CRMD (CorMedix)

The only FDA approved solution for Catheter related infections is 71% better than the existing solution. Monopoly for 10 more years

The Unfortunate Little Secret in Hospitals

Imagine you’re in the hospital, hooked up to a catheter, and suddenly, your bloodstream gets invaded by bacteria like it’s a bad sci-fi movie.

This isn’t just a plot twist; it’s a Catheter-Related Bloodstream Infection (CRBSI), and it’s the medical equivalent of your Wi-Fi dropping during the season finale.

This meme is akin to the situation.

Why This Sucks (A Lot)

It’s Common AF: Over 250,000 people in the U.S. get CRBSIs every year. That’s like filling Madison Square Garden six times with people who just wanted a simple IV drip.

Out of that 80k are in ICU’s. The worst place to get a blood related infection.It’s Deadly AF: 15-25% of patients don’t make it. That’s worse odds than a game of Russian roulette with a Nerf gun.

It’s Expensive AF: Each infection costs between $45,000 and $75,000 to treat. For that price, you could buy a Tesla, or—you know—not get a life-threatening infection.

The “Solutions” We’re Stuck With (Spoiler: They Suck Too)

Right now, hospitals are basically using antibiotics to fight these infections. But here’s the kicker: bacteria are evolving faster than TikTok trends, making antibiotics about as useful as a screen door on a submarine.

Other “lock” solutions exist, but they’re like putting a Band-Aid on a bullet wound—not FDA-approved for prevention, and definitely not winning any innovation awards.

