FLNC Deep Dive Part 2

Blowout guidance and very important information to build conviction for FY26

Techdrifts is now called Stockdrifts.

DISCLAIMER: Nothing on this post is FA. I own a big position in FLNC

For some odd reason, they call this earnings Q4 and end the FY2025 with this quarter. Wierdos!!

Contents:

- Deep Dive into Q4 Earnings report and FY 2025

- Multiple Revenue streams for BESS (Battery Energy Storage Systems)

- Parallels between BESS and hedge funds

- Key Performance Metrics for BESS

I’ve been saying it since late May/early June that FLNC will be a major AI beneficiary

If you are interested in reading the full thesis on FLNC, when I posted it first, check it out here. Literally got the bottom and avg. of $4.5.

They are finding ways to be FEOC compliant and be China proof. I predicted that it would happen and now you can see their slide from today.

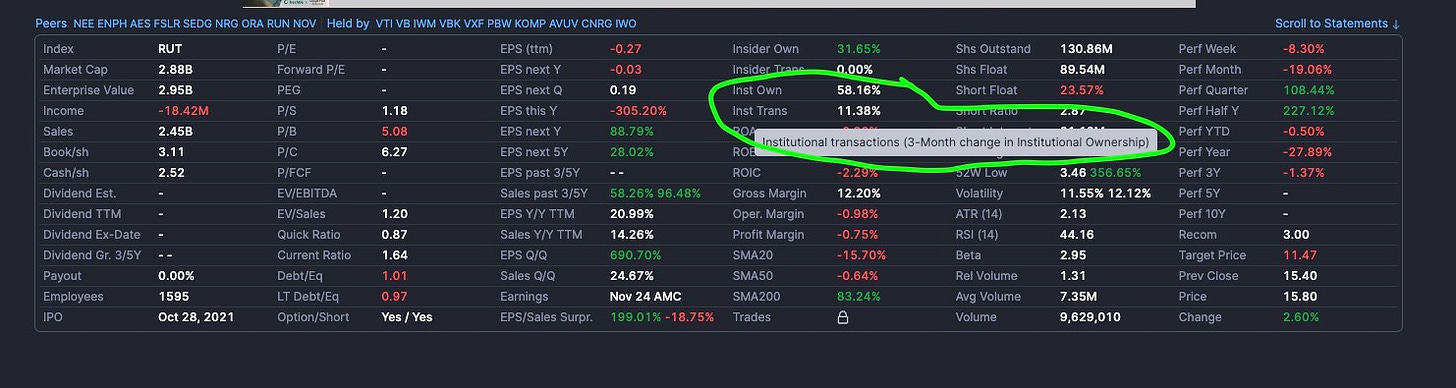

There is massive institutional inflow. Ownership increased by 11% in the last quarter.

Okay, now lets look at the bad, ugly and good of what’s been announced. Stock’s up 13% AH.

