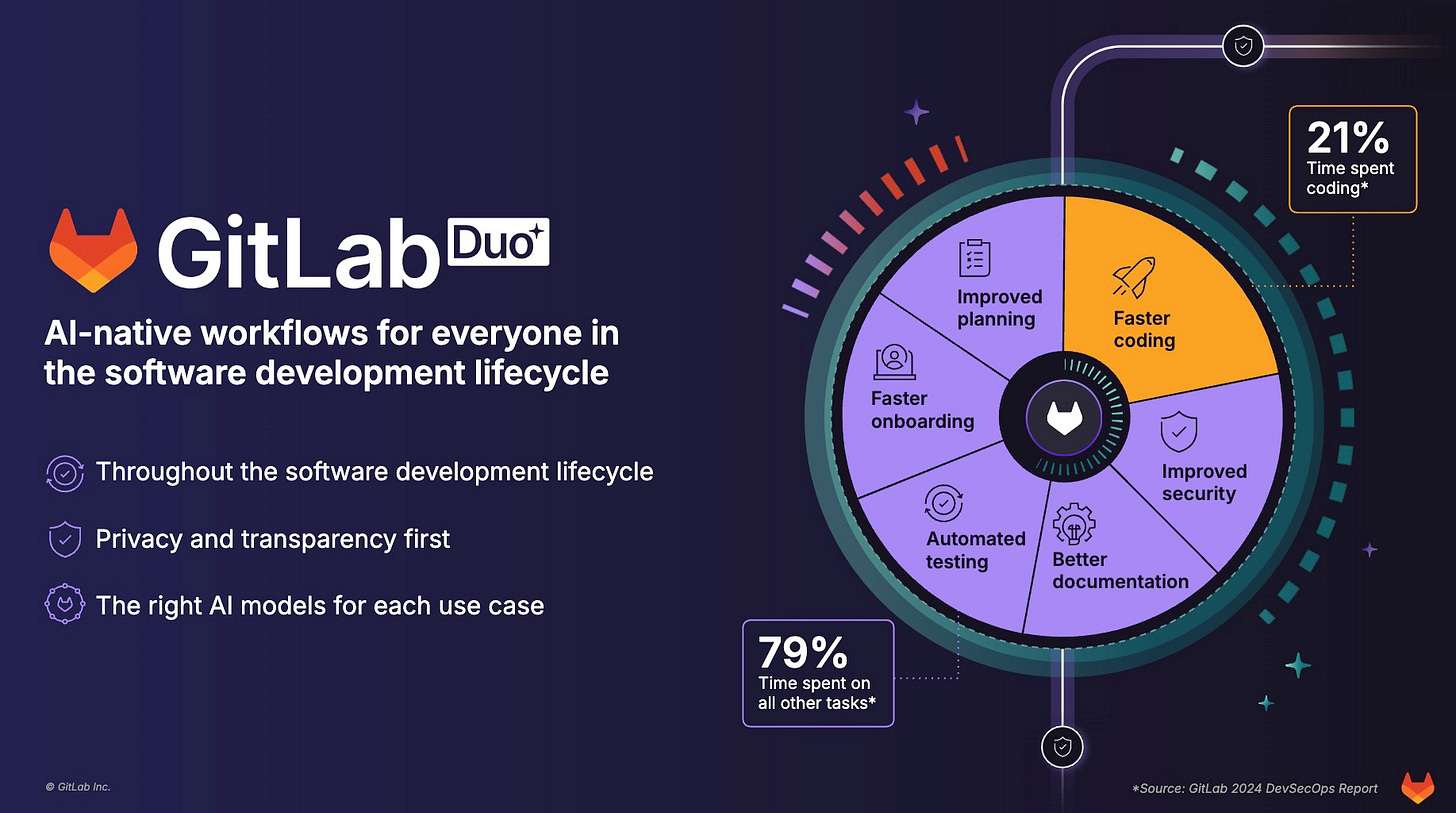

Gitlab focuses on providing one point of solution for all. From top to bottom tech stack

Lots of good things in their fundamental charts

The Operating margin improvements is juicy and love the cash flow influx this year. Plus Clean Balance sheet. No debt!!

This got me interested to deep dive. But mostly it was the 13F portfolio of this guy. Gavin Baker from Atreides Management

He manages ±4B in portfolio and last quarter initiated a big position into Gitlab, ploughing 5% of his fund into it.

He has outperformed S&P significantly in the last 3 years and has returned annualy CAGR of ±35%

So. Gitlab. This stock spent 4 years consolidating and has been trying to grow into it’s valuation since then.

Where is the opportunity in this under 10B mid cap?

What is the market NOT yet seeing in this stock?

The problem is that there are wayyy too many softwares 15-17 to deliver software.

They want to combine it all and bring it under one roof. Imagine being able to embed intelligence everywhere in the stock and make it seamless.

Insight 1: AI as a Seat Expander, Not a Reducer

I think that the Market is overly pessimistic about seat based pricing in B2B enterprise software due to Gen AI. The argument is that you can do more with less number of seats.

However this thinking is incorrect. It’s also increases your ARPU massively based on USage based pricing (But thats a whole other topic)

First Lemme give a few examples of it’s peers who have talked about it openly.

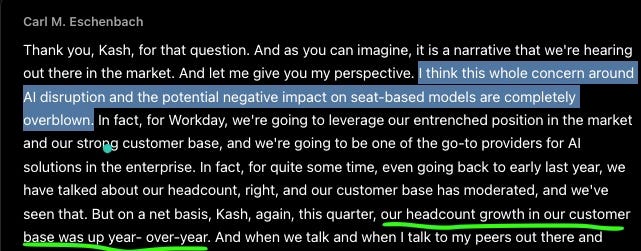

EXHIBIT 1 ($WDAY, 65B company)

“I think this whole concern around AI disruption and the potential negative impact on seat based models are completely overblown”

”New AI modules (Illuminate, agent-based workflows) are sold in addition, driving both seat count and ACV higher.”

