$FLNC one of the best pure play Batteries bet for ON premise AI Data centre play.

Check my thread from 5 months ago on X.

No financial advice and only used AI to proofread

The market has slowly started to realize how important utility-grade batteries are for data centers. The flavour of the month has been Grid Batteries in the stock market.

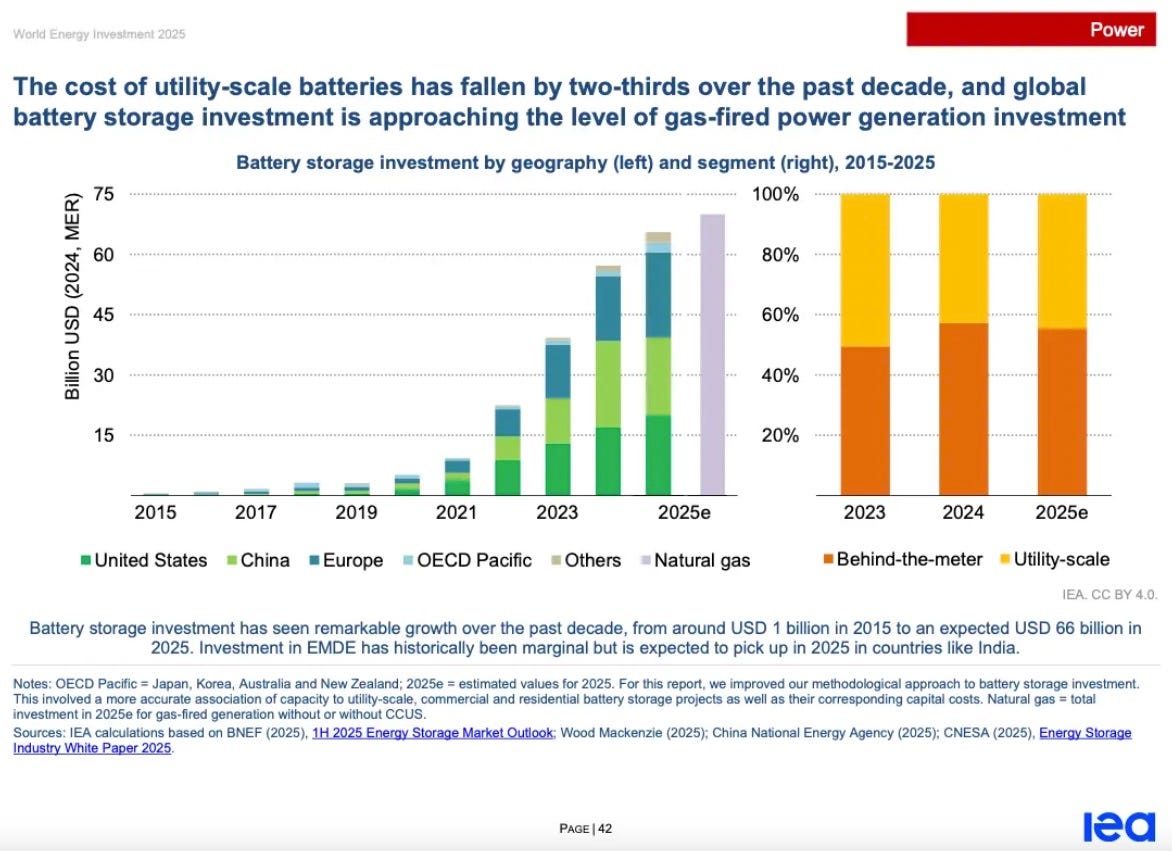

66x investment growth in utility-grade batteries over 10 years. It is also interesting to note that much of it is being colocated at the source of demand.

Batteries at data centers serve specific, valuable functions

Power quality management - handling rapid load swings from AI workloads.

Peak shaving and load management (price arbing)- reducing demand charges by up to 30% and making money by storing energy when it’s cheap.

Backup power replacement - replacing diesel generators (For eg. Microsoft is aiming for diesel-free data centers by 2030)

Reducing interconnection delay - enabling faster interconnection. In some US regions backlogs are 5-9 years long. In EU it can be easily 10-13 years

Renewable integration - storing excess solar/wind for 24/7 use

The first one is probably the most important one.