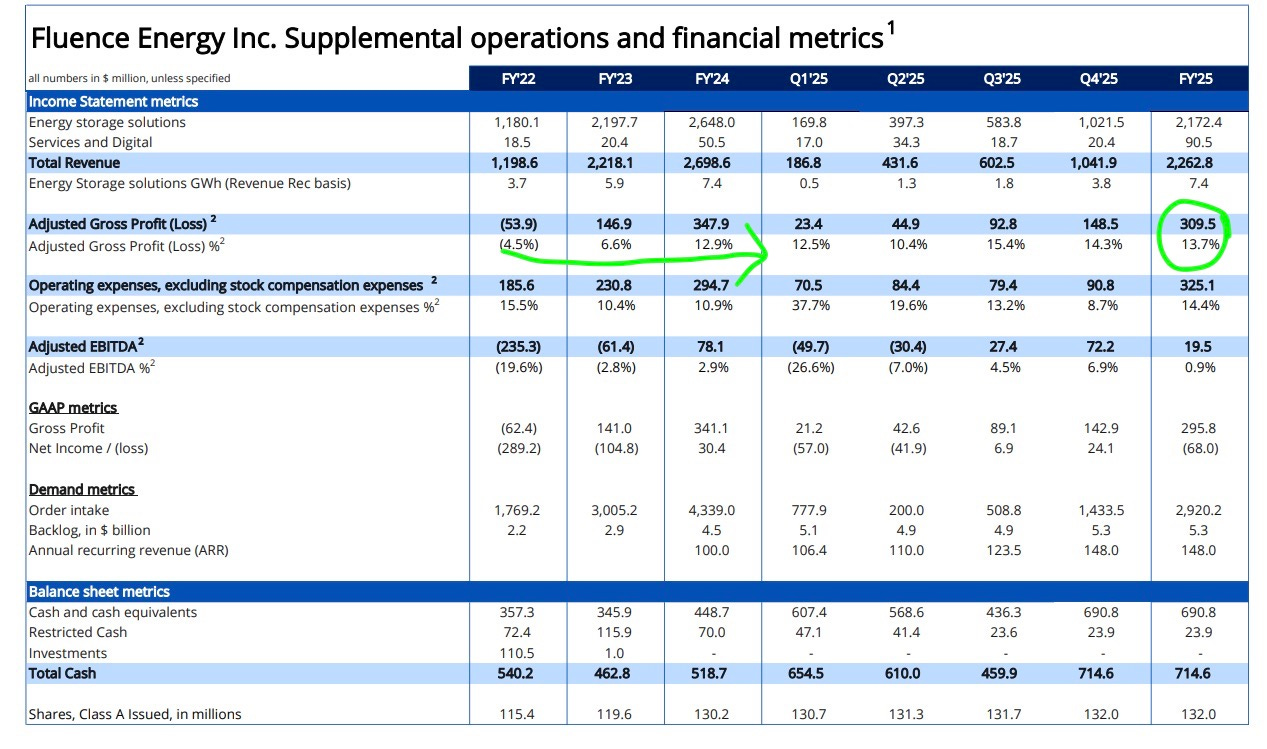

GAAP gross profit margin up 13.1% for fiscal year 2025 and approximately 13.7% for the fourth quarter, compared to 12.6% and 12.8% for the same periods in fiscal 2024, respectively. This improvement is really great to see. Meaning they are able to command better pricing.

ARR up to $148M. Dissapointed with slowdown in ARR growth. Only 20% next year to $180M.

Rev came at $1.0B vs $1.4B est, and lower end of $2.3B in 2025. But this year was already priced into the stock. It’s all about looking forward

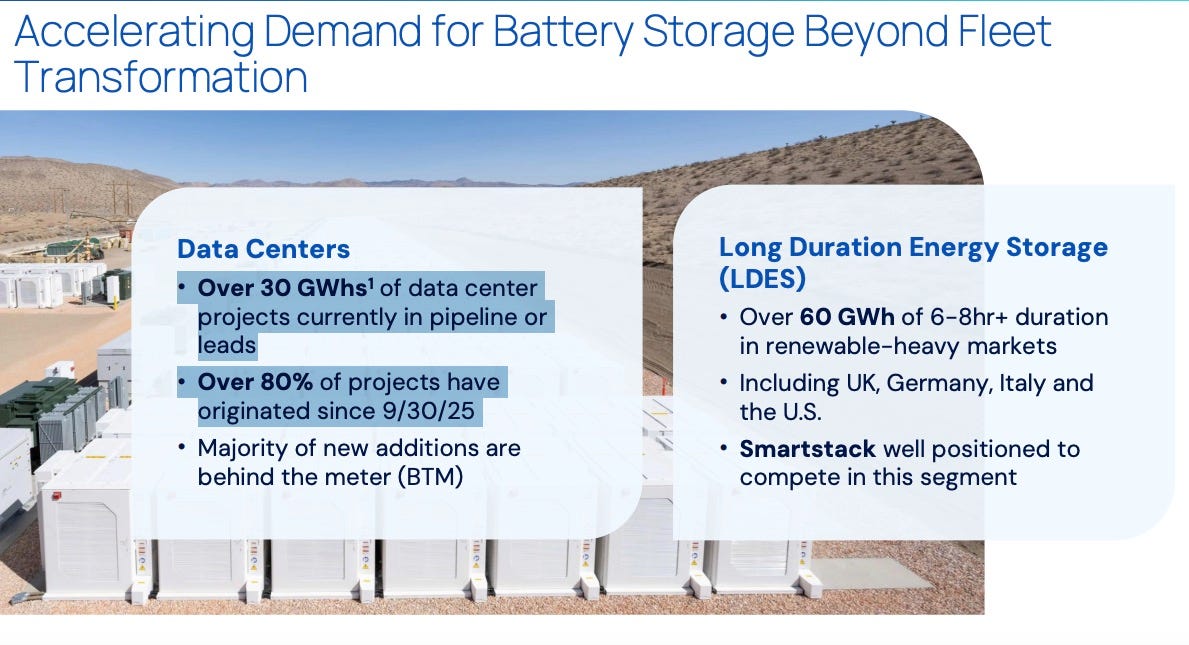

This is the crucial part why the stock’s really excited. 30GWh Pipeline added for AI data centres in ±50 days.