Here is the FDA approved Solution

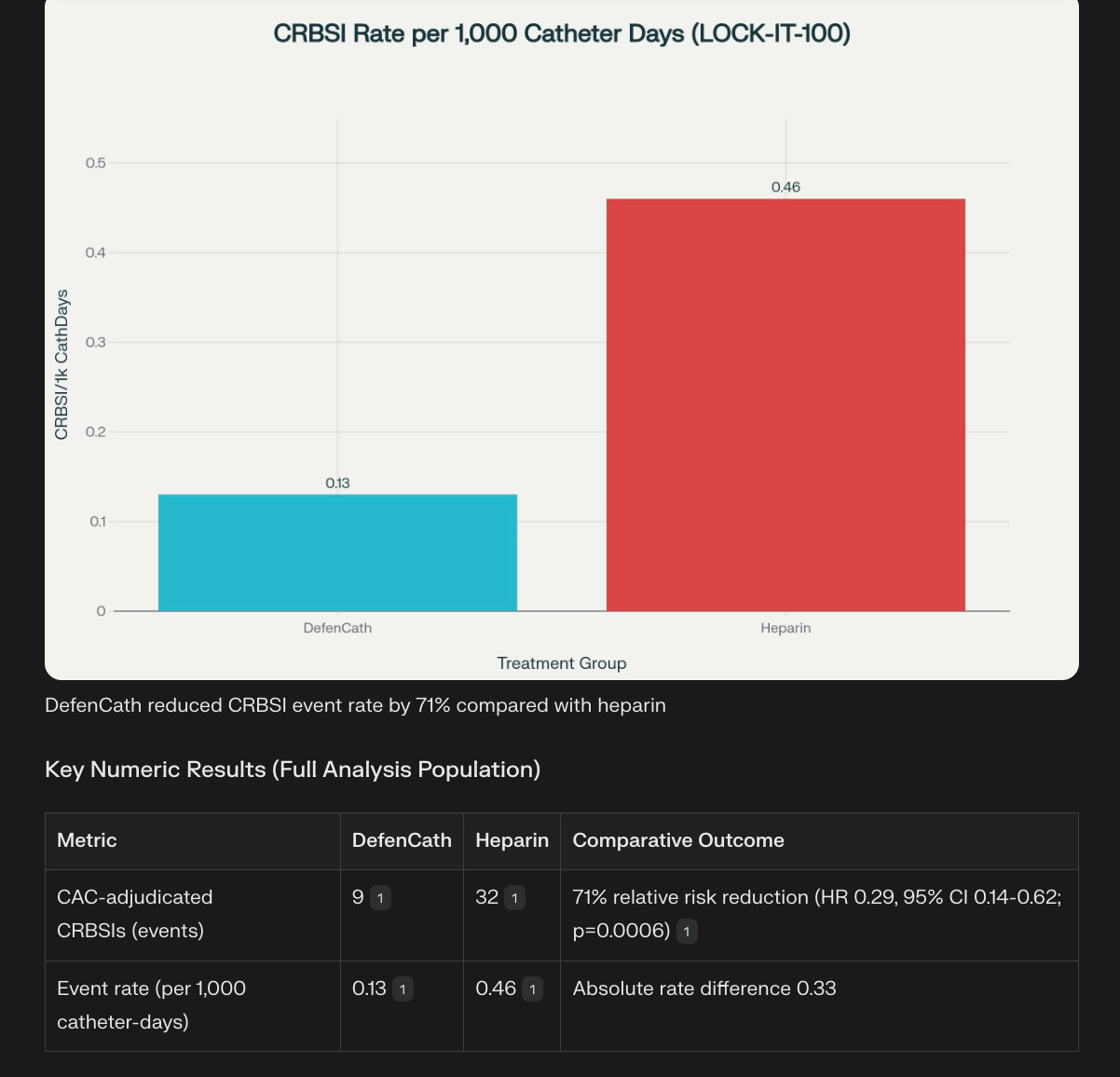

DefenCat reduces CRBSIs by 71% compared to standard treatments like Heparin

It is the first FDA-approved antimicrobial catheter lock solution in the US

DefenCath is currently used by over 4,000 patients, with agreements in place with four of the top five outpatient dialysis operators.

DefenCat combines an antimicrobial agent and Heparin, preventing infections and blood clots

This proactive approach makes it particularly beneficial for high-risk patients

I am attaching some screenshots from the study. CRBSI is Catheter related infections.

The Phase 3 LOCK-IT-100 trial, a randomized, double-blind, active-controlled, multicenter pivotal study, evaluated DefenCath’s efficacy and safety in adult hemodialysis patients receiving chronic hemodialysis through CVCs. In the full analysis population of 795 patients, only nine participants in the taurolidine-heparin arm experienced a CRBSI event compared to 32 participants in the heparin control arm, corresponding to event rates of 0.13 and 0.46 per 1000 catheter days, respectively.

Here is the announcement from FDA

Another way to look at the same data. Quite a drastic difference, that should excite hospitals.

