Extremely undervalued Nat Gas Turbine play (50M market cap and 150M Annual revenue)

CEO mentioned that they have 4Xed their Gas turbine related business in a year

DISCLAIMER: Nothing in this post is financial advice and I am not the finance Gandalf. Small caps are extremely risky

Global gas turbine demand has accelerated faster in 2025 than at any other time in the past decade.

Big industrial companies are saying these are unprecedented times with unprecedented demand for power for Data centres. Specifically Nat gas capacity is backlogged upto 4 years already.

Lets look at a few examples.

EXHIBIT A ($GE Vernova)

The Gas Boss at GE was asked how their Gas business was doing, Whether it is experiencing softening. He said that People are instead paying extra premium to cut lines for Nat Gas capabilities.

”What I would not say is that we’re experiencing any softening. I can understand how you can look at the orders amount in the gigawatts and any orders booked in the quarter come to that conclusion, but it’s more a mix. In the third quarter, as an example, we had substantially more smaller gas turbines, more aero derivatives that are higher priced per megawatt than the baseload units. In totality, we continue to see prices accelerating in gas. And as an illustration, when we look at the profitability and price in our slot reservation agreements that 29 gigawatts that’s not yet in order relative to the 33 gigawatts that is on order, the slot reservation agreements are at higher price and more attractive orders -- more attractive margins, excuse me, that will translate to orders in directionally in the next 12 months. So we continue to see price accelerating.” — Scott Strazik CEO of Gas power business GE

More booking with slot reservation at $GE, meaning they want to pay more to skip lines. Half the backlog is trying to pay extra to expedite. There is only one direction that the pricing for Gas and related industries can take.

2. EXBHIT 2 (Siemens)

“Gas turbines were dead in 2022–2023. I heard customers say we’ll never be able to get a regulator to approve gas turbines ever, but Look at where we are today. We’re ramping up our capacity, we’re trying to produce more and more gas turbines,And frankly, we can’t make enough gas turbines to support this market.”

—- Richard Voorberg, president of Siemens Energy North America, during a keynote speech at POWERGEN International in February