This is so insane.

With a 40% pipeline jump in under 50 days, FY26 is hard to predict. I think they’re playing it safe by pointing to the 85% already secured by signed contracts.

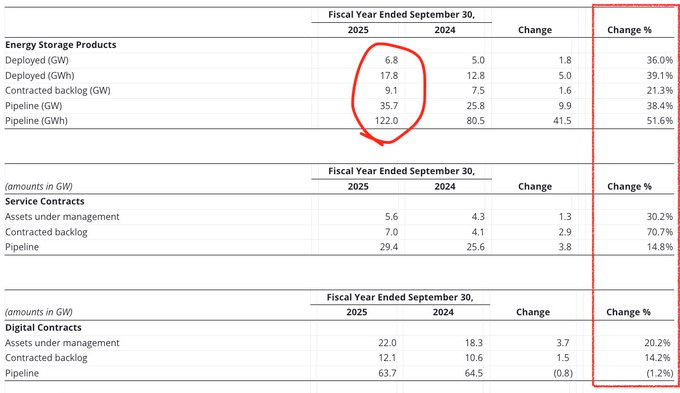

Energy storage growth is explosive—they’re guiding to 50% growth, which is huge for an energy company. I suspect that’s conservative if the AI data centre build out continues.

Order intake hit a record $1.4B in Q4, the largest ever for Fluence, driving backlog to a record $5.3B, up 18% from last year.

- Q4 order intake $1.4B

- Contracted backlog grows to $5.3B, highest ever

- Contracted backlog covers ~85% of 2026 revenue guidance

If you missed it. Just read the %Change again. This is insane in my opinion. These are GW and GWh numbers, so no joke. Only TSLA had such high growth numbers for energy products earlier.

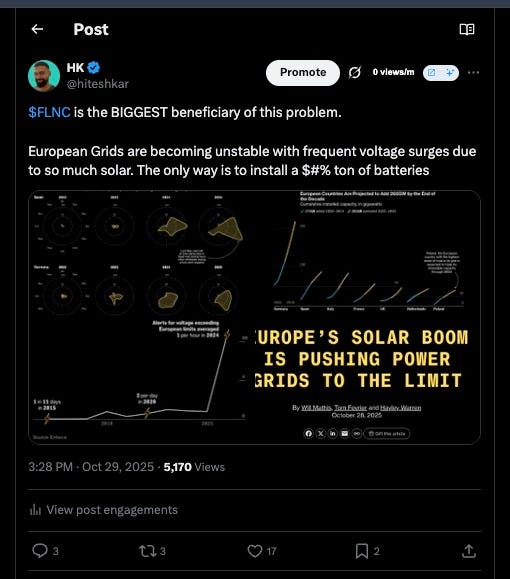

At the expense of being annoying, I predicted that Fluence will be the biggest beneficiary of European grid security. Europe has too much renewables and too much voltage fluctuations to take care of. Without even considering the AI data centres.

12 Days later, this announcement came

Not to anybody’s suprise, EU is leading the charge on Battery regulations.

On August 18, 2025, the EU Battery Regulation fully replaces the previous 2006 EU Battery Directive, marking a major legal shift in battery regulation within the EU market. What you need to understand that there is going to be more red tape and more insurance responsibility for Battery producers and developers.

This will make EU a high barrier of entry for smaller players due to compliance and risk increase. The fact that Fluence contracted the biggest battery in EU in this environment, is doubly impressive

Okay, so while we wait for the earnings call tomorrow, I have a couple of interesting technical insights that will help you make predictions like these.

Multiple Revenue streams for (BESS)

Now I would like to mention how these BESS batteries can have multiple revenue streams.

There are 7 ways a BESS projects can generate massive revenues and profits. I found a great table.

Wholesale Energy Arbitrage

Balancing Mechanism (BM)

Ancillary / Frequency Services (e.g., DC, DR)

Capacity Market

Grid / Network Services

Quick Reserve / Grid Stability Products

Local Flexibility Markets

Depending on your geography, they could be growing, stable etc.

Optimizing Battery revenue is a lot like running a hedge fund.