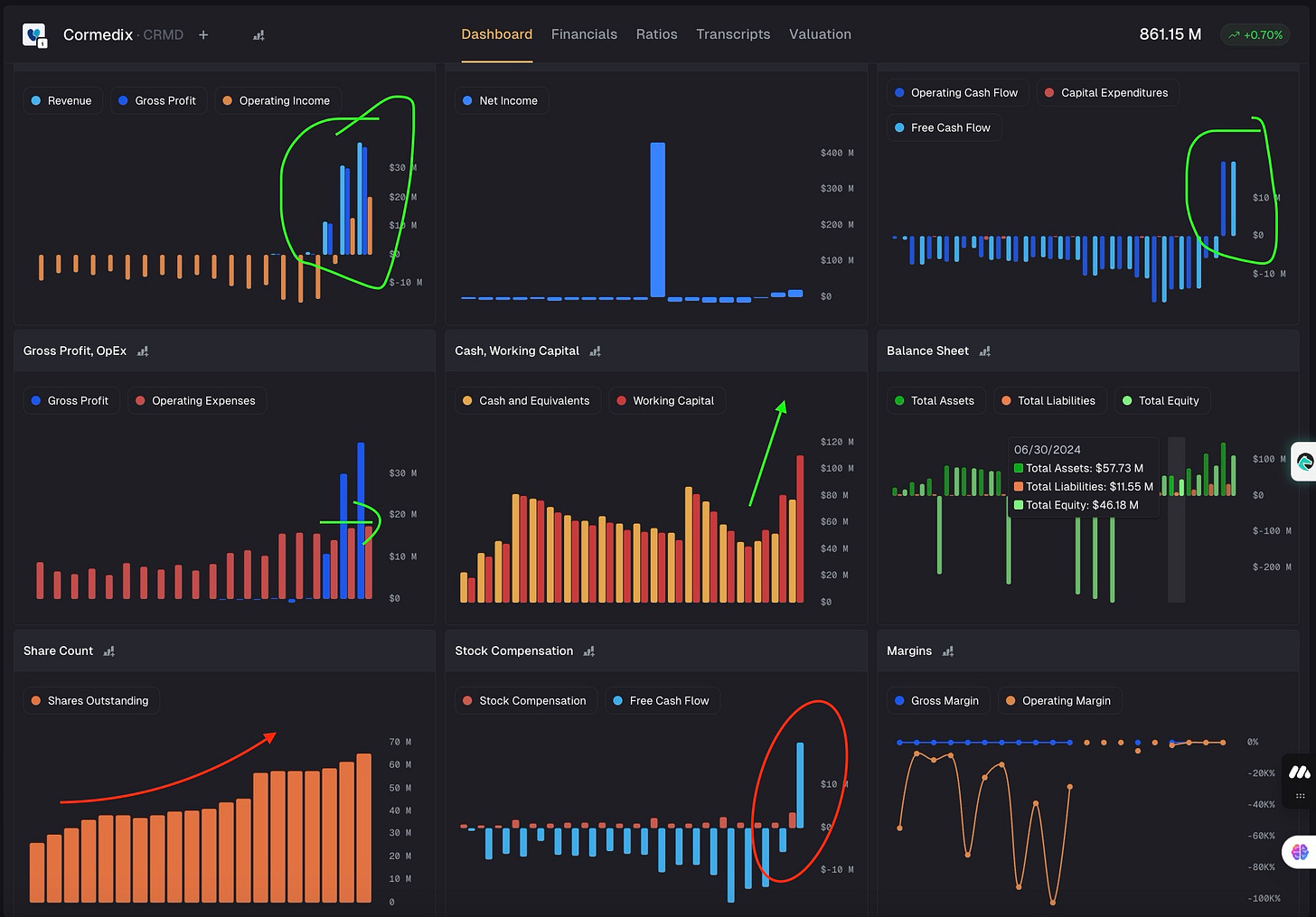

Let me show you the dashboard that will help you understand the power of this drug finally coming to fruition and showing up in financials.

Most metrics like FCF, Revenue, Cash has turned massively postive. What is even crazier is that it is happening with flat operating expense. This tells me there are early signs of operating leverage. Which means, it could have massive organic growth with hospitals.

These little clues helps us see the intent of hospitals while acquiring CRMD’s solution. However, you can also just listen to what they been saying