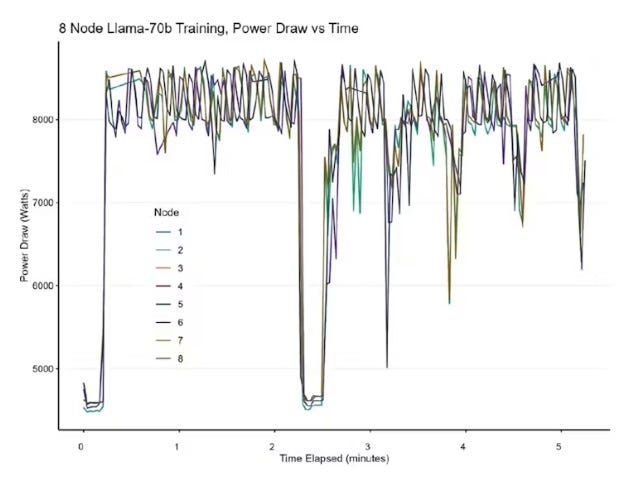

Data centre GPU training can destabilise the grid very fast. Look below an actual load from a AI data centres.

Dylan Patel explained how Meta engineers accidently open sourced this code named “Power_plant_no_blow” (unbelievable) to create fake wasteful demand in their training runs just to not have so much variability in their in the demand loads.

I spent an hour looking for the timestamp video for you all to hear it from the dragon’s mouth. Click on the video and it will take you to the timestamp.

Okay, so is this info still not priced in?

It’s the scale and extent of it that are not yet realized. All major hyperscale data centers will want batteries on premise.

I recently just started beeing active on substack. So go check out my original thesis on X (My original thesis) and come back. I had been posting non stop posts about FLNC in May/June. It has 4X since then so the ARR software valuation does not apply, however there have been a few more things that happened since then.

Quite a few things have happened since my post.This is according to the company slides:

This is what I am thinking:

The One Big Beautiful Bill Act, or the OBBBB, came out with strong support for battery storage. It differentiates BESS from other sources of generation by recognizing FLNC’s technology as a dependable and dispatchable source of electricity, much like nuclear or gas plant

MArket’s understood that AI data centre co location might be imperative to handle grid stability

P.S. Stock’s about 30-35% SHORT according to Finviz and Fintel

Did you just say 30% short interest after such a big move? Okay, lets give shorts a real scare stare.

Also btw, most of Fluence is mostly institutions owned; and their average price is around 18. They held through the whole drawdown. You think they will already sell it?