Discharge = shorting power (sell now, expecting lower prices )

Charge = long power (buy now, expect prices to rise)

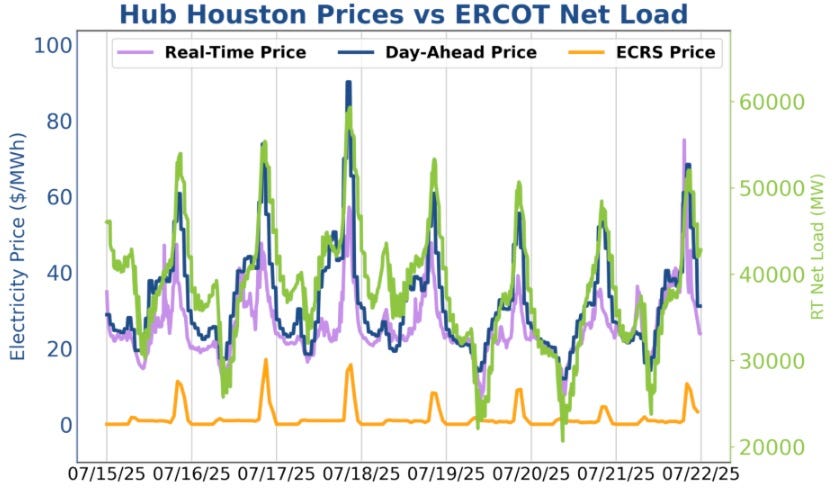

It’s all about timing the peaks and the troughs. This chart really drives home the point. Just look at the price swings during the day in Texas during peak summer load.

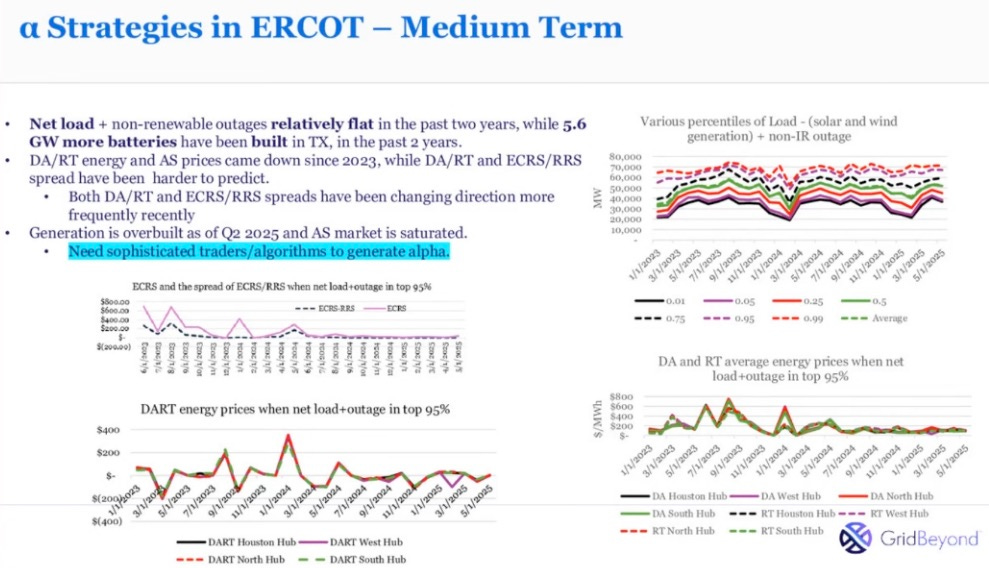

Recent ERCOT price spikes occur even during off-peak hours and weekends due to thermal outages, requiring sophisticated forecasting beyond traditional weather-based models