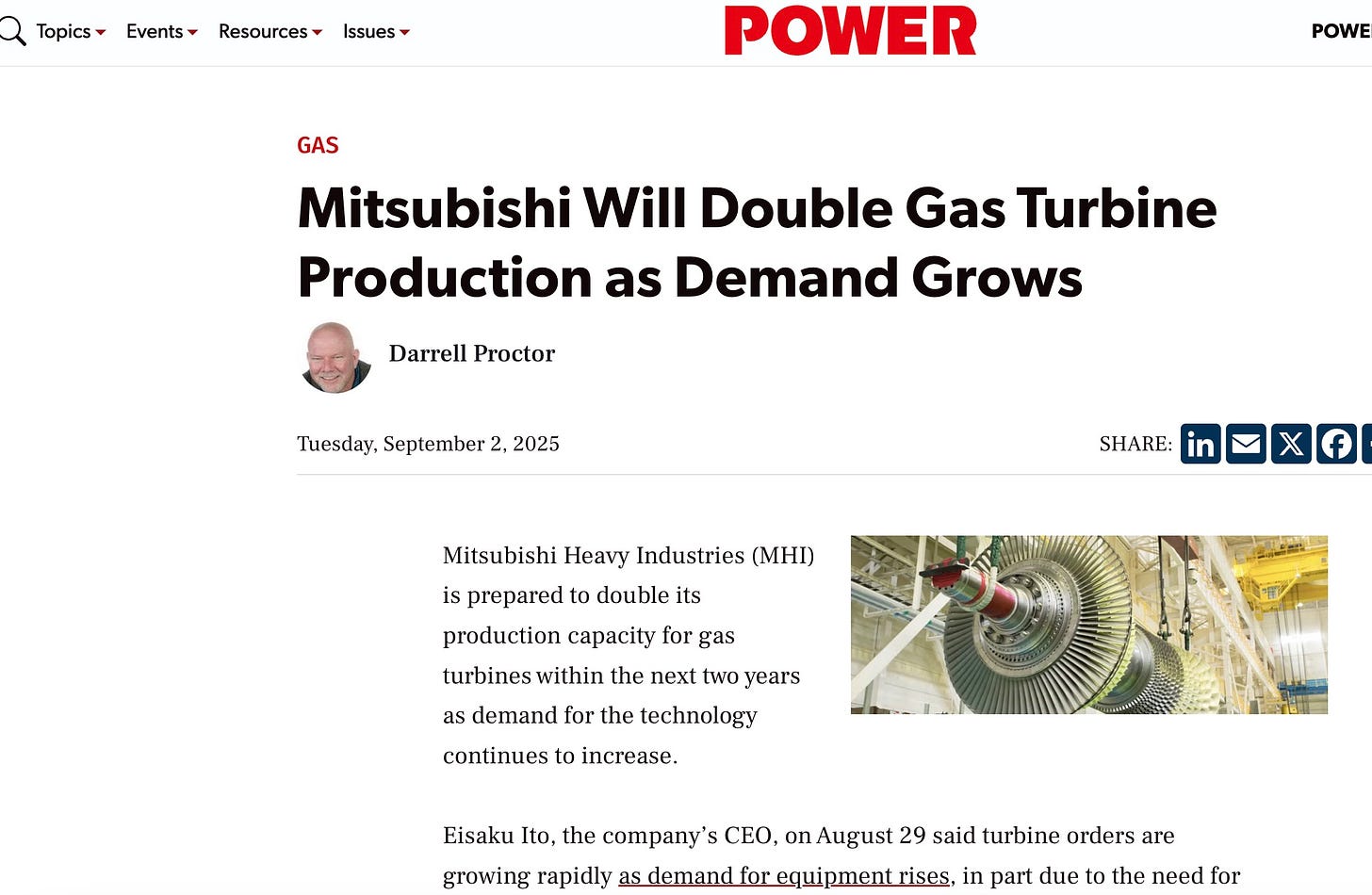

EXHIBIT 3 (Mitsubishi Heavy industries)

Mitsubishi Heavy Industries reported that it MUST double production capacity within two years to handle current orders, describing a “massive backlog” of new contracts and unprecedented order flow tied to power needs from AI and data centers.

Do you remember anytime when Heavy industry producers talked about doubling anything in 2 years? Woah are you serious? World war 2 maybe?