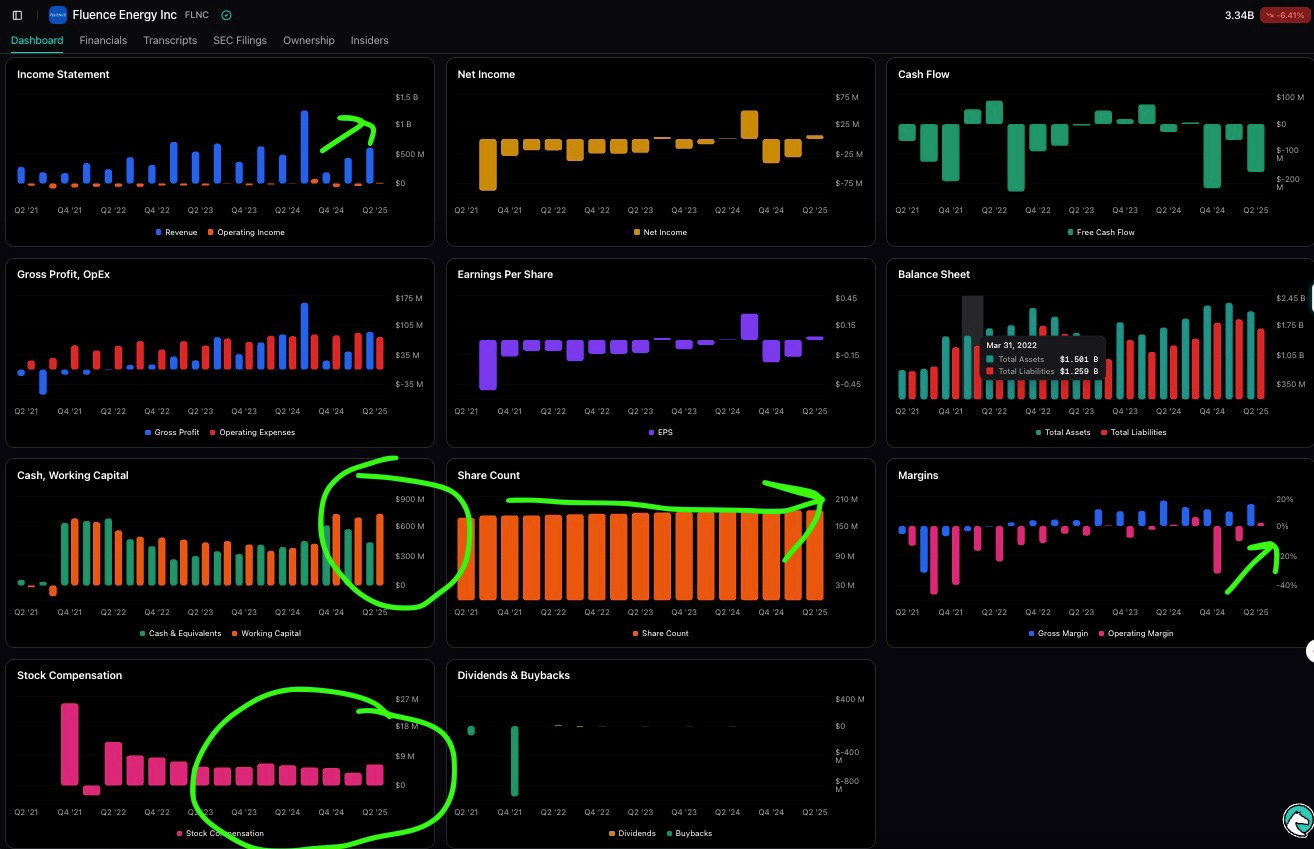

Fundamentals have a lot to like. Yes the margins could or should improve, but its a good trend. Also Stock based compensation on check.

Okay, let me also include some Excerpt from their last earnings call

”Batteries can be co-located at the data center itself or deployed at the transmission or distribution level, offering both behind-the-meter and grid-level flexibility. That’s a key advantage in markets with interconnection bottlenecks or constrained infrastructure.” — Fluence’s CEO in Q3 2025

Interestingly, he mentions there are some discussions with AI data centre operators. Hmmmm

I am definitely holding my breath (or heart) for the announcements. That might further rerate the stock.

Technology Advancements and Software Offerings

Beyond hardware, Fluence’s software platform (SaaS for grid optimization and battery management), is a rare in the sector.

I project this high margin ARR (145M in 2025) is probably going to 300-500M in 3-5 years. That alone could value the company at $3B in 1-2 years. Hardware business is also cherry on top.

Fluence’s software is very good in handling different types of assets from different companies. This is where it shines the most and could be unstoppable.

I might decide to deep dive into their software, as well as issues in general BESS systems need to handle at the software level in the coming days.

My Price targets for FLNC 0.00%↑ in the short to mid term is $36. Long term depends on how many AI data centre deals they are able to capture.

Risks:

LFP batteries do have a risk of thermal runaway. South korean government lost 858TB of data (not backed up) due to data centre fire.

In Jan 2025, there was a major fire at Moss Landing battery storage facility in California. Culprit was thermal runaway began with an internal defect known as abnormal lithium metal deposition and dendritic growth inside a single cell, which then propagated heat through neighboring cells.

Might have contributed to downturn in Fluence’s stock starting in Jan 2025. Luckily, Nobody was harmed.

Since then numerous security measures are in place. Also, reminds me of media focusing on a few battery combustions in TESLA vehicles vs thousands of fires in gas cars. EV fire is largely a controlled problem. Utility grade fire will be a solved problem too.

Now there is a massive bottleneck to install batteries fast to the grid. It is not cell production. I will talk about it in the next post and reveal some plays on this problem.