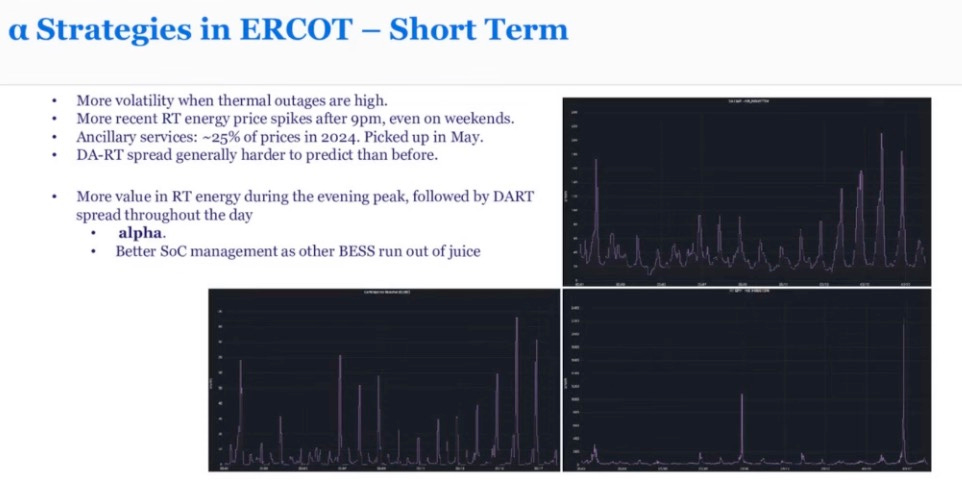

Interestingly, grid beyond is talking about Alpha generating trading algorithms, just like in the stock market.

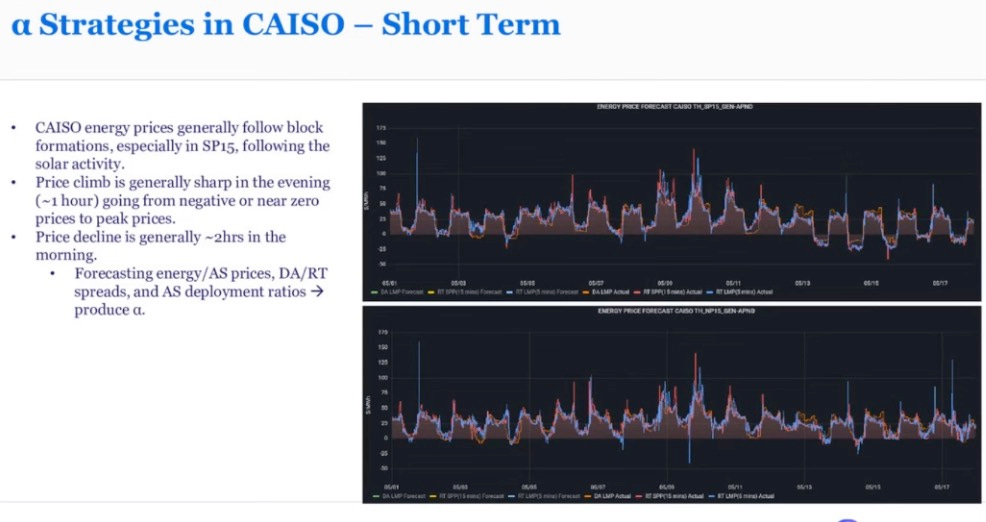

Some more alpha strategies in CAISO

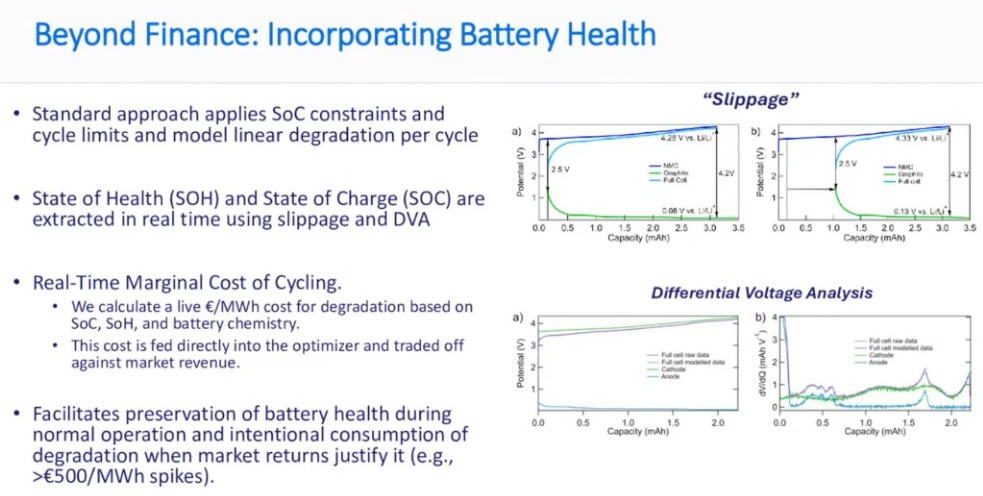

BESS operators face a dual challenge: maximize revenue while safeguarding safety and battery health.

Failures and downtime hurt trading, so bid optimization must be integrated with OEM controls to protect longevity.

Unlike solar or wind, every trading move accelerates or preserves battery degradation—demanding tight coordination between technical and commercial teams.