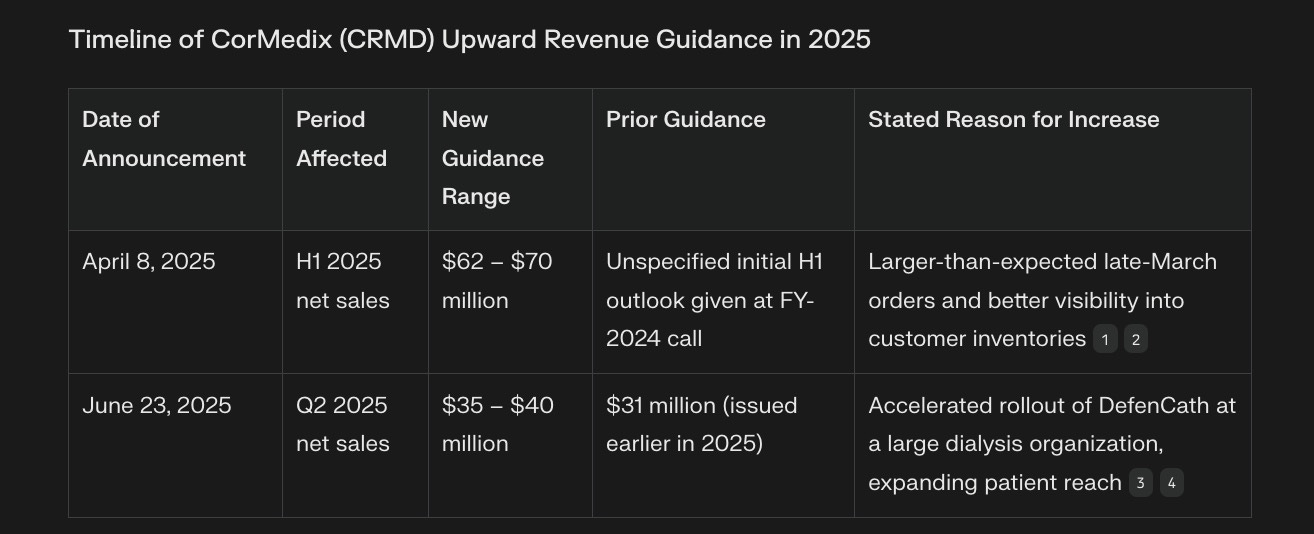

CorMedix first guided for higher revenue on April 8, 2025, when it raised its H1 2025 net-sales outlook to $62–$70 million. It issued a second upward revision on June 23, 2025, lifting its Q2 2025 net-sales target to $35–$40 million

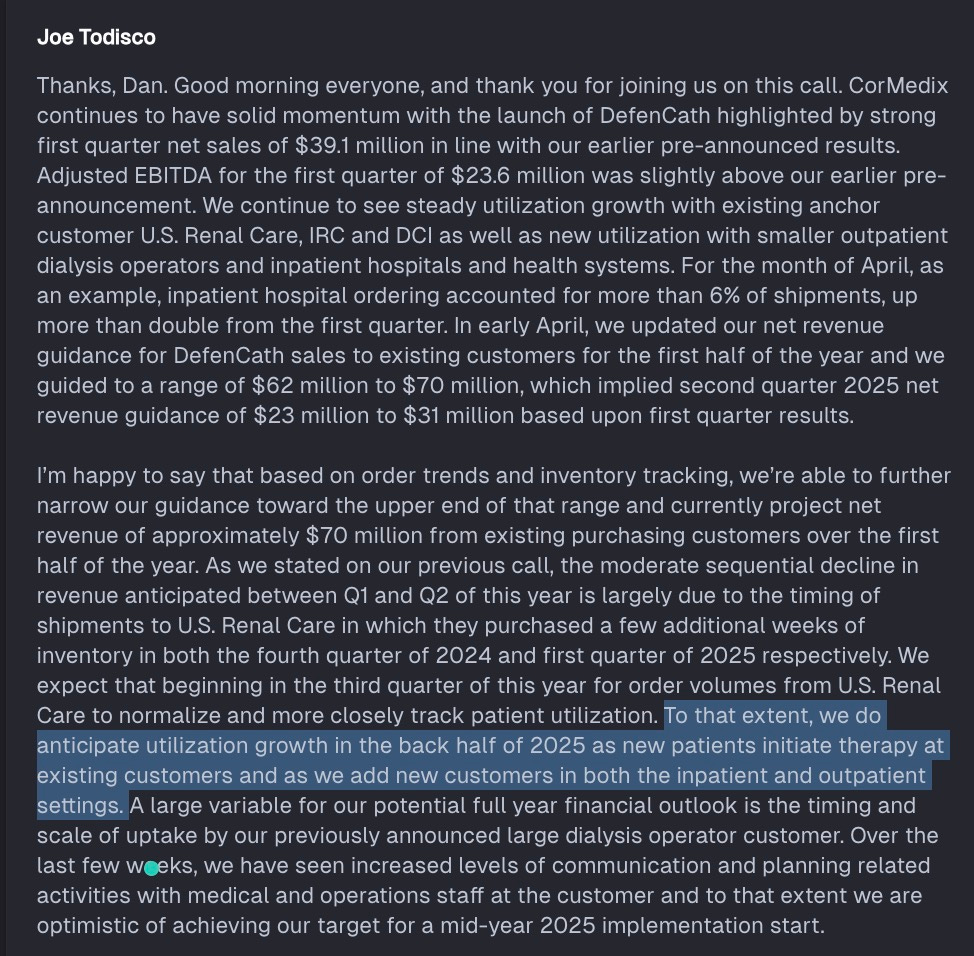

Following highlights are extracted from the last Earnings transcripts.