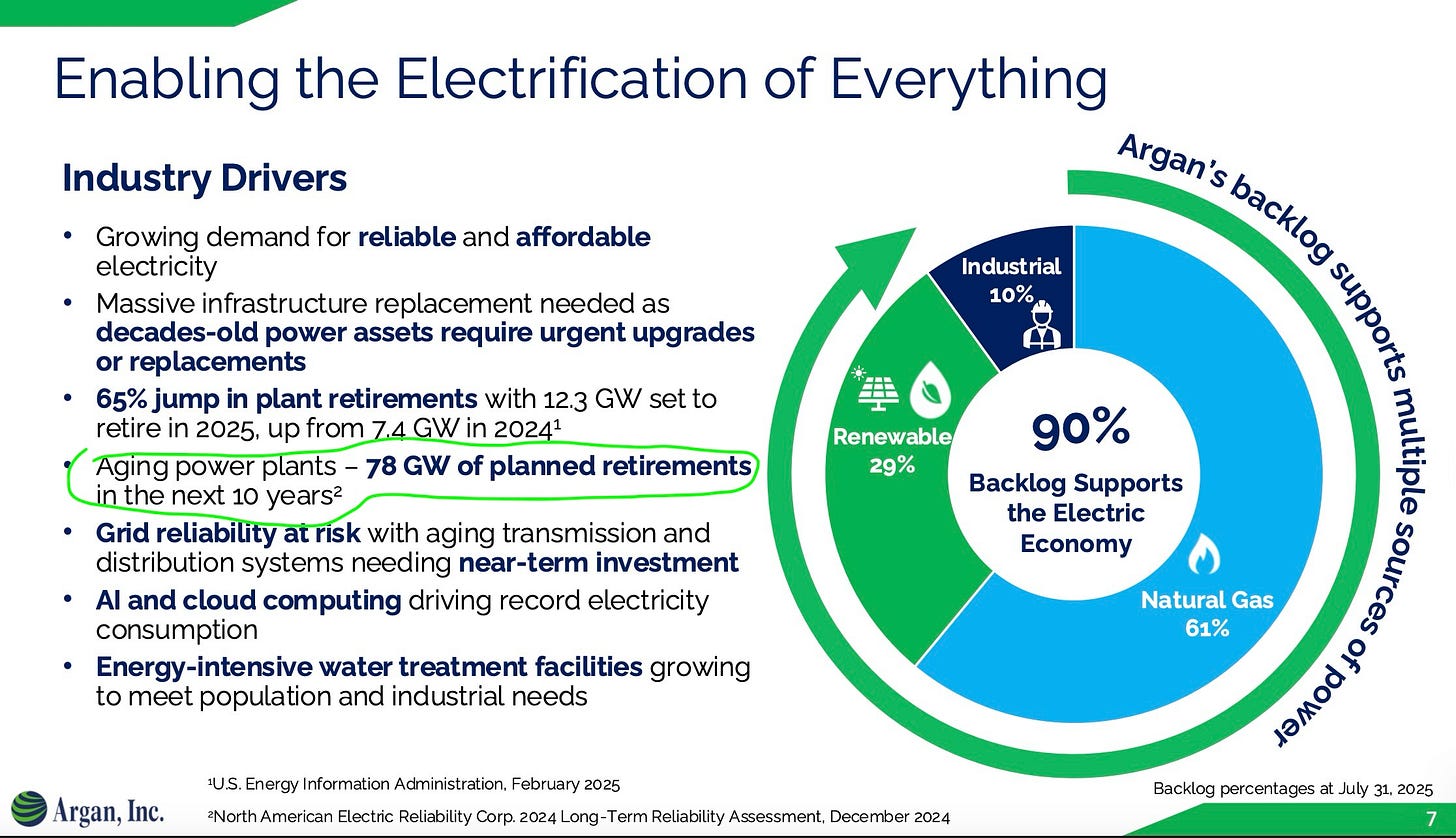

EXHIBIT 4 (Argan Inc $AGX)

Argan Inc (An industrial unsexy construction utility company just did a 6X on their stocks in 1.4 years. What world are we in?) just said this

“The OEMs who build the gas turbines have been sold out for many years, which clearly confirms that there’s an abundance of opportunities.” — Argan Inc AGX 0.00%↑

As if this shortage wasn’t enough, there is also retirement of 78GW power plants.

”A substantial portion of the nation’s natural gas infrastructure is aging out.” — David Watson from Argan inc

Okay enough of pumping. Lets get to the relevant small cap.

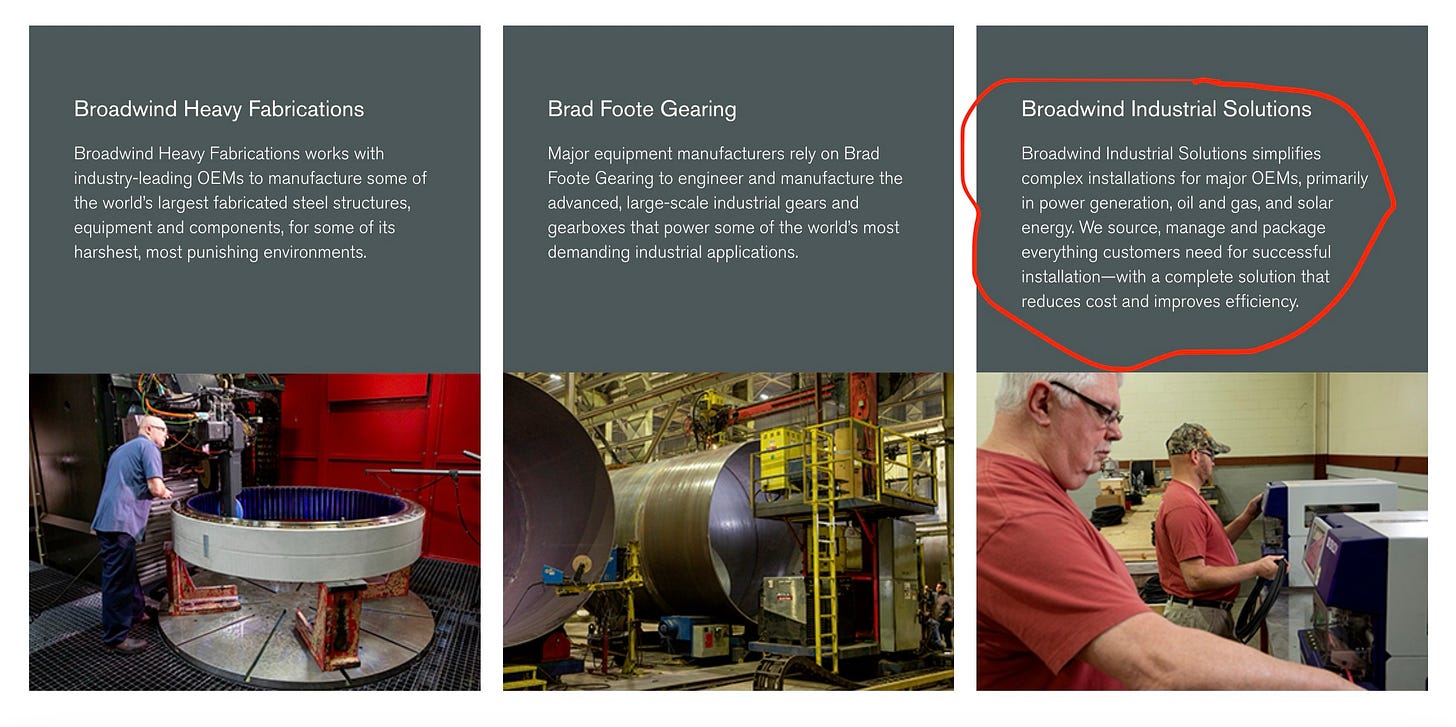

BWEN 0.00%↑ Broadwind Inc. is a manufacturing company that produces structures, equipment, and components for clean technology and other specialized applications. The company focuses on serving the power generation, wind energy, and infrastructure sectors.