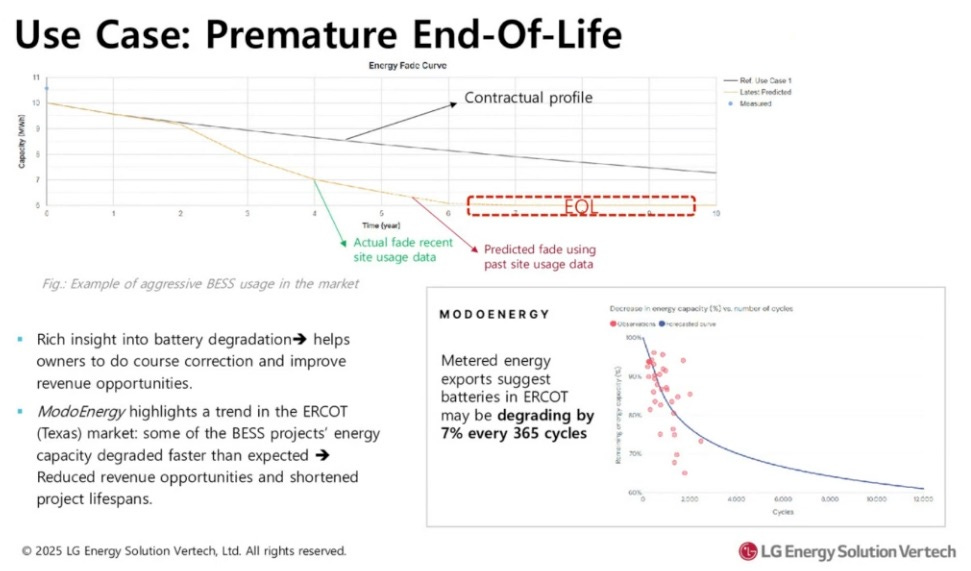

In many cases, the actual degradation of BESS is much higher than contractually agreed upon. Often BESS managers abuse the lifecycle of batteries for short term gain. However, it is a delicate balance in maximizing returns for asset owners.

More difficulty arises when battery don’t degrade at the same time. Imagine having to replace individual cells at different times. It’s a complete nightmare.

That said, Batteries can be operated to accept more degradation during high market price spikes while staying within warranty limits, optimizing returns.

Basic strategies like charging when the sun is out and discharging at sunset work but advanced optimization incorporating ancillary services and state-of-charge management can increase revenue by ~7% or more

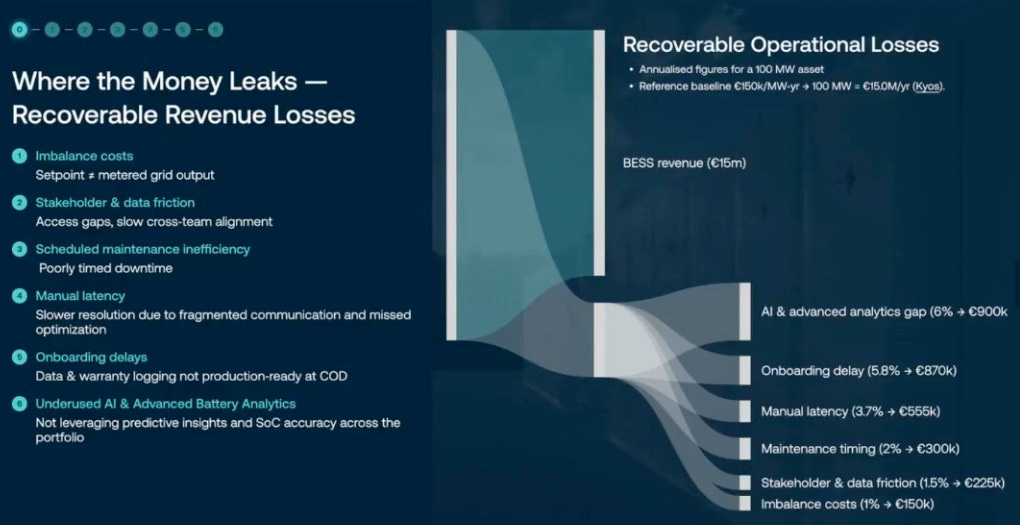

Interestingly, Significant revenue leakage is not from technology failures but from operational inefficiencies. Operators can lose up to 20% of annual revenue through avoidable issues like data fragmentation and poor coordination.