CorMedix’s DefenCath is crushing it, with Q1 sales hitting $39.1M and EBITDA soaring to $23.6M.

• First net profit: $20.6M vs. $14.5M loss last year.

•. Cash reserves balloon to $77.5M.

• Hospitals doubled orders in April for inpatient. This is the market that is lucrative that would be beneficial for them to capture.

I think that the market is not appreciating the improvement in utilization and inventory drags will end in H1 2025. And that there could be a positive surprise anytime.

What are the Catalyst?

Real-world data from 2,000 patients due July 2025.

Pediatric trials start Q3—untapped $500M+ market

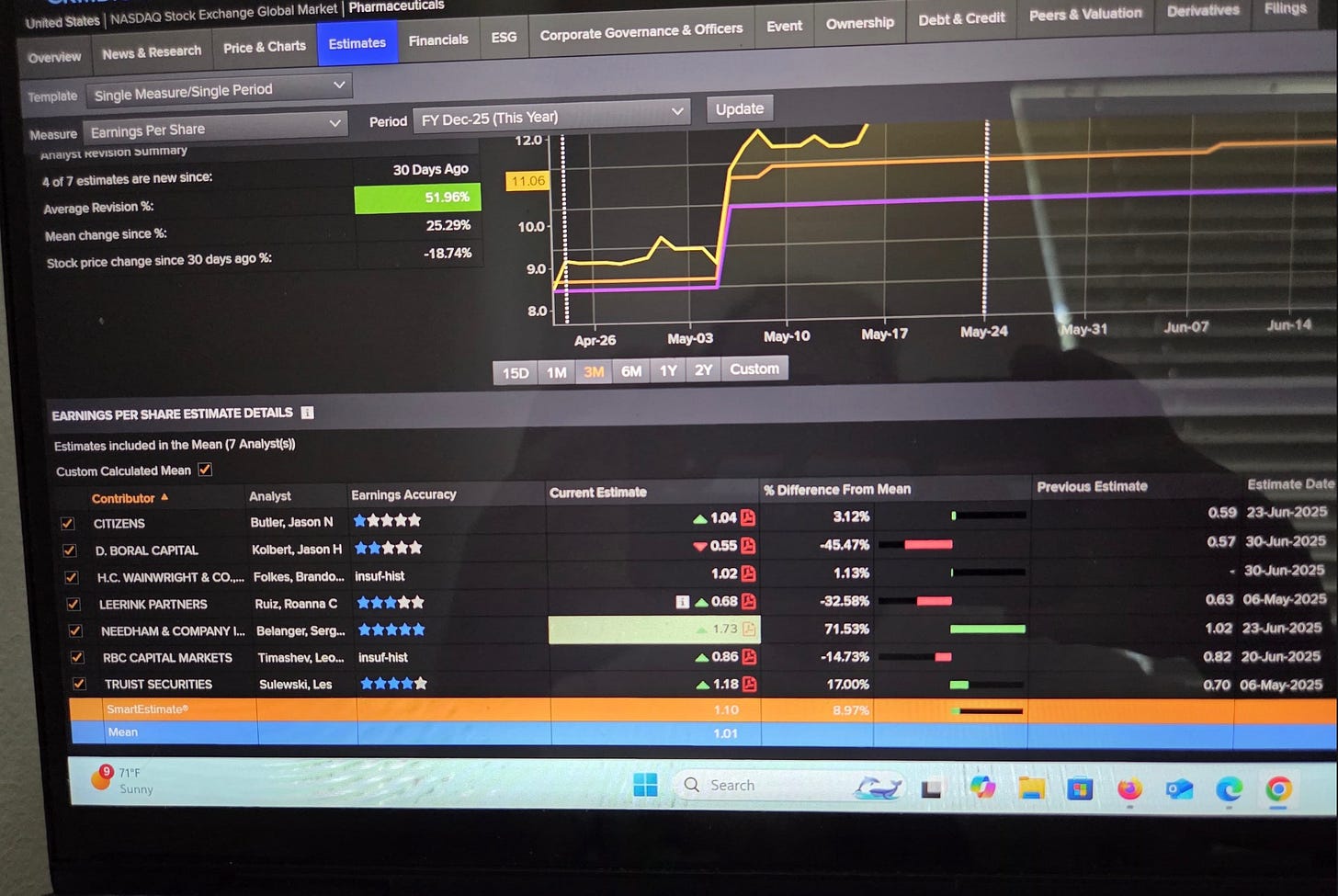

For next year consensus is $1.69. but the five star guy is at $2.84. There is definitely a mismatch that could be bought.

I initiated a position at $11.1 and will buy again if the stock gets at $10.4.

Technically, it is retesting the base and has some way to go.

Risks:

Reliance on a single product and high market share uncertainty

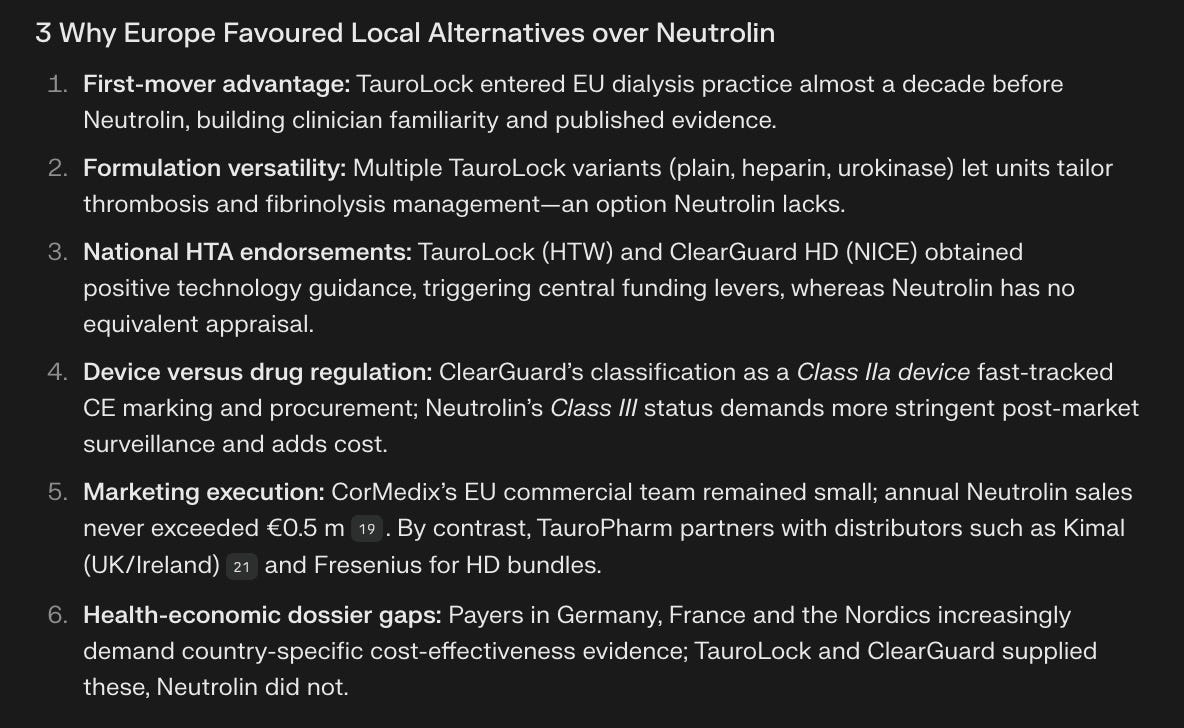

The europeans have been using another product which seemingly has a few other advantages.

Thanks for the article! What platform do you use for the financial dashboard?