It is priced at 0.3 Price to TTM sales. 50M market cap for 150M revenue. Undervalued

THe bussiness can be lumpy, but the increase in working capital is a very encouraging sign.

Broadwind’s product portfolio includes complex components such as wind towers, gearing products for natural gas turbines, and industrial fabrication solutions.

Since Wind energy faces some headwind (pun intended), they are pivoting to focus on Industrial solutions for Gas turbines OEM’s.

So what caught my eye to deep dive into this? This is what they said in their earnings call

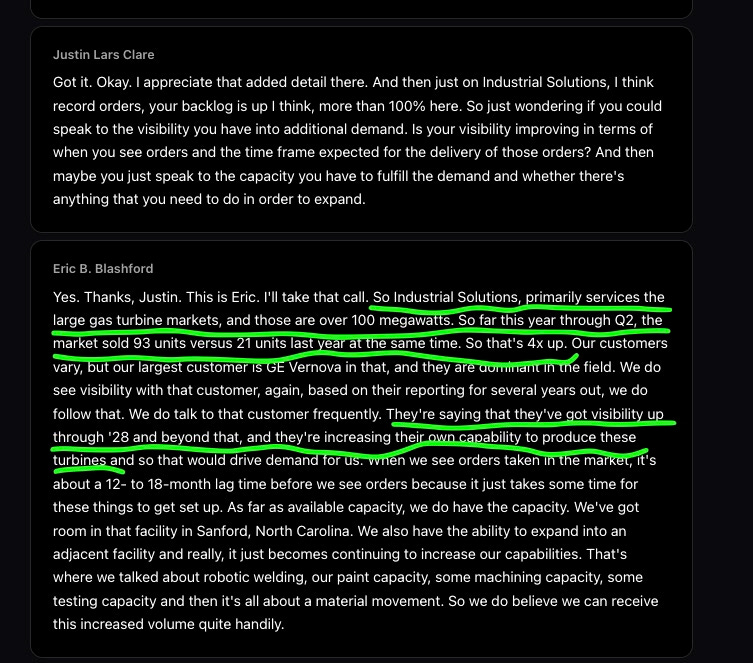

“On Industrial Solutions, primarily services the large gas turbine markets, and those are over 100 megawatts. So far this year through Q2, the market sold 93 units versus 21 units last year at the same time. So that’s 4x up.”

They emphasize U.S.-based manufacturing and are strategically shifting towards higher-margin, stable recurring revenue streams.