Key Performance Metrics for (BESS)

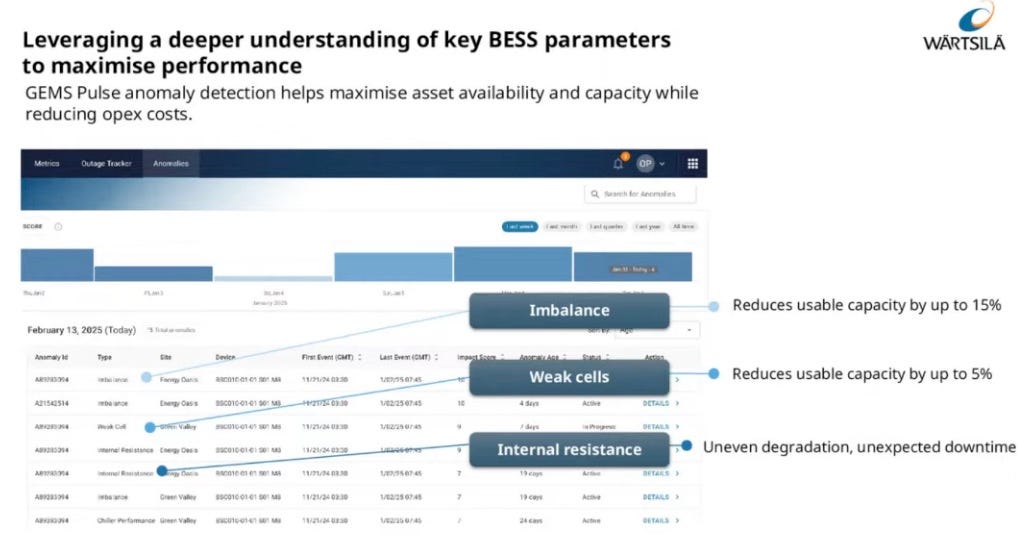

These metrics collectively impact the performance, operational optimization, and profitability of battery energy storage systems. Understanding and accurately measuring them is essential for maximizing system value and longevity