- Carl Eschenbach CEO of WORKDAY

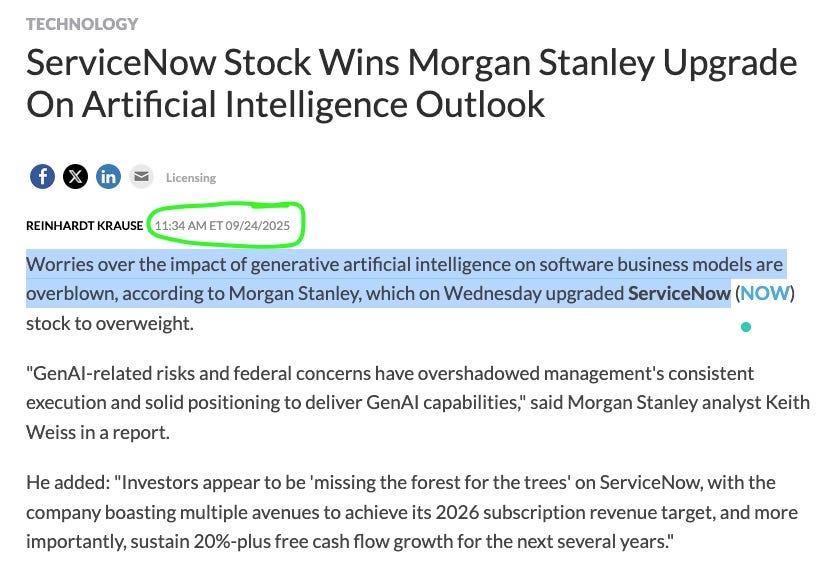

EXHIBIT 2 ($NOW, 190B company)

Morgan Stanley conference commentary & Q2 materials (24 Sep 2025) Analysts noted “investor fears of seat shrinkage are overblown; AI workflows are leading customers to deploy additional Pro+ SKUs” that bundle advanced GenAI features

EXHIBIT 3 ($MNDY, 11B company)

“There is annual contract value increase mostly due to seat expansion”

- Eran Zinman (CEO of MONDAY)

While not every SaaS vendor will succeed, these examples show that the narrative of inevitable seat decline is not universal; when AI augments workflows inside the same platform, it can stimulate seat growth

Insight 2: Gitlab is a long term ARR compounder

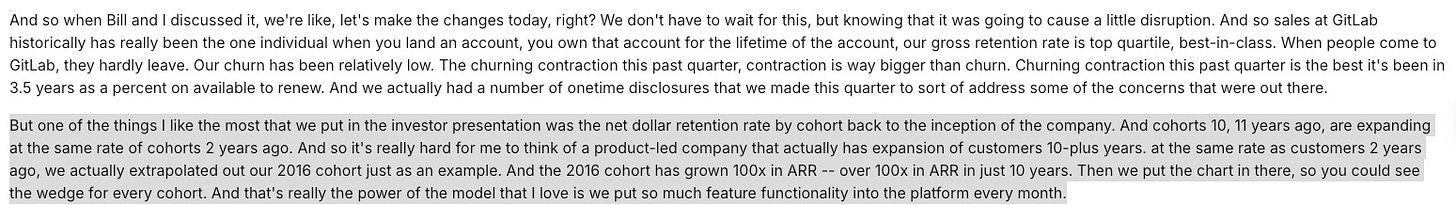

2016 customer cohort has grown its ARR by 103.6 times!!. 100X under 10 years.

Growth rate amongst 10 year old cohorts is the same as 2 year olds. Meaning customers are here to stay and compound over the years.

This is what Brian robbins (CFO at Gitlab) said a week ago in a conference.

Large customer growth is robust, with clients generating over $100,000 in ARR increasing by 25% in a recent quarter. And most importantly NEt dollar retention rate at 121%

Customer expansion with Gitlab thrives on bottoms-up adoption, growing seats and upgrading to Ultimate for security features

For eg. UBS deployed 9000 licensing in 9 months then 18,000 licenses in 15 months.

Insight 3: AI native workflows will introduce Hybrid seat-plus-usage-based system. This will drive growth

AI creates more code but also more security, automated testing, planning work

“ The bottleneck for software has never been software code authoring. To accelerate that’s important, and it’s really cool that all those AI dev tools are accelerating code creation because it lowers the barrier to creating code. It means there’s more volume of code, but that code cannot go to customers unless it’s version controlled, unless it’s tested, unless it’s secured, unless all of the security and compliance rules that the business has to maintain in order to serve their customers, unless those happen.”

- William Staples Board member of Gitlab

Insight 4: GitHub may be the bigger competitor, but its sweet spot is tightly regulated enterprises—often running in secluded, on‑premise environments with the heaviest security demands.

GitLab is the only cloud agnostic and AI-model agnostic player to capture the desires of Defense, Finance or FIG, and Healthcare..

Dedicated single-tenant SaaS grew 92% YoY. There is ONLY 1 solution to host your applications in a secluded environment on premise. And that is Gitlab!!

Insight 5: Business is getting more efficient

Despite Gross margins staying constant, EBIT margin or Operating margin is improving in a clear trend

GitLab sees a bigger market fueled by AI and software complexity, not fewer developers. Software compexity is about to grow sharply

My Entry positions are at $47. Will buy some more at ±$40 if it gets there.