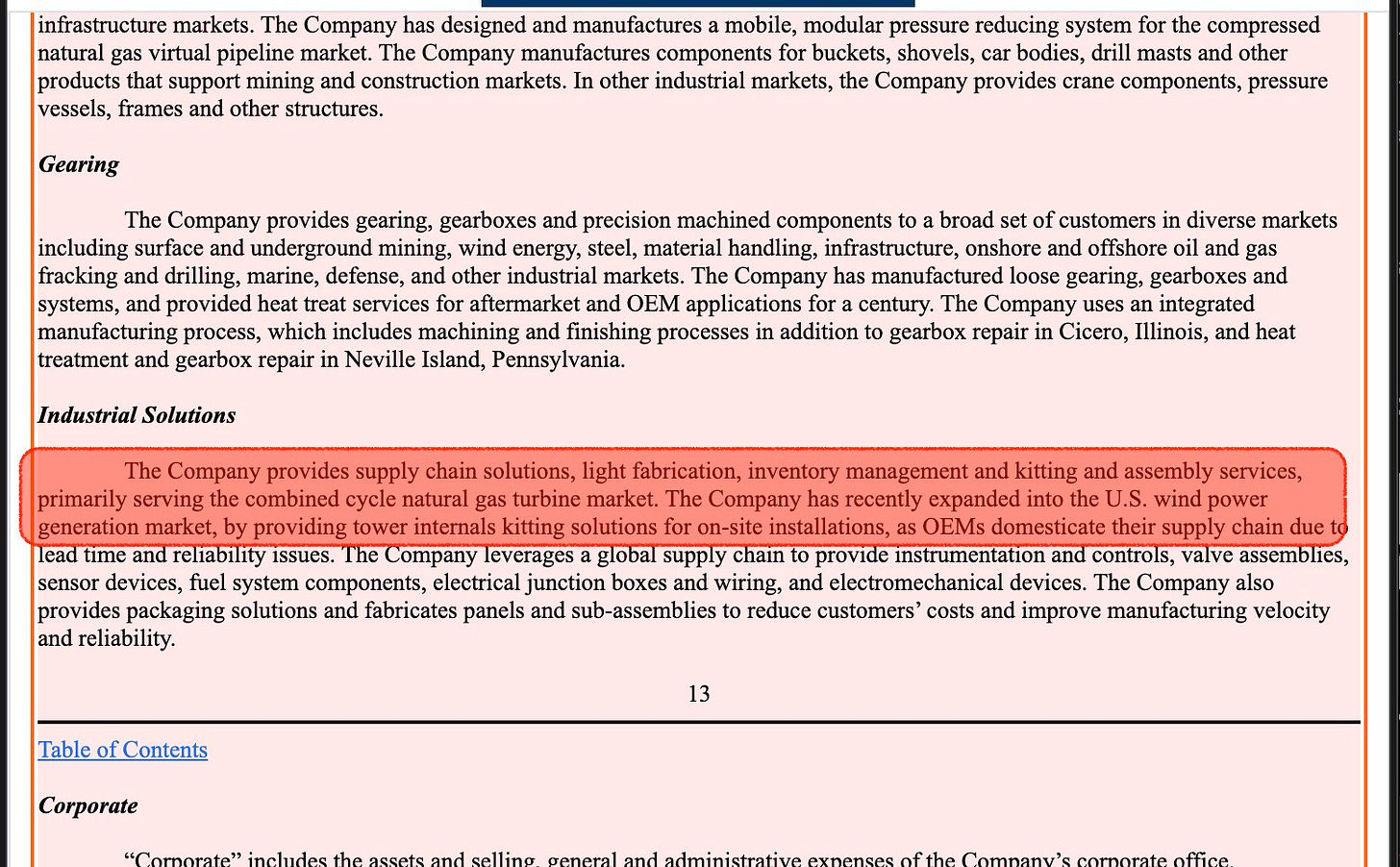

Here is some of the commentary from their SEC 10Q filings.

“We received $20,956 in new orders in the second quarter, up from $18,372 in the second quarter of 2024. Industrial Solutions orders increased by over 200% compared to the prior year quarter primarily due to an increase in demand associated with new gas turbine and aftermarket gas turbine projects. Additionally, Gearing segment orders increased 45% versus the prior year period primarily due to improved demand from most markets served.”

Clearly they are getting some boost on their gas focused bussiness. On top they are selling the unprofitable Manitowoc facility for 13M additional cash on their sheet, also 8M less costs.

So Industrial Solutions, primarily services the large gas turbine markets, and those are over 100 megawatts. So far this year through Q2, the market sold 93 units versus 21 units last year at the same time. So that’s 4x up.

Assessment: Can They Execute the Nat Gas Pivot?

Positive Signs:

Gas turbine orders growing 200%+ with multi-year contracts worth $8M+

Market growing 4x YoY with decade-long backlogs at major OEMs

Gas turbine margins (6-7%) better than wind (currently negative)

CEO Eric Blashford explicitly prioritizing “diversification” and reducing wind dependence

Working capital on the rise. This could mean they are closing sales and are gearing up to deliver. Ofcourse it could mean inventory build up or other things. Just the closing sales is more plausible

Critical Concerns:

Still 52% dependent on wind revenue—unclear how quickly they can pivot

Margins collapsing across all segments including gas turbines

Currently posting net losses (-$1.4M in H1 2025)

Working capital requirements ballooning while cash remains constrained. This one is significant, it either shows that they are building inventory or

The Bottom Line

The natural gas turbine opportunity is genuine and substantial. One of their segments grew 4x YoY with multi-decade tailwinds from AI infrastructure buildout.

BWEN might be a good overlooked play. But the rerating of the stock might not happen anytime soon, so get ready to hold it for some time. I haven’t bought so much of it because I do see a lot of opportunity everywhere in the market.

Thanks for the write-up; I'm very excited about another $50M market cap maker of gas/biofuel microturbines called Capstone Green Energy Holdings, Inc. CGEH. They have an over 30 year history with over 10,000 deployments but emerged from bankruptcy about 2 years ago and are starting to regain traction.

BWEN actually went up 20-30% in this carnage week