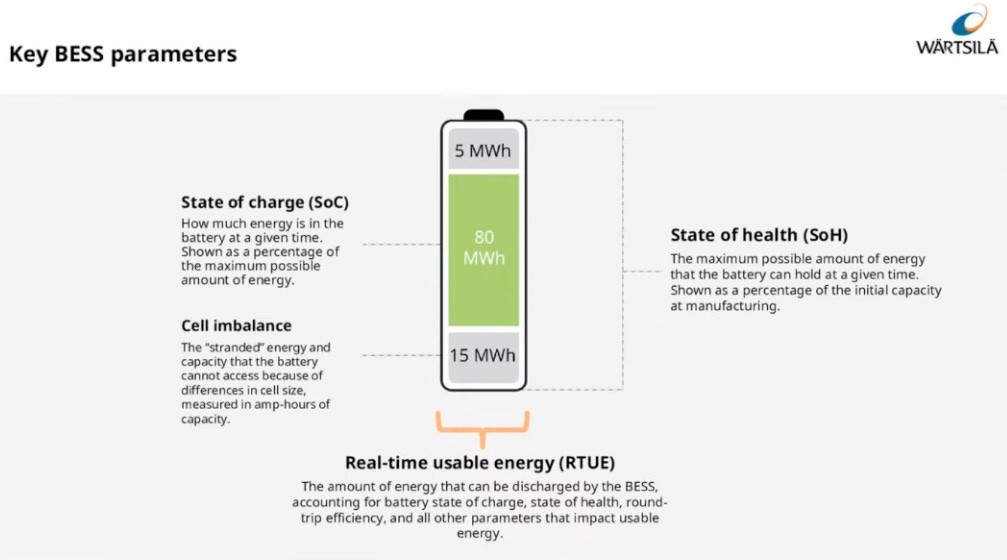

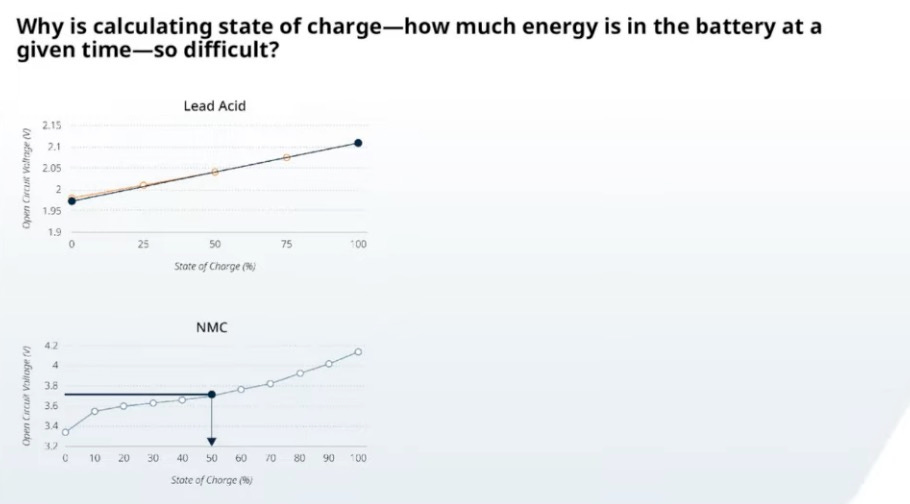

State of Charge (SoC): Represents the estimated amount of energy currently stored in the battery, expressed as a percentage of its maximum capacity. It is a calculated parameter, not directly measured, can be very complex to determine accurately

The long, flat voltage curve of LFP batteries makes it very difficult to determine SoC from voltage alone. A single voltage reading could correspond to a wide range of SoC values (e.g., 60% to 80%), leading to potential errors of 20-30% if relying solely on this method.

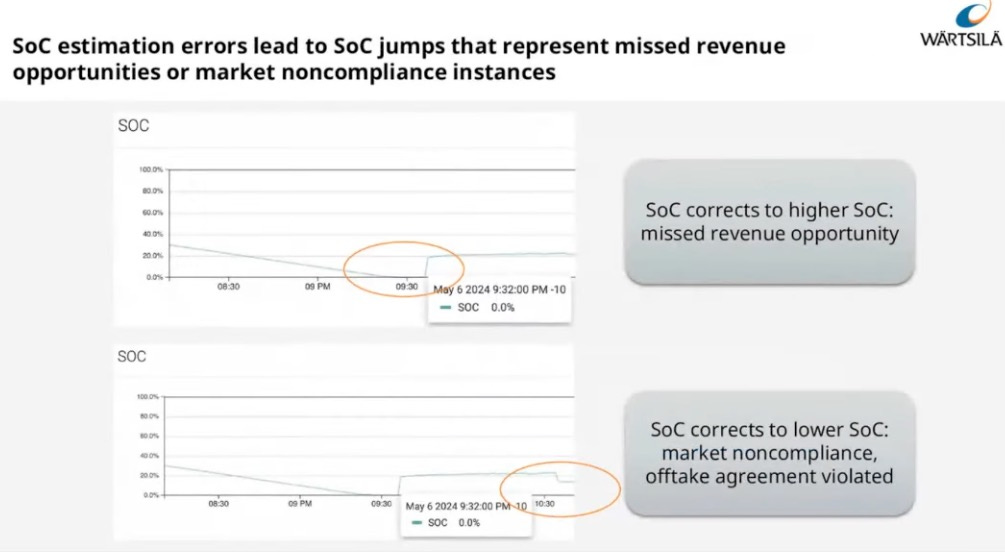

It is common for a battery’s reported SoC to “jump” significantly after a calibration. An upward jump means missed revenue opportunities (the battery had more energy than thought), while a downward jump risks market non-complianceState of Health (SoH): Indicates the maximum possible capacity of the battery relative to its original capacity at manufacturing. It reflects battery degradation over time, with a decrease in SoH meaning increased degradation

Cell Imbalance: Refers to differences in state of charge or capacity among individual cells within a battery module. Imbalance leads to stranded energy that cannot be accessed because the battery must stop discharging or charging when the weakest cell reaches its limit, impacting usable capacity

Round-trip Efficiency (RTE): Measures the ratio of energy output to energy input at the point of interconnect, reflecting how efficiently the battery charges and discharges. High RTE is desirable for maximizing energy and financial returns

Real-time Usable Energy: The actual amount of energy that can be discharged by the BESS at any moment, considering SoC, SoH, and cell imbalance. This metric is crucial for operational decisions and trading activities.

FLNC’s software stack is increasingly important to understand key BESS parameters and maximize performance

I might decide to do a deep dive Part 3 on FLNC after the earnings call tomorrow and incorporate the insights from the call. Let me know if you like me to get more technical on batteries or would you prefer I do more financial analysis.

Thanks! I think we would